/Zebra%20Technologies%20Corp_%20logo%20on%20laptop-by%20Jack_the_sparow%20via%20Shutterstock.jpg)

With a market cap of $15.6 billion, Zebra Technologies Corporation (ZBRA) is a global leader in Enterprise Asset Intelligence (EAI) solutions within the Automatic Identification and Data Capture (AIDC) industry. The company designs, manufactures, and provides a wide range of products and services, including mobile computers, barcode scanners, RFID systems, specialty printers, software, and cloud-based solutions that enhance visibility, efficiency, and automation across industries worldwide.

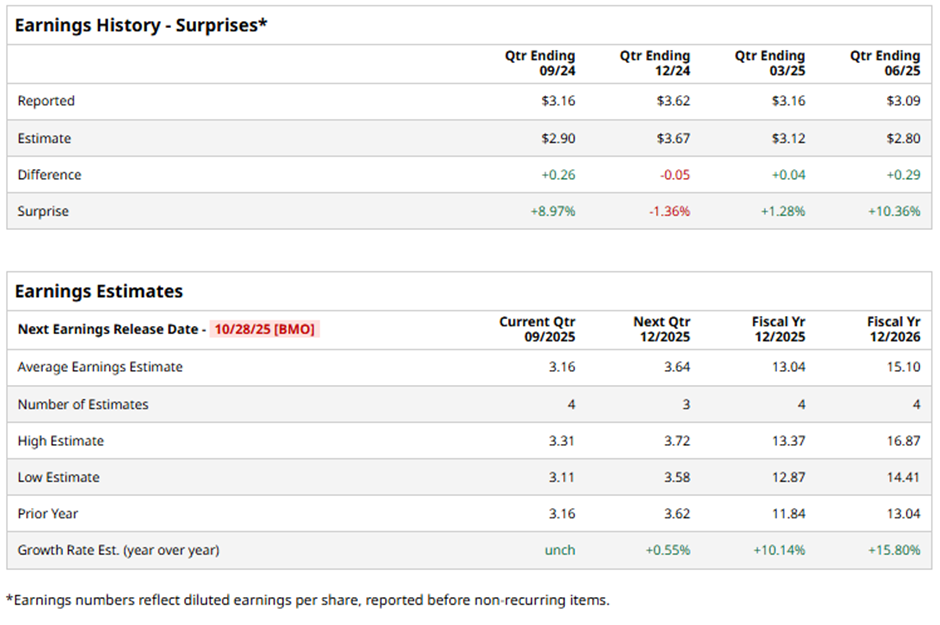

The Lincolnshire, Illinois-based company is slated to announce its fiscal Q3 2025 results before the market opens on Tuesday, Oct. 28. Ahead of the release, analysts expect Zebra Technologies to report EPS of $3.16, in line with the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the barcode scanner maker to report EPS of $13.04, marking an increase of 10.1% from $11.84 in fiscal 2024. Looking forward, EPS is projected to grow 15.8% year-over-year to $15.10 in fiscal 2026.

Shares of Zebra Technologies have decreased 20.7% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 16.2% gain and the Technology Select Sector SPDR Fund's (XLK) 25.5% surge over the same period.

Shares of Zebra Technologies tumbled 11.4% on Aug. 5 despite Q2 2025 adjusted EPS of $3.61 beating estimates and rising 13.5% year-over-year, and revenue of $1.3 billion topping forecasts and growing 6.2%. Investors reacted negatively to weaker segmental performance in Asset Intelligence & Tracking, where revenues of $418 million missed the consensus, and to margin pressure as cost of sales rose 7.8% to $677 million.

Analysts' consensus view on ZBRA stock remains moderately optimistic, with an overall "Moderate Buy" rating. Out of 17 analysts covering the stock, 11 recommend a "Strong Buy," one "Moderate Buy," and five "Holds." This configuration is more bullish than three months ago, with nine analysts suggesting a "Strong Buy."

The average analyst price target for Zebra Technologies is $370, indicating a potential upside of 24.2% from the current levels.