/Zoetis%20Inc%20HQ%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $64.3 billion, Zoetis Inc. (ZTS) is a global leader in animal health, specializing in the discovery, development, and commercialization of medicines, vaccines, diagnostics, and precision animal health products for both livestock and companion animals. The company’s diversified portfolio spans multiple species and product categories, catering to veterinarians, livestock producers, and pet owners worldwide.

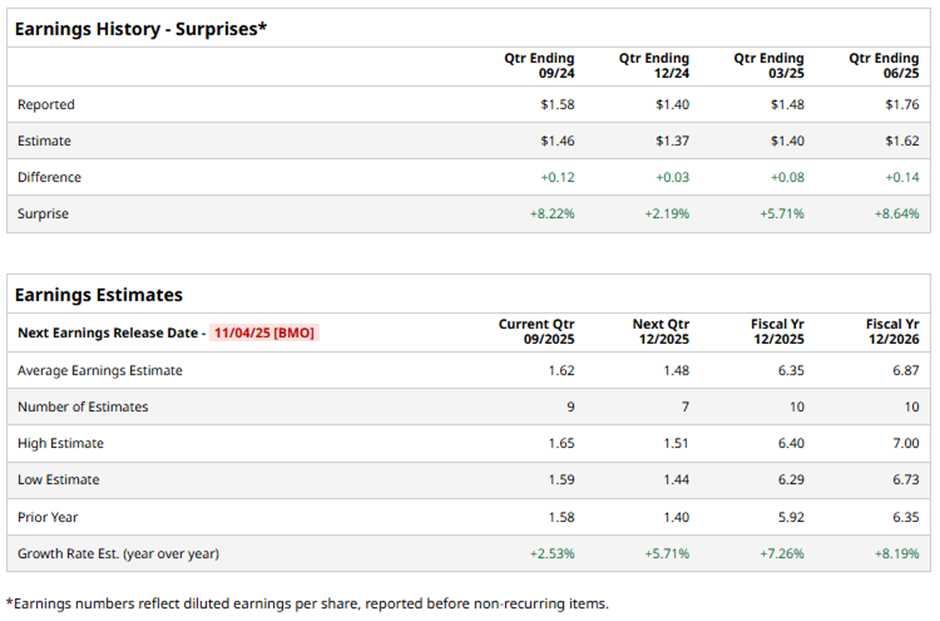

The Parsippany, New Jersey-based company is slated to announce its fiscal Q3 2025 results before the market opens on Tuesday, Nov. 4. Ahead of the event, analysts expect Zoetis to report an adjusted EPS of $1.62, up 2.5% from $1.58 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2025, analysts predict the animal health company to report adjusted EPS of $6.35, a 7.3% rise from $5.92 in fiscal 2024. In addition, adjusted EPS is anticipated to grow 8.2% year-over-year to $6.87 in fiscal 2026.

Shares of Zoetis have fallen 22.9% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.3% increase and the Health Care Select Sector SPDR Fund's (XLV) 4.1% decline over the same period.

Despite posting better-than-expected Q2 2025 adjusted EPS of $1.76 and revenue of $2.5 billion, Zoetis shares fell 3.8% on Aug. 5 due to weakness in certain product lines. U.S. sales of monoclonal antibody OA pain treatments Librela and Solensia declined, likely due to fears of side effects in some dogs, partially offsetting the 9% growth in companion animal sales. Additionally, U.S. livestock product sales plunged 21% to $180 million.

Analysts' consensus rating on ZTS stock is bullish, with an overall "Strong Buy" rating. Among 16 analysts covering the stock, 11 recommend a "Strong Buy,” one has a "Moderate Buy" rating, and four give a "Hold" rating. The average analyst price target for Zoetis is $192.50, indicating a potential upside of 31.2% from the current levels.