/Chipotle%20Mexican%20Grill%20storefront%20by-%20Anne%20Czichos%20via%20Shutterstock.jpg)

Newport Beach, California-based Chipotle Mexican Grill, Inc. (CMG) operates quick-casual and fresh Mexican food restaurant chains. Its offerings include burritos, quesadillas, tacos, salads, and more. With a market cap of $54.9 billion, Chipotle’s operations span the U.S., Canada, France, Germany, Dubai, and the U.K.

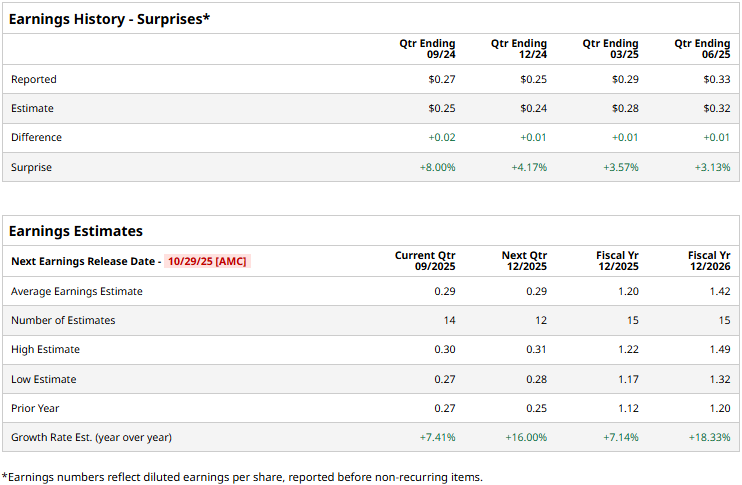

The restaurant giant is gearing up to announce its third-quarter results after the markets close on Wednesday, Oct. 29. Ahead of the event, analysts expect CMG to deliver an EPS of $0.29, up 7.4% from $0.27 reported in the year-ago quarter. Moreover, the company has a solid earnings surprise history. Chipotle has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect CMG to deliver earnings of $1.20 per share, up 7.1% from $1.12 reported in 2024. While in fiscal 2026, its earnings are expected to surge 18.3% year-over-year to $1.42 per share.

CMG stock prices have plummeted 29.3% over the past 52 weeks, notably underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 20% surge and the S&P 500 Index’s ($SPX) 17.4% gains during the same time frame.

Chipotle’s stock prices plunged 13.3% in a single trading session after the release of its lackluster Q2 results on Jul. 23. During the quarter, Chipotle opened 61 company-owned restaurants, with 47 locations including a Chipotlane. This increased its overall revenues by 3% year-over-year to $3.1 billion, which fell 1.2% below the Street’s expectations.

Chipotle’s comparable restaurant sales during the quarter dropped by 4% year-over-year due to a 4.9% decline in transactions, partially offset by an increase in average check. Further, its restaurant-level operating margins contracted by 1.5% to 27.4%, unsettling investor confidence. Meanwhile, its adjusted EPS dipped 2.9% year-over-year to $0.33.

Nevertheless, the consensus view on CMG remains highly optimistic, with a “Strong Buy” rating overall. Of the 32 analysts covering the stock, opinions include 22 “Strong Buys,” three “Moderate Buys,” and seven “Holds.” Its mean price target of $58.13 suggests a 41.8% upside potential from current price levels.