With a market cap of $126.2 billion, Constellation Energy Corporation (CEG) produces and sells electricity, natural gas, and other energy-related products and services across the United States. Operating through five segments: Mid-Atlantic; Midwest; New York; ERCOT; and Other Power Regions, it has approximately 31,676 megawatts of generating capacity from nuclear, wind, solar, natural gas, and hydroelectric assets.

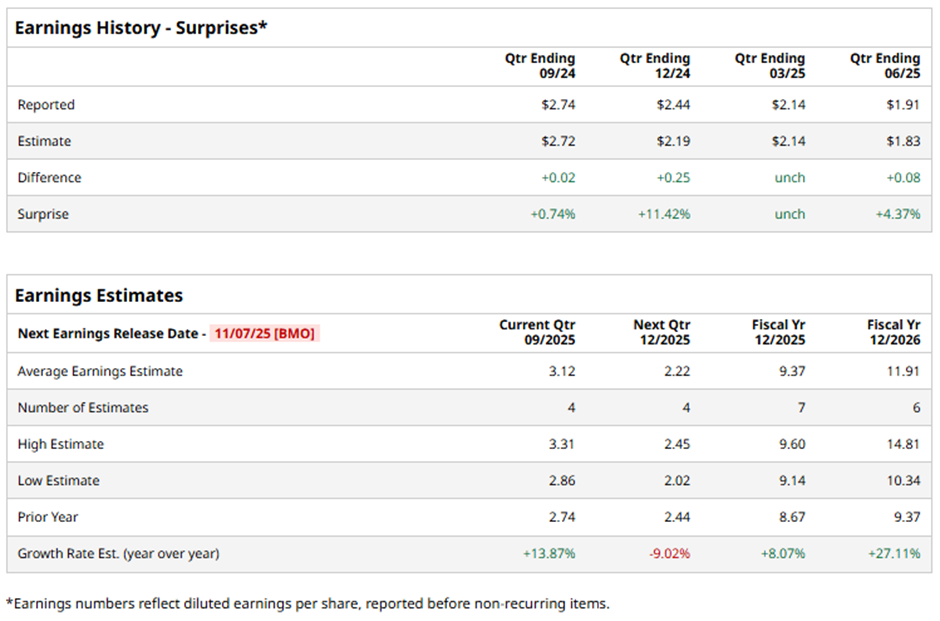

The Baltimore, Maryland-based company is slated to announce its fiscal Q3 2025 results before the market opens on Friday, Nov. 7. Ahead of this event, analysts expect Constellation Energy to report an adjusted EPS of $3.12, a 13.9% rise from $2.74 in the year‑ago quarter. It has exceeded or met Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts expect the nuclear power utility company to report adjusted EPS of $9.37, an 8.1% increase from $8.67 in fiscal 2024. In addition, adjusted EPS is anticipated to surge 27.1% year-over-year to $11.91 in fiscal 2026.

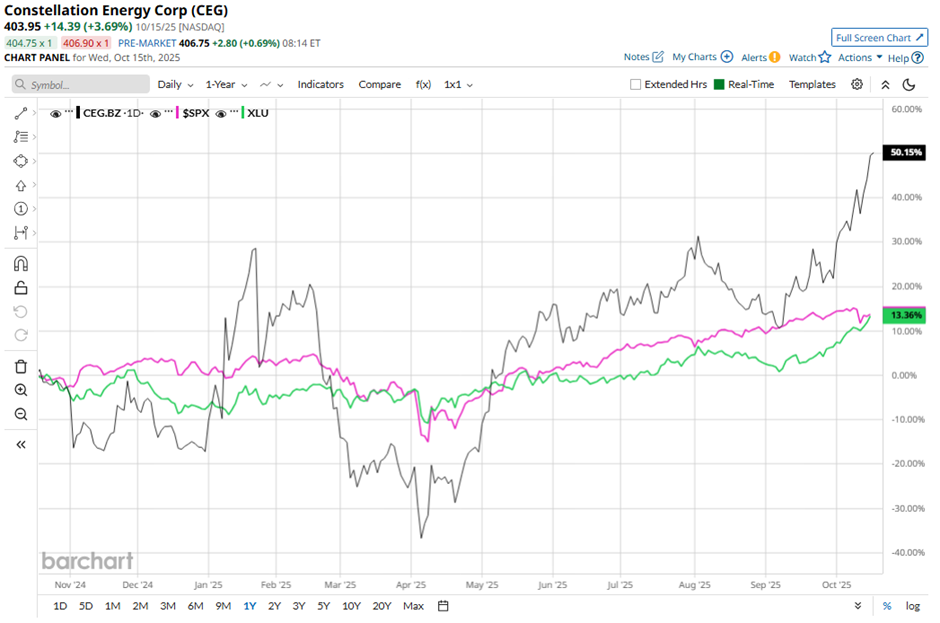

Shares of Constellation Energy have jumped 51.8% over the past 52 weeks, exceeding the broader S&P 500 Index's ($SPX) 14.7% return and the Utilities Select Sector SPDR Fund's (XLU) 15.3% gain over the same period.

Despite Constellation Energy’s better-than-expected Q2 2025 adjusted EPS of $1.91 and revenues of $6.1 billion, shares fell marginally on Aug. 7 due to concerns over rising operating expenses, which jumped 17.7% to $5.15 billion year-over-year. Investors also reacted cautiously to a slight decline in nuclear generation output to 45,170 GWh from 45,314 GWh, reflecting higher non-refueling outage days.

Analysts' consensus view on Constellation Energy stock remains cautiously optimistic, with an overall "Moderate Buy" rating. Out of 17 analysts covering the stock, 11 recommend a "Strong Buy," one "Moderate Buy," and five "Holds." As of writing, the stock is trading above the average analyst price target of $382.31.