/Axon%20Enterprise%20Inc%20logo%20with%20buy%20and%20sell-by%20NPS_87%20via%20Shutterstock.jpg)

With a market cap of $55 billion, Axon Enterprise, Inc. (AXON) is an Arizona-based public safety technology company best known for its TASER weapons and body-worn cameras. Founded in 1993, Axon has evolved from a weapons manufacturer into a full-fledged technology platform that integrates hardware, cloud software, and data analytics to help law enforcement and enterprises enhance safety and transparency.

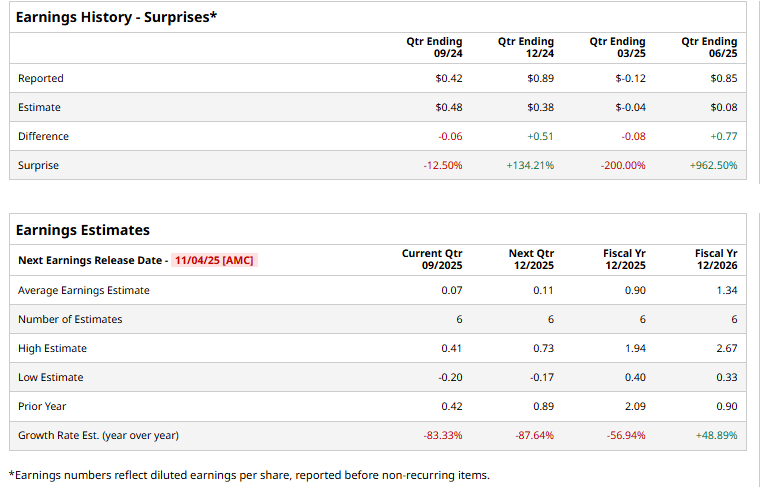

The company is expected to release its fiscal Q3 2025 earnings results on Tuesday, Nov. 4. Ahead of this event, analysts project AXON to report an EPS of $0.07, an 83.3% drop from $0.42 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast the company to report EPS of $0.90, down 56.9% from $2.09 in fiscal 2024. However, EPS is expected to rebound, growing 48.9% year over year to $1.34 in fiscal 2026.

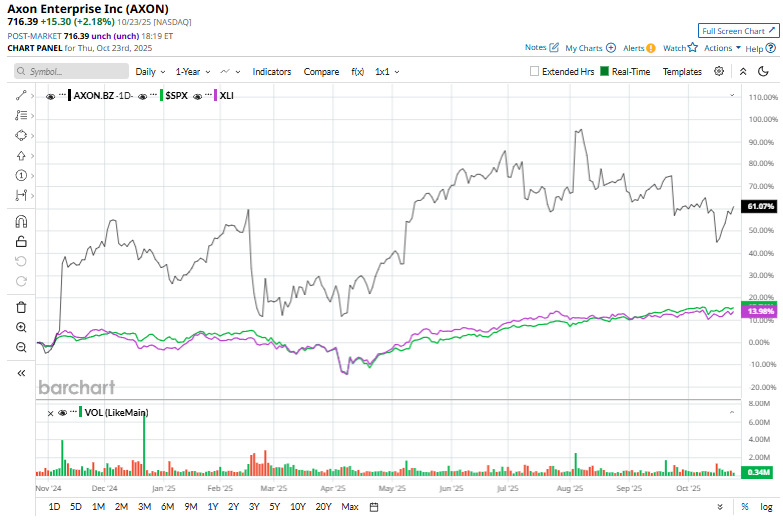

Shares of Axon Enterprise have surged 61.8% over the past 52 weeks, significantly outperforming the broader S&P 500 Index's ($SPX) 16.2% return and the Industrial Select Sector SPDR Fund's (XLI) 13.2% gain over the same period.

On Oct. 18, Shares of AXON climbed 3.2% after TD Cowen reiterated a “Buy” rating with a $925 price target, citing expectations of strong quarterly performance and an accelerating AI product cycle. The firm projected revenue growth above 30% and noted that Axon’s expanding AI capabilities, durable end markets, and limited competition justify its premium valuation and strong growth outlook.

Analysts' consensus view on AXON stock is bullish, with an overall "Strong Buy" rating. Among 19 analysts covering the stock, 13 suggest a "Strong Buy," three give a "Moderate Buy," and three provide a "Hold" rating. The mean price target of $871.19 implies an upswing potential of 21.6% from the current market price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.