/Cognizant%20Technology%20Solutions%20Corp_%20Plano%2C%20TX%20office-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $37.3 billion, Cognizant Technology Solutions Corporation (CTSH) is a leading global provider of IT consulting, business process services, and outsourcing solutions. Headquartered in Teaneck, New Jersey, the company operates through four segments: Financial Services; Health Sciences; Products and Resources; and Communications, Media and Technology.

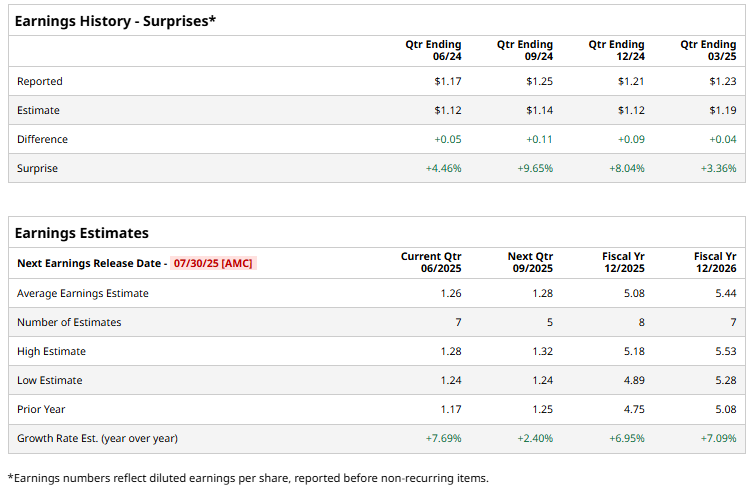

CTSH is expected to report its Q2 earnings on Wednesday, July 30, after the market closes. Ahead of the event, analysts expect CTSH to report an EPS of $1.26 per share, up 7.7% from a profit of $1.17 per share reported in the year-ago quarter. It has exceeded analysts' earnings estimates in all of the past four quarters.

For the current year, analysts expect CTSH to report an EPS of $5.08, up 7% from $4.75 in fiscal 2024.

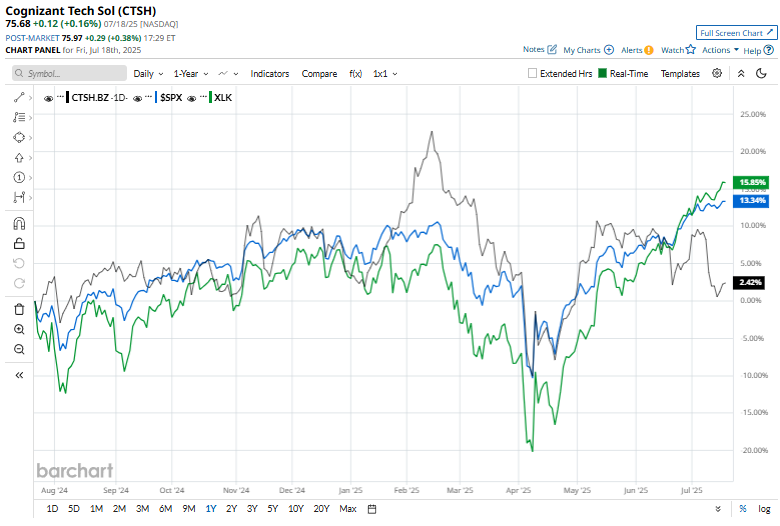

Over the past year, CTSH shares have fallen marginally, underperforming the S&P 500 Index’s ($SPX) 13.6% gains but outperforming the Technology Select Sector SPDR Fund’s (XLK) 16.3% returns over the same time frame.

On April 30, shares of Cognizant surged marginally following the release of its Q1 results. The company reported an adjusted EPS of $1.23, surpassing the Street’s estimate of $1.19, while revenue came in at $5.12 billion, ahead of the projected $5.07 billion. For the full year, Cognizant expects adjusted EPS to range between $4.98 and $5.14, with revenue guidance set between $20.5 billion and $21 billion.

Moreover, analysts remain fairly upbeat about CTSH stock’s future prospects, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, seven recommend a “Strong Buy,” one suggests a “Moderate Buy,” and 16 suggest a “Hold.” Its mean price of $89.79 implies a premium of 18.6% from its prevailing price level.