/Boeing%20Co_%20corporate%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

Arlington, Virginia-based The Boeing Company (BA) is an aerospace company that designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human spaceflight and launch systems. Valued at a market cap of $173.1 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

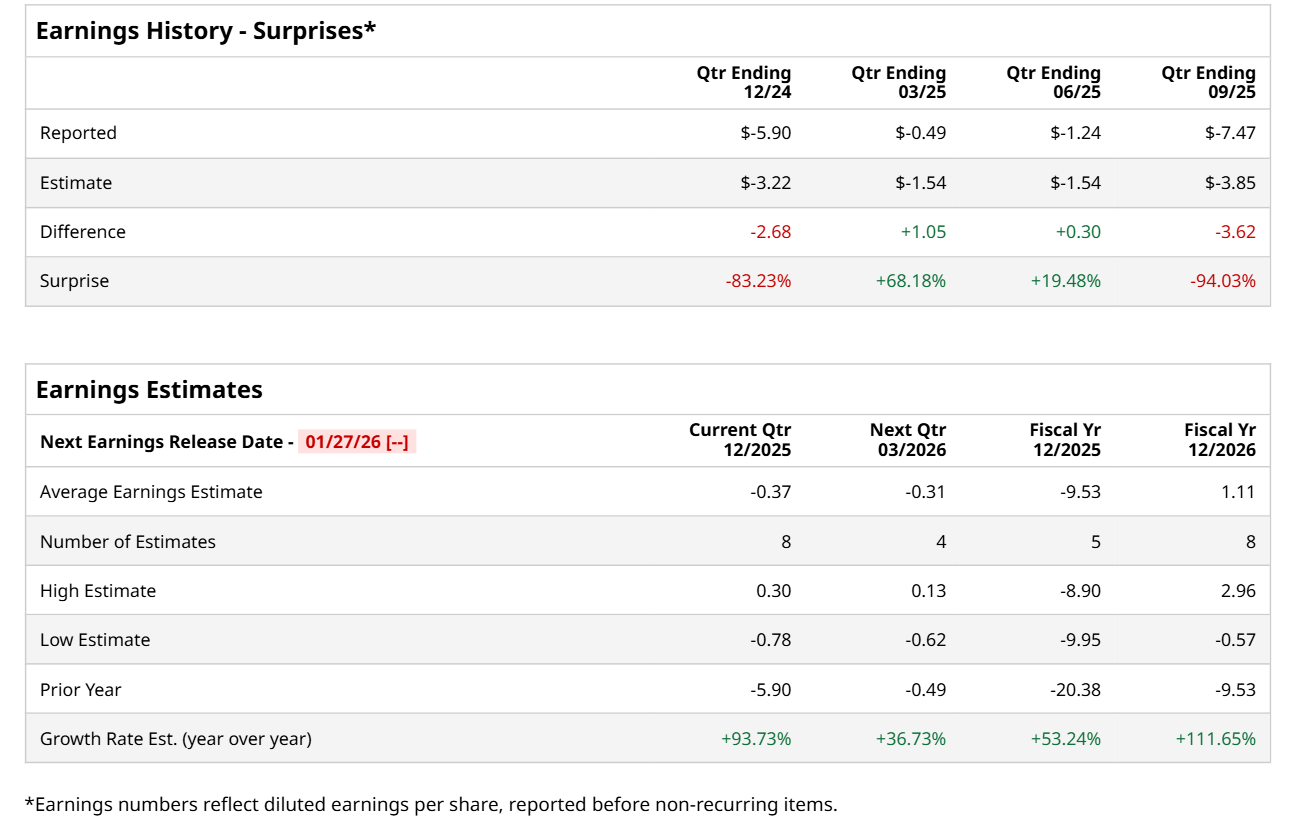

Ahead of this event, analysts expect this aerospace giant to report a loss of $0.37 per share, 93.7% narrower than a loss of $5.90 per share in the year-ago quarter. The company has topped Wall Street’s earnings estimates in two of the last four quarters, while missing on two other occasions. In Q3, BA’s loss per share of $7.47 missed the forecasted figure by a notable margin of 94%

For the current fiscal year, ending in December, analysts expect BA to report a loss of $9.53 per share, down 53.2% from a loss of $20.38 per share recorded in fiscal 2024. Furthermore, BA’s bottom line is expected to grow 111.7% year-over-year to $1.11 in fiscal 2026.

BA has surged 32.5% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 16.9% rise and the State Street Industrial Select Sector SPDR ETF’s (XLI) 20.3% uptick over the same time period.

On Dec. 19, shares of Boeing climbed 2.8% after JPMorgan Chase & Co. (JPM) raised its price target on the stock to $245 from $240 and reiterated its “Overweight” rating. The upgrade was driven by a strong outlook for the aerospace sector, supported by large multi-year order backlogs at Boeing and Airbus, rising air travel demand, and an aging global aircraft fleet.

Wall Street analysts are highly optimistic about BA’s stock, with a "Strong Buy" rating overall. Among 27 analysts covering the stock, 19 recommend "Strong Buy," three indicate "Moderate Buy,” four suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for BA is $251.04, indicating a 10.2% potential upside from the current levels.