Valued at a market cap of $63 billion, American Electric Power Company, Inc. (AEP) is an electric public utility company that generates, transmits, and distributes electricity for sale to retail and wholesale customers. The Columbus, Ohio-based company generates electricity using a combination of coal and lignite, natural gas, and renewable energy sources, including nuclear, hydro, solar, wind, and other alternative energy sources. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Wednesday, Oct. 29.

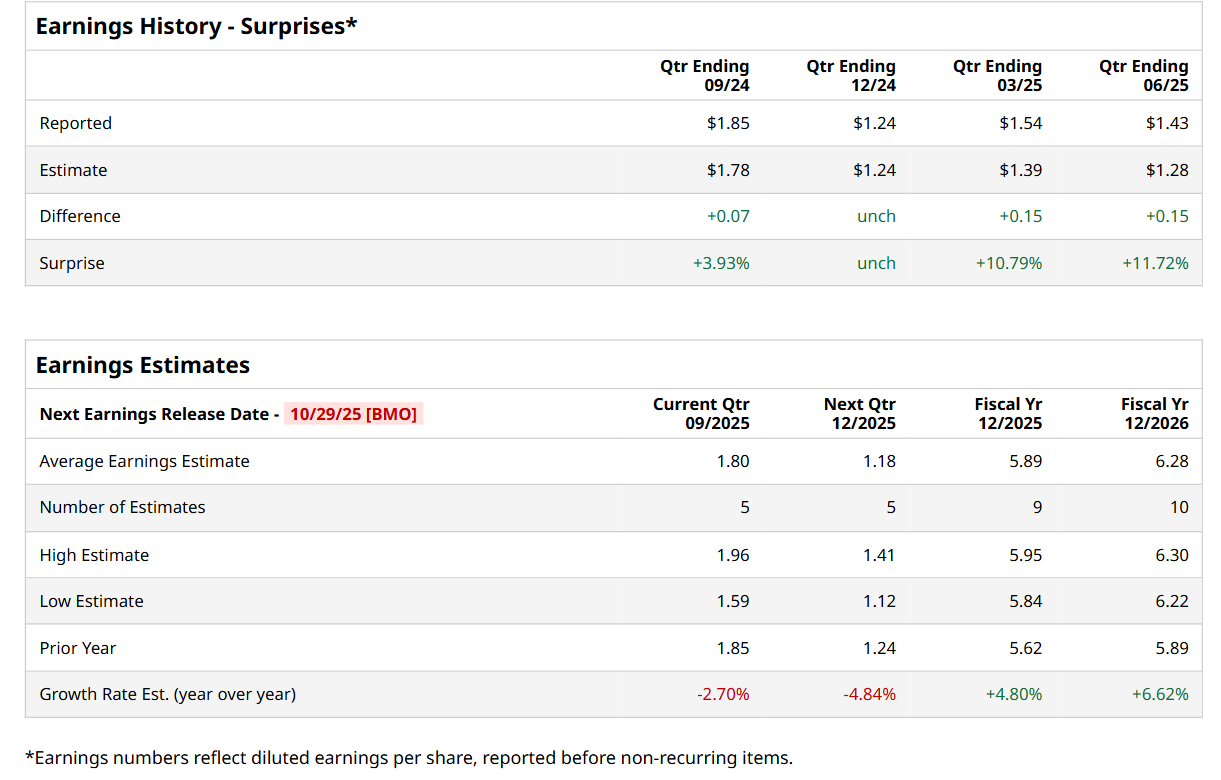

Ahead of this event, analysts expect this utility company to report a profit of $1.80 per share, down 2.7% from $1.85 per share in the year-ago quarter. The company has a solid trajectory of consistently beating and meeting Wall Street’s earnings estimates in each of the last four quarters. In Q2, AEP’s EPS of $1.43 exceeded the forecasted figure by a notable margin of 11.7%.

For fiscal 2025, analysts expect AEP to report a profit of $5.89 per share, up 4.8% from $5.62 per share in fiscal 2024. Furthermore, its EPS is expected to grow 6.6% year-over-year to $6.28 in fiscal 2026.

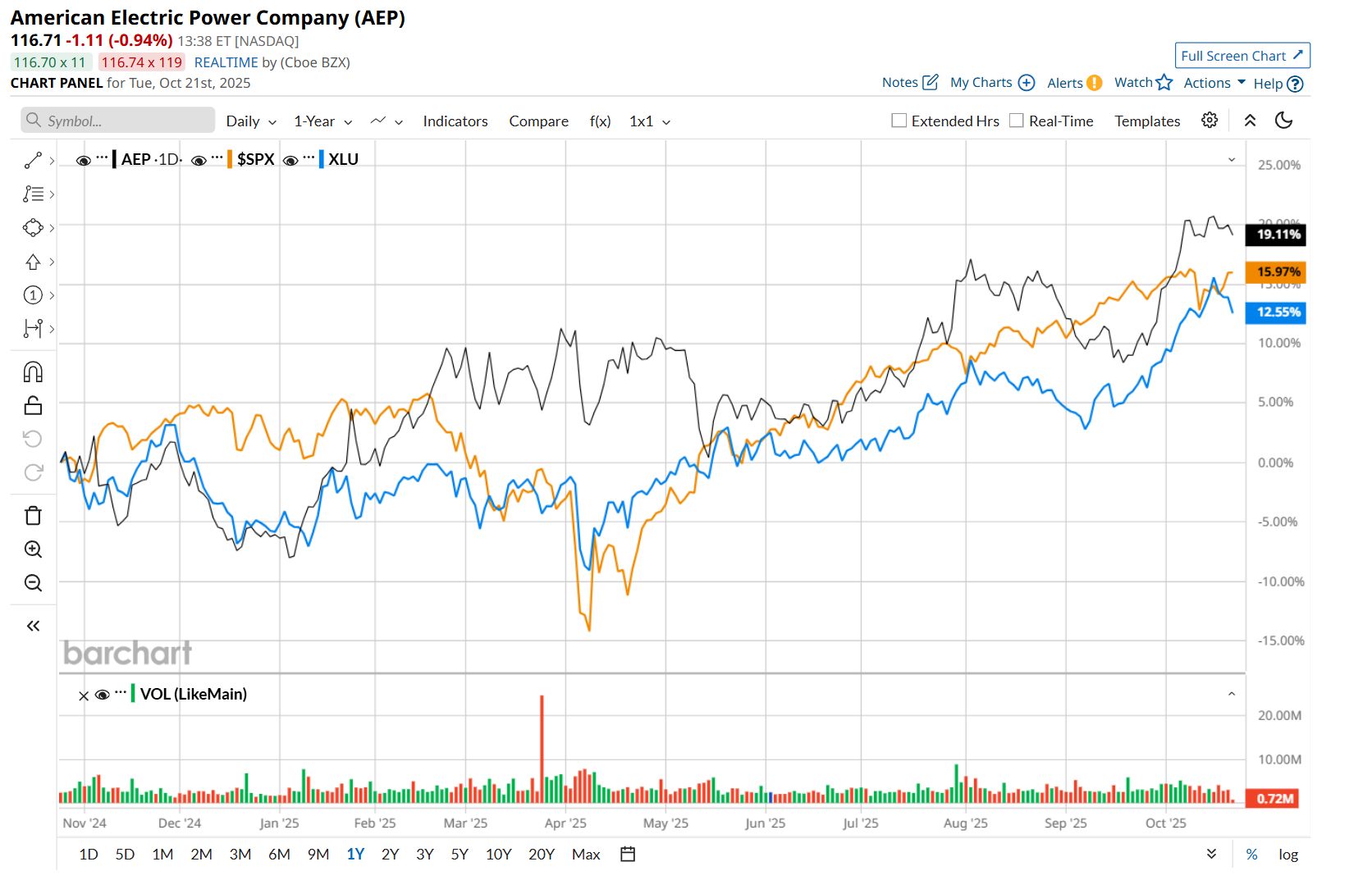

Shares of AEP have rallied 16.5% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 15.2% return and the Utilities Select Sector SPDR Fund’s (XLU) 10.7% rise over the same time frame.

Shares of AEP rose 3.7% on Jul. 30 after the company posted better-than-expected Q2 results. The company’s revenue improved 11.1% year-over-year to $5.1 billion, surpassing consensus estimates by 3%. Moreover, its operating earnings of $1.43 per share advanced 14.4% from the year-ago quarter and came in 11.7% ahead of analyst estimates. Looking ahead, AEP reaffirmed its fiscal 2025 operating earnings guidance of $5.75 to $5.95 per share and now expects it toward the upper end, further bolstering investor confidence.

Wall Street analysts are moderately optimistic about AEP’s stock, with an overall "Moderate Buy" rating. Among 19 analysts covering the stock, six recommend "Strong Buy," one indicates a “Moderate Buy," 11 suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for AEP is $120.32, implying a 3.2% potential upside from the current levels.