/Assurant%20Inc%20logo%20on%20phone-%20by%20rafapress%20via%20Shutterstock.jpg)

Assurant, Inc. (AIZ) is an Atlanta, Georgia-based provider of risk management solutions, specializing in lifestyle and housing protection products. Valued at $9.4 billion by market cap, the company offers a diverse portfolio of services, including mobile device protection, extended service contracts, vehicle protection plans, renters insurance, and lender-placed homeowners insurance.

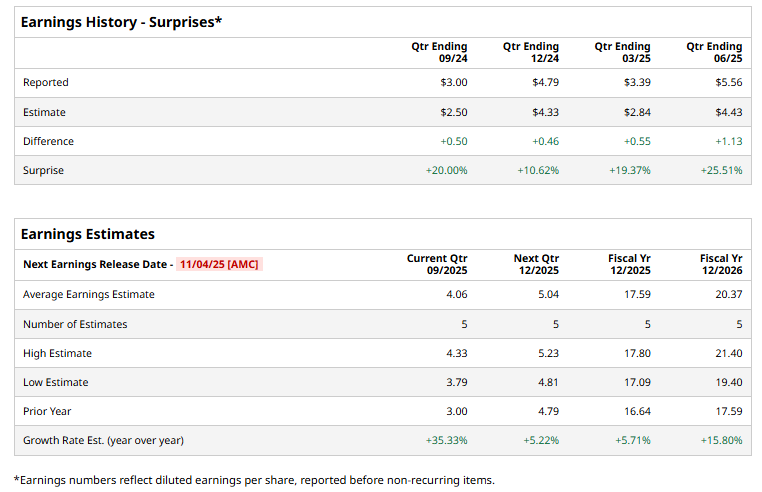

The lifestyle and housing solutions specialist is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Tuesday, Nov. 4. Ahead of the event, analysts expect AIZ to report a profit of $4.06 per share on a diluted basis, up 35.3% from $3 per share in the same quarter last year. The company has consistently surpassed Wall Street’s EPS estimates in its previous four quarterly reports.

For the current year, analysts expect AIZ to report EPS of $17.59, up 5.7% from $16.64 in fiscal 2024. Moreover, its EPS is expected to rise 15.8% year-over-year to $20.37 in fiscal 2026.

AIZ stock has climbed 5.9% over the past year, underperforming the S&P 500 Index’s ($SPX) 14.8% gains and the Financial Select Sector SPDR Fund’s (XLF) 10.9% gains over the same time frame.

On August 5, 2025, Assurant shares popped more than 11% after the company reported strong second-quarter results. Its adjusted EPS was $5.56, far exceeding Wall Street’s estimate of $4.43, and revenue rose about 8% year over year to $3.2 billion. The company’s performance was driven by solid growth across both its Global Housing and Global Lifestyle segments, supported by higher premiums in lender-placed homeowners and renters insurance, as well as steady gains in mobile device and vehicle protection services.

Analysts’ consensus opinion on AIZ stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of seven analysts covering the stock, four advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and two give a “Hold.” AIZ’s average analyst price target is $233.20, indicating a potential upside of 25.6% from the current levels.