/Airbnb%20Inc%20phone%20app%20by%20-%20Tada%20Images%20via%20Shutterstock.jpg)

With a market cap of $86.8 billion, Airbnb, Inc. (ABNB) is a San Francisco, California-based online marketplace that connects hosts offering unique accommodations, anything from spare rooms to entire homes, with travelers worldwide. Airbnb has revolutionized travel by enabling peer-to-peer lodging, later expanding into experiences and services.

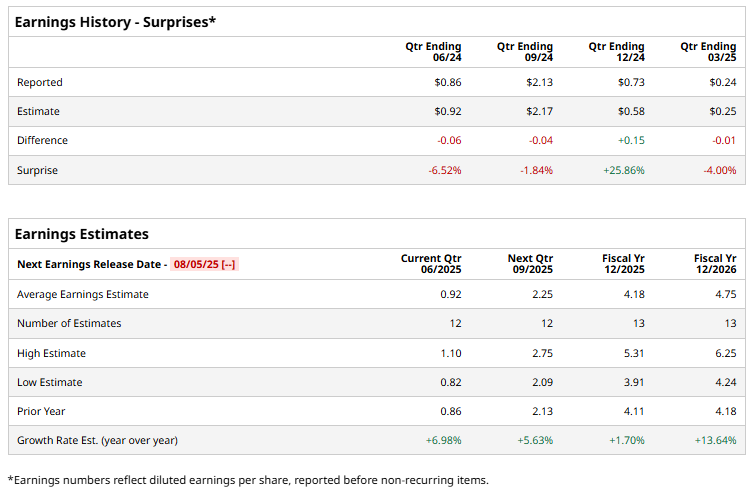

The company is expected to release its Q2 2025 earnings on Tuesday, Aug. 5. Ahead of this event, analysts expect Airbnb to post adjusted earnings of $0.92 per share, up 7% from $0.86 per share reported in the same quarter last year. The company has surpassed Street's bottom-line estimates in only one of the past four quarters, while falling short of expectations on three other occasions.

For fiscal 2025, analysts forecast ABNB to report an adjusted EPS of $4.18, an increase of 1.7% from $4.11 reported in fiscal 2024. Moreover, in fiscal 2026, its earnings are expected to grow 13.6% year-over-year to $4.75 per share.

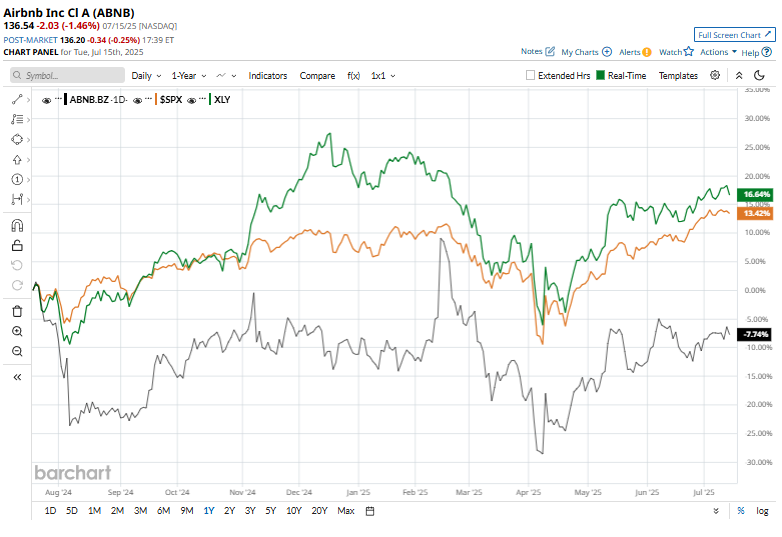

Shares of ABNB have plunged 7.3% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 10.9% gain and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 14.5% returns during the same period.

On May 1, ABNB reported its Q1 results, and its shares rose more than 1% in the following trading session. Driven by increased nights and experiences bookings, its revenue increased 6.1% year over year to $2.3 billion. However, the company’s EPS declined 41.5% year over year to $0.24, due to higher stock-based compensation, investment write-downs, and lower interest income.

Airbnb continued to demonstrate strong cash-generating ability, delivering $1.8 billion in free cash flow with an impressive 78% margin, which supported $807 million in share buybacks. Global booking activity remained resilient, with nights and experiences booked rising 8% to 143 million, fueled by solid demand in Latin America and Asia Pacific, even as U.S. bookings softened due to economic uncertainty.

Analysts' consensus view on ABNB is cautious, with a "Hold" rating overall. Out of 39 analysts covering the stock, opinions include 11 "Strong Buys," one “Moderate Buy,” 20 "Holds,” two “Moderate Sell,” and five “Strong Sells.” Its mean price target of $139.67 represents a 2.3% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.