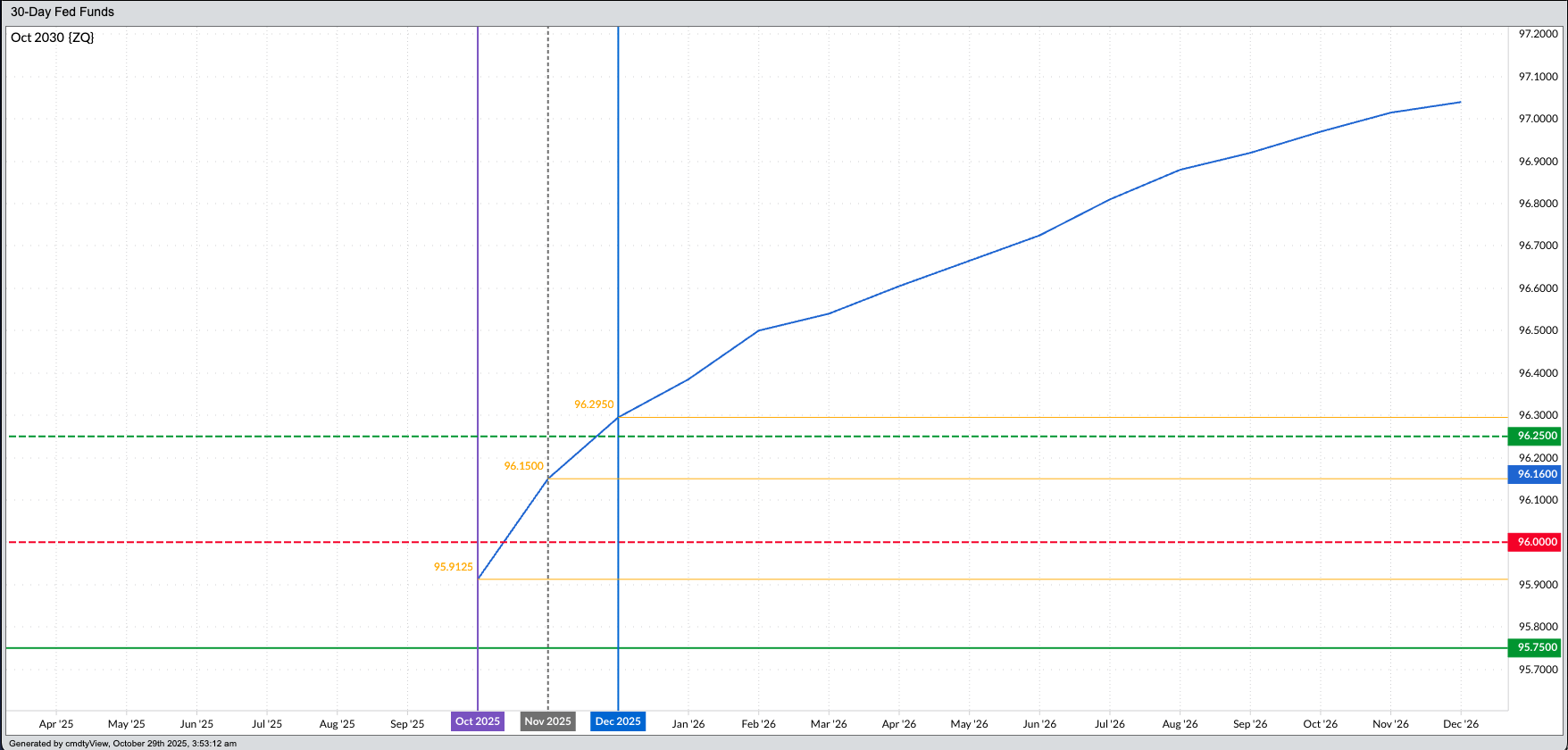

- The Fed find futures forward curve is not as clear cut this time around.

- The October futures contract shows an expected rate within the 4% to 4.25% range.

- The December futures contracts is indicating a more sizable rate cut.

It’s pre-dawn Wednesday morning. Early this afternoon, the US Federal Open Market Committee (Fed, FOMC) 2-day meeting will conclude, culminating with an interest rate announcement from Chairman Jerome Powell at 14:00 (ET) and subsequent press conference (14:30). This leaves ample time for the debate to continue about if the Fed will offer the US president another pacifier to keep him quiet (as if that is possible) or if rates stay unchanged this time around.

Most of the talking heads on financial television are expecting Chairman Powell to announce another 25-basis point rate cut. However, that’s not what the market is saying. And as you know, when it comes to what I listen to, the market wins every time. Almost. As you’ll see in a moment.

Recall at the end of the September 2025 meeting (September 17), the Fed fund rate range dropped to 4.0% to 4.25%.

As of this morning, the Fed fund futures contracts showed expected Fed fund rates (100% – Futures price) of:

- October (ZQV25) at 95.9125 = 4.0875%

- Still above the low end of the current range

- November (ZQX25) at 96.14 = 3.86%

- Below the expected low end of the range, indicating another 25-basis point rate cut

- Putting the next range between 3.75% and 4.0%

- There is no FOMC meeting during November

- December (ZQZ25) at 96.305 = 3.695%

- What would be below the low end of the projected range of 3.75% to 4.0%

- Indicating another possible 25-basis point cut to 3.5% to 3.75%

- The next Fed meeting is December 9 and 10

Here’s where things get fun.

- Given there is no meeting during November, and the December futures contract shows an expected Fed fund rate 39.25-basis points below the current range

- The FOMC could cut 25 basis points this month, and another 25 basis points in December

- Or nothing this month and 50 basis points at the conclusion of the December meeting

- Or 50 basis points this month

- Since recent inflation reads, most notably the September Consumer Price Index (CPI) showed a smaller increase than expected, the Fed could feel confident to make another 25-basis point cut Wednesday afternoon, then wait to see what happens toward the end of the year.

- This would likely throw another log on the fire of the long-term rally in US stock indexes

- Theoretically it would also weaken the US dollar

- And also theoretically raise commodity prices

We’ll see what happens.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.