/Apple%20logo%20-%20by%20Pexels%20via%20Pixabay.jpg)

Cupertino, California-based Apple Inc. (AAPL) designs, manufactures, and sells smartphones, personal computers, tablets, wearables, and accessories, and provides other related services. With a market cap of $3.7 trillion, Apple’s operations span across various countries across the Americas, Indo-Pacific, Europe, and MENA.

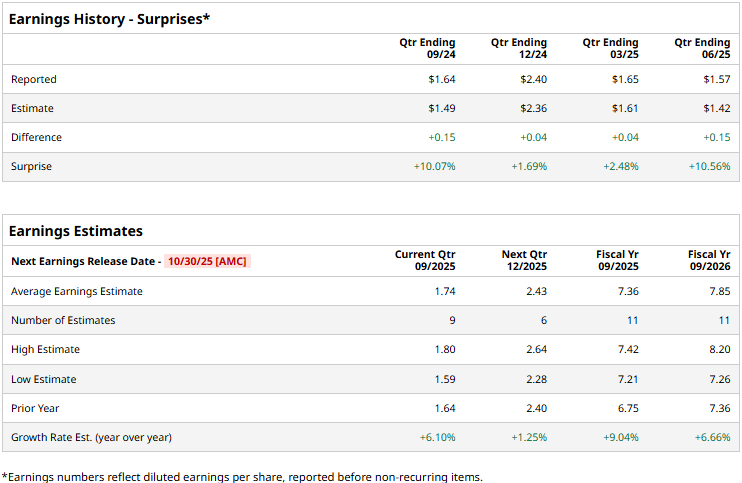

The tech giant is expected to announce its fourth-quarter results after the market closes on Thursday, Oct. 30. Ahead of the event, analysts expect Apple to report a profit of $1.74 per share, up 6.1% from $1.64 per share reported in the year-ago quarter. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters.

For the full fiscal 2025, AAPL is expected to deliver an EPS of $7.36, up 9% from $6.75 reported in 2024. While in fiscal 2026, its earnings are expected to grow 6.7% year-over-year to $7.85 per share.

AAPL stock prices have gained 7.1% over the past 52 weeks, notably lagging behind the Technology Select Sector SPDR Fund’s (XLK) 20.4% surge and the S&P 500 Index’s ($SPX) 13.4% gains during the same time frame.

Despite delivering better-than-expected results, Apple’s stock prices dipped 2.5% in the trading session following the release of its Q3 results on Jul. 31. The quarter was marked with an impressive double-digit growth in iPhone, Mac, and services, driven by revenue growth across all geographic segments. Further, Apple reached a new all-time high in its installed base of active devices across all product categories and geographic segments. Its sales for the quarter soared almost 10% year-over-year to a Q3 record of $94 billion, beating the Street’s expectations by 5.8%.

Meanwhile, Apple’s EPS increased 12.1% year-over-year to $1.57, beating the consensus estimates by a notable 10.6%. Following the initial dip, AAPL stock prices soared 13.3% over the next five trading sessions.

The consensus opinion on AAPL stock remains moderately optimistic, with an overall “Moderate Buy” rating. Out of the 41 analysts covering the stock, 21 recommend “Strong Buys,” two advise “Moderate Buys,” 15 suggest “Holds,” two give “Moderate Sells,” and one advocates a “Strong Sell” rating. As of writing, the stock is trading slightly below its mean price target of $250.09.