With a market cap of $13.5 billion, Alexandria Real Estate Equities, Inc. (ARE) is a leading urban office REIT focused on developing and operating collaborative life science, agtech, and technology campuses in top innovation cluster locations. Alexandria pioneered the life science real estate niche and continues to drive long-term value through its best-in-class Megacampus ecosystems and strategic venture capital platform.

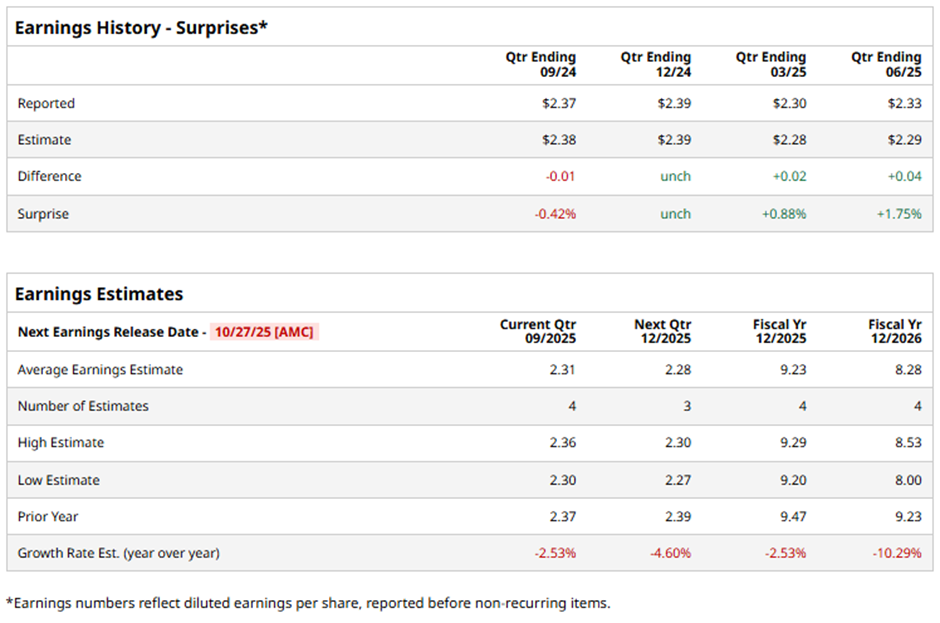

The Pasadena, California-based company is expected to release its fiscal Q3 2025 earnings results after the market closes on Monday, Oct. 27. Ahead of this event, analysts project ARE to report an AFFO of $2.31 per share, reflecting a decrease of 2.5% from $2.37 per share in the year-ago quarter. It surpassed or met Wall Street's bottom-line estimates in three of the last four quarterly reports while missing on another occasion.

For fiscal 2025, analysts forecast the life science real estate company to report AFFO of $9.23 per share, down 2.5% from $9.47 per share in fiscal 2024.

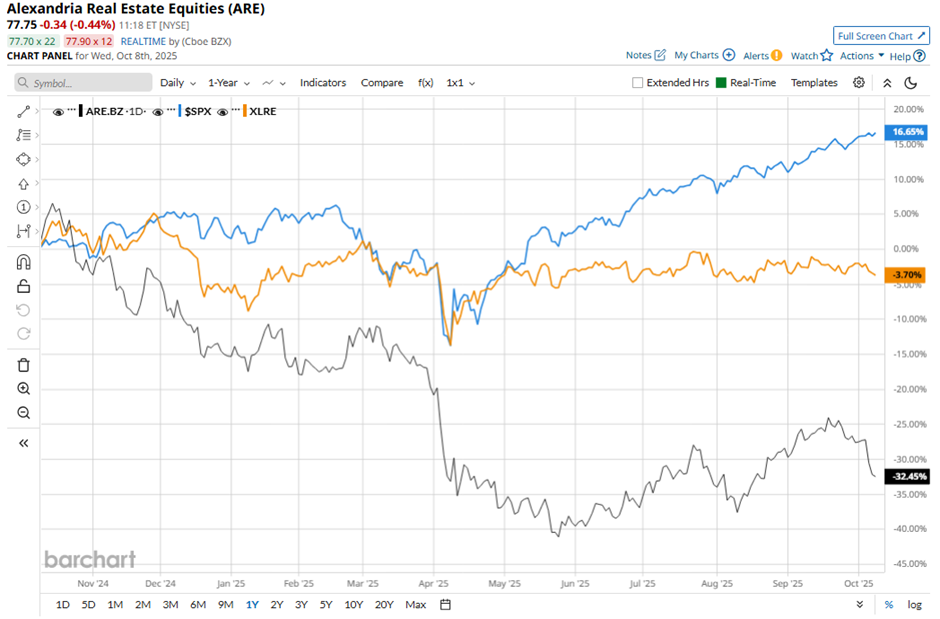

ARE stock has fallen 31.5% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 17.3% increase and the Real Estate Select Sector SPDR Fund's (XLRE) 4.5% decrease over the same time frame.

Shares of ARE rose 3.1% following its Q2 2025 results on Jul. 21, with AFFO of $2.33 per share, beating the consensus estimate. Revenue of $762 million also beat expectations, reflecting solid leasing activity of 769,815 RSF and rental rate growth of 5.5%. Investor sentiment was further boosted by the announcement of a record 16-year, 466,598 RSF lease with a multinational pharmaceutical tenant, signaling robust long-term demand for Alexandria’s life science properties.

Analysts' consensus view on ARE stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 15 analysts covering the stock, six suggest a "Strong Buy," eight give a "Hold," and one has a "Strong Sell." This configuration is more bullish than three months ago, with four analysts suggesting a "Strong Buy."

The average analyst price target for Alexandria Real Estate Equities is $97.43, indicating a potential upside of 25.3% from the current levels.