/Boston%20Scientific%20Corp_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $144.2 billion, Boston Scientific Corporation (BSX) develops, manufactures, and markets innovative medical devices used in various interventional medical specialties worldwide. It operates through two main segments: MedSurg and Cardiovascular, offering advanced solutions for diagnosing and treating complex conditions across gastrointestinal, urological, neurological, and cardiovascular care.

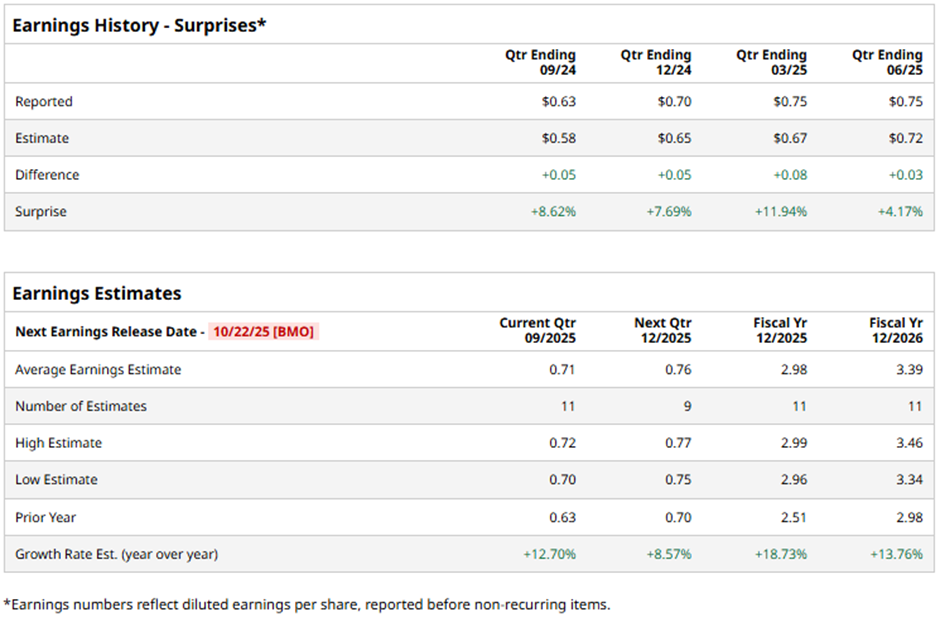

The Marlborough, Massachusetts-based company is slated to announce its fiscal Q3 2025 earnings results before the market opens on Wednesday, Oct. 22. Ahead of the event, analysts expect Boston Scientific to report an adjusted EPS of $0.71, up 12.7% from $0.63 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2025, analysts predict the medical device manufacturer to report an adjusted EPS of $2.98, an 18.7% increase from $2.51 in fiscal 2024.

Shares of BSX have risen 14.5% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 17.1% increase. However, the stock has outpaced the Health Care Select Sector SPDR Fund's (XLV) 4.6% decline over the same period.

Shares of Boston Scientific soared 4.5% on Jul. 23 after the company reported better-than-expected Q2 2025 adjusted EPS of $0.75 and revenue of $5.1 billion. Management raised its 2025 adjusted profit outlook to $2.95 per share - $2.99 per share while cutting expected tariff-related costs in half to about $100 million. Strong demand for key cardiovascular devices like Watchman and Farapulse, supported by favorable trial results and expanded indications, further boosted investor confidence.

Analysts' consensus rating on BSX stock is bullish, with an overall "Strong Buy" rating. Among 32 analysts covering the stock, 27 recommend a "Strong Buy,” three have a "Moderate Buy" rating, and two give a "Hold" rating. The average analyst price target for Boston Scientific is $126.16, indicating a potential upside of 30.5% from the current levels.