We’re mid-week, and so far, it’s been a quieter trading affair.

Traders and investors are awaiting the annual Kansas City Federal Reserve Economic Policy Symposium that moves into full swing Thursday in Jackson Hole, Wyoming. Fed Chair Jerome Powell is expected to give an update on the Fed’s monetary policy framework on Friday morning.

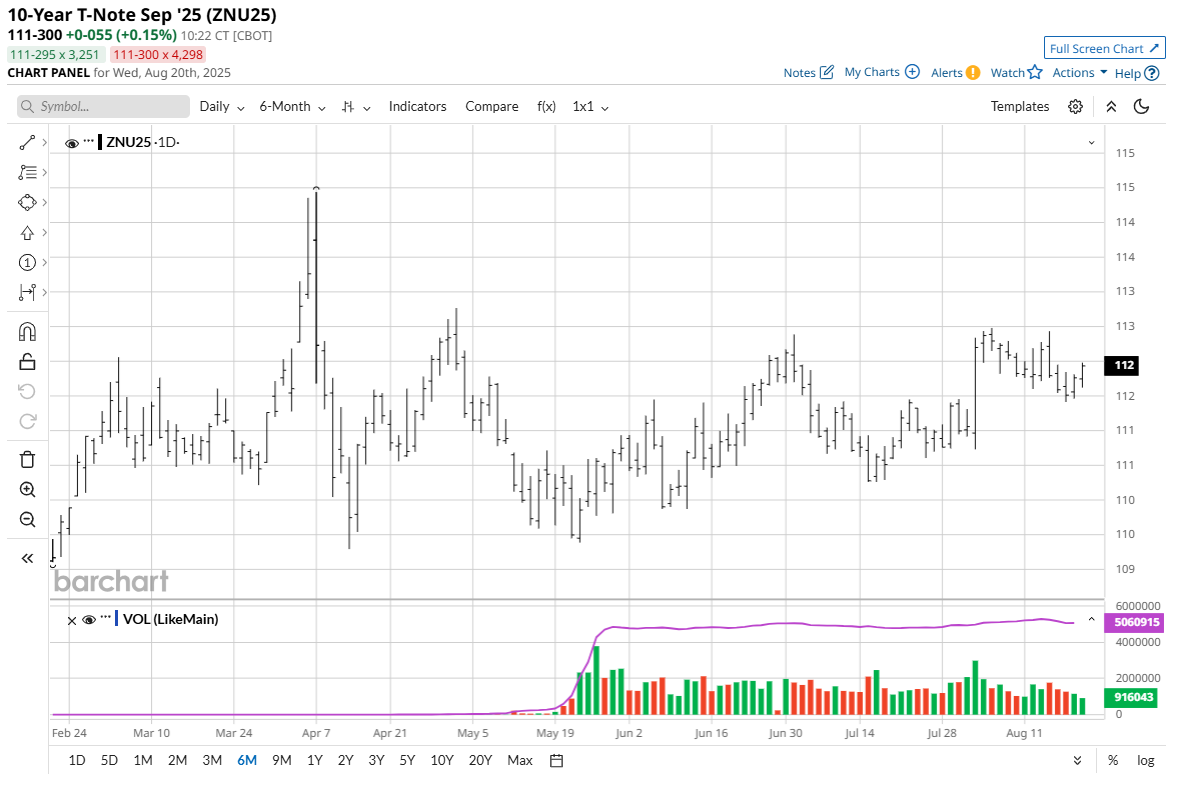

Powell’s speech could give the market a new perspective on how much Federal Open Market Committee (FOMC) support there is to lower U.S. interest rates in September.

Following are some of the arguments that have been put forth by monetary policy doves (who want lower U.S. interest rates sooner) and hawks (who want no U.S. interest rate cuts anytime soon). Then I’ll give you my prediction for Friday’s Powell speech.

The Dove Case on Interest Rate Cuts

- The surprisingly weak U.S. employment report for July showed a modest increase in the unemployment rate, rising to 4.2% from 4.1% the previous month. While the headline number showed a small increase, the jobs growth was surprisingly minimal, with only 73,000 jobs added — and there were downward revisions to job gains in the May and June reports.

- Other major central banks are starting to lower, or leaning toward lowering, their interest rates, including the European Central Bank and the Bank of England. The U.S. Fed does not want to get behind the curve on global central bank monetary policy easing.

- Recent U.S. inflation reports have been mostly tame. The July Consumer Price Index (CPI) report rose 2.7% annually. That’s just slightly above what the Federal Reserve wants to see for annual inflation.

- The “Too late Powell” nickname from President Donald Trump gained some credence following the July jobs report. Trump’s needling of Powell for not lower U.S. interest rates faster may well have pushed Powell into a more dovish posture, to be revealed at Jackson Hole.

The Hawk Case on Interest Rate Cuts

- The hotter-than-expected July Producer Price Index reading of up 3.1%, year-over-year, raised eyebrows.

- Most of the recent U.S. economic data has been upbeat, which supports a steady U.S. monetary policy stance.

- U.S. tariffs are a wild card. While the tariffs have so far not sparked problematic inflation, there is the distinct possibility inflation will fire up in the coming months, as U.S. consumers may have to scramble to buy a shorter supply of goods on store shelves. Also, higher tariffs on imported goods to the U.S. suggest manufacturers and retailers will pass along those increased costs to consumers.

- Holding steady on U.S. monetary policy and not lowering interest rates is bullish for the U.S. dollar.

How I See Powell Leaning Friday and the Resulting Impacts on Markets

I don’t think anyone has a solid read on what Powell will say at Jackson Hole on Friday. That means markets are a little more anxious — not knowing what to expect. My best guess is that Powell leans a bit easier on U.S. monetary policy, mainly due to the surprisingly weaker U.S. jobs data in July. Also, Trump’s pressure on Powell to lower rates has likely impacted Powell’s thinking, especially after the weak July jobs data.

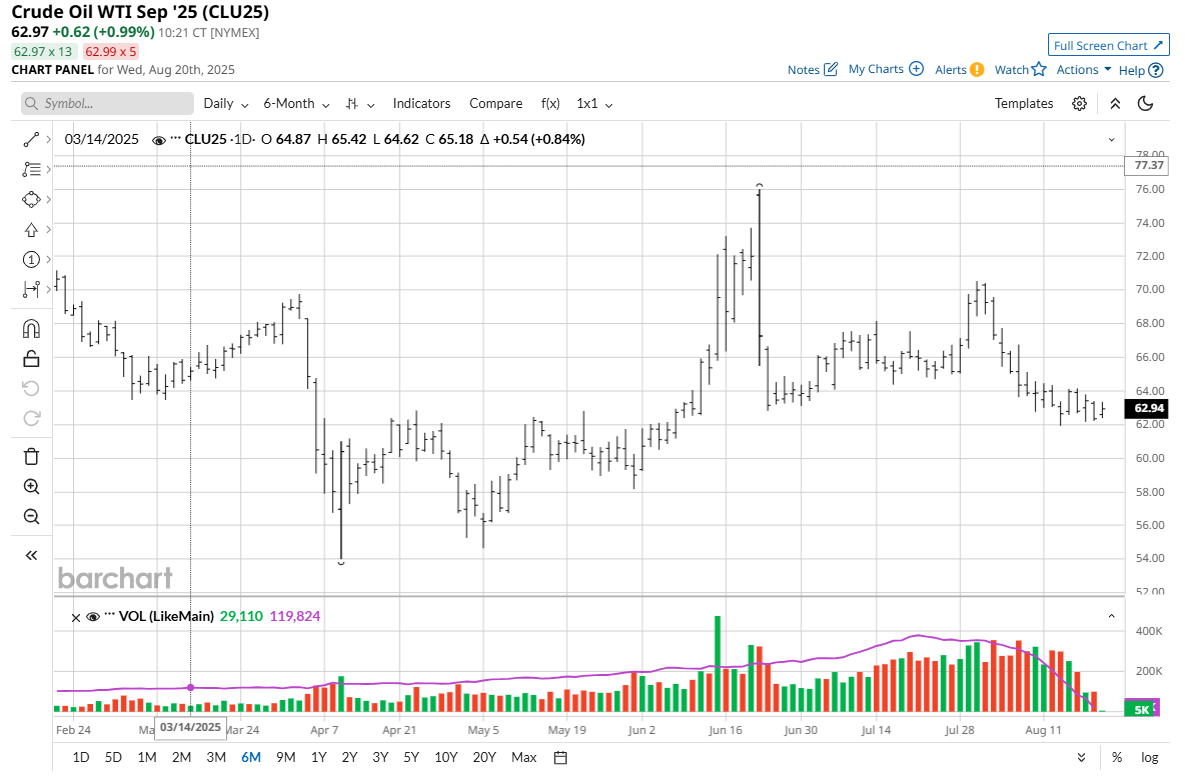

And if Powell does lean easy, commodity markets, including the metals, energies, grains, livestock and softs, would be supported. The U.S. dollar index would likely be pressured, and the Euro currency would rally. U.S. stock indexes would also rally, probably to new record highs since they are already close to record highs. U.S. Treasuries would also see price rallies (lower yields). We’ll see what happens Friday.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.