Seattle, Washington-based Weyerhaeuser Company (WY), is one of the world's largest private owners of timberlands, and owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada. Valued at $18.1 billion by market cap, the company primarily grows and harvests trees, develops and constructs real estate, and makes a range of forest products. The timber giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Thursday, Oct. 30.

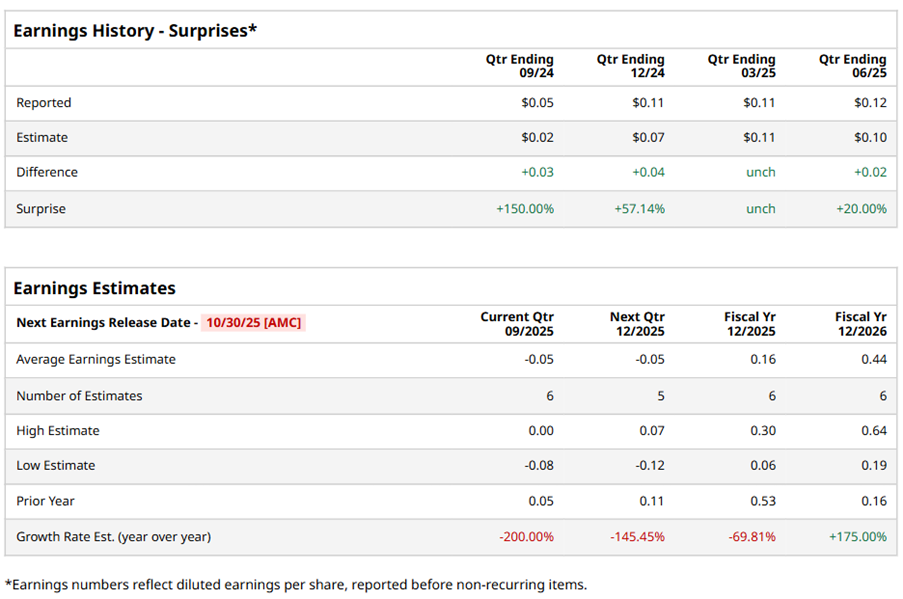

Ahead of the event, analysts expect WY to report an FFO deficit of $0.05 per share on a diluted basis, down 200% from FFO of $0.05 per share in the year-ago quarter. The company has consistently surpassed or matched Wall Street’s FFO estimates in its last four quarterly reports.

For the full year, analysts expect WY to report FFO per share of $0.16, down 69.8% from $0.53 in fiscal 2024. However, its FFO is expected to rise 175% year-over-year to $0.44 per share in fiscal 2026.

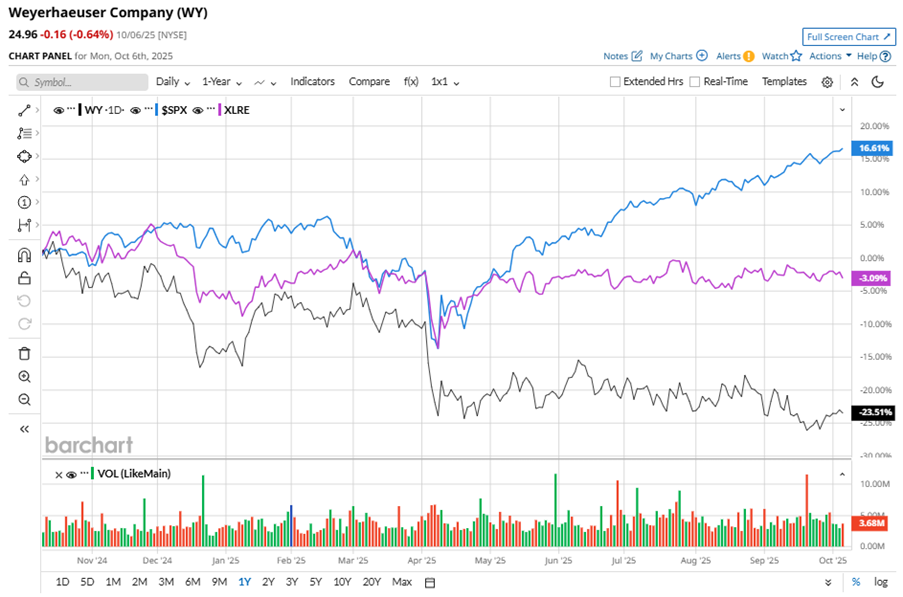

WY stock has significantly underperformed the S&P 500 Index’s ($SPX) 17.2% gains over the past 52 weeks, with shares down 24.1% during this period. Similarly, it substantially underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 4.3% downtick over the same time frame.

Weyerhaeuser's underperformance is attributed to a seasonal decline in construction projects and lumber demand, as well as ongoing U.S.-Canada tariff issues that are impacting lumber prices. These factors may lead to lower wood prices, elevated price variance in the lumber futures market, and increased costs in its Timberlands segment.

On Jul. 25, WY shares closed up more than 3% after reporting its Q2 results. Its EPS of $0.12 beat Wall Street expectations of $0.10. The company’s revenue was $1.9 billion, topping Wall Street forecasts of $1.8 billion.

Analysts’ consensus opinion on WY stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 13 analysts covering the stock, eight advise a “Strong Buy” rating, two suggest a “Moderate Buy,” two give a “Hold,” and one recommends a “Strong Sell.” WY’s average analyst price target is $32.82, indicating an ambitious potential upside of 31.5% from the current levels.