Crown Castle Inc. (CCI), headquartered in Houston, Texas, owns, operates and leases more than 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every primary U.S. market. Valued at $41.5 billion by market cap, the company manages and offers wireless communication coverage and infrastructure sites in the U.S. and Australia. The leading provider of wireless infrastructure is expected to announce its fiscal third-quarter earnings for 2025 on Wednesday, Oct. 15.

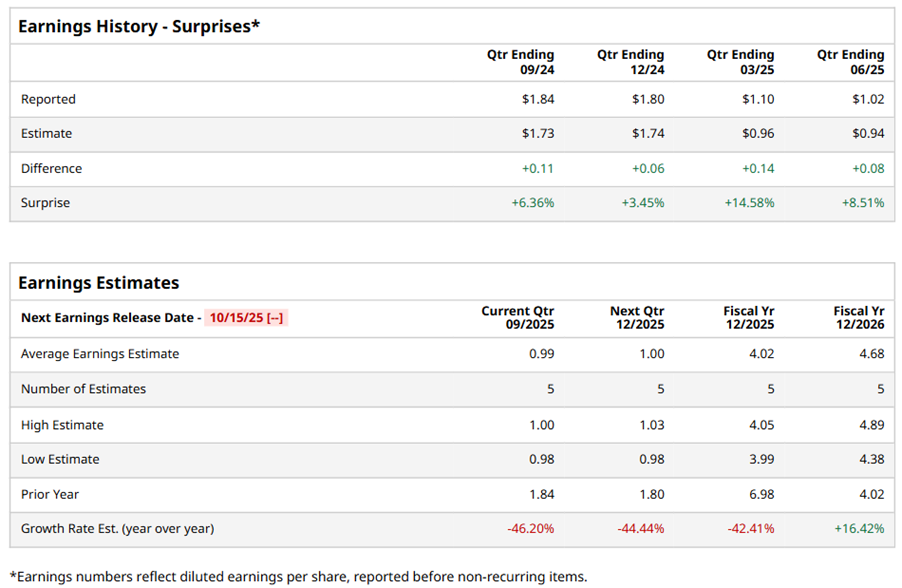

Ahead of the event, analysts expect CCI to report an FFO of $0.99 per share on a diluted basis, down 46.2% from $1.84 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s FFO estimates in its last four quarterly reports.

For the full year, analysts expect CCI to report FFO of $4.02 per share, down 42.4% from $6.98 per share in fiscal 2024. However, its FFO is expected to rise 16.4% year-over-year to $4.68 per share in fiscal 2026.

CCI stock has considerably underperformed the S&P 500 Index’s ($SPX) 15.6% gains over the past 52 weeks, with shares down 17% during this period. Similarly, it underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 5.3% downtick over the same time frame.

On Jul. 23, CCI reported better-than-expected Q2 results, leading to a 3.8% surge in its shares in the next trading session. Although the company's revenue declined 4.2% year-over-year to $1.1 billion due to lower site rental revenues, it still exceeded consensus estimates by 1.9%. The adjusted EBITDA dropped 3% to $705 million, and AFFO per share decreased 1% to $1.02, yet still beat Wall Street's expectations by 2%. Strong operational execution and increased leasing activity drove the company's performance, prompting CCI to raise its fiscal 2025 guidance. The company now expects site rental revenues of $4 billion and AFFO per share of $4.20 at the midpoint.

Analysts’ consensus opinion on CCI stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 19 analysts covering the stock, 12 advise a “Strong Buy” rating, and seven give a “Hold.” CCI’s average analyst price target is $117.83, indicating a potential upside of 23.6% from the current levels.