Valued at $50 billion by market cap, Warner Bros. Discovery, Inc. (WBD) is a leading global media and entertainment company formed through the 2022 merger of WarnerMedia and Discovery. The New York-based company operates across studios, networks, and direct-to-consumer platforms, with a vast portfolio that includes Warner Bros. Pictures, HBO, CNN, Discovery Channel, and Max.

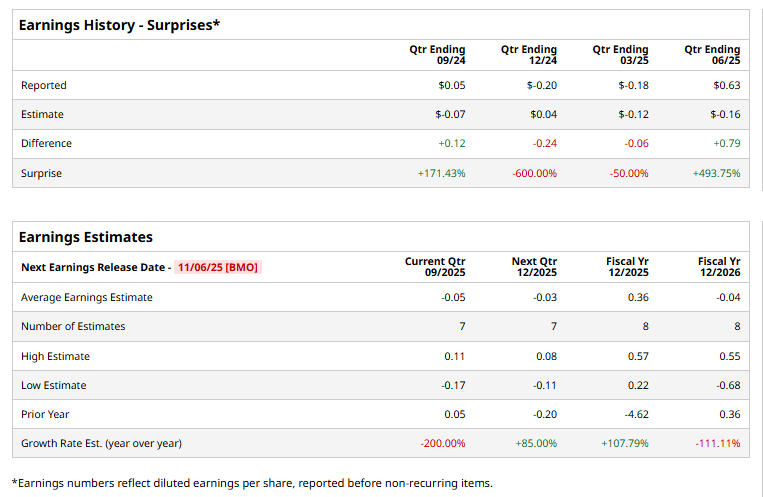

The media giant is expected to release its Q3 results before the markets open on Thursday, Nov. 6. Ahead of the event, analysts expect WBD to report a loss of $0.05 per share, notably down 200% from the profit of $0.05 per share reported in the year-ago quarter. The company has surpassed the Street’s bottom-line projections in two of the past four quarters and has missed the estimates on two other occasions.

For the full fiscal 2025, analysts expect WBD to report an EPS of $0.36 per share, up 107.8% from the $4.62 loss per share reported in fiscal 2024.

WBD stock has soared 172.6% over the past 52 weeks, notably outperforming the Communication Services Select Sector SPDR ETF Fund’s (XLC) 27.1% surge and the S&P 500 Index’s ($SPX) 14.5% gains during the same time frame.

On Oct. 21, WBD shares jumped over 10% after the company announced it had begun reviewing strategic alternatives following unsolicited interest from multiple parties. The review could involve a full company sale, a divestiture of its studio and streaming business (Warner Bros.), or adjustments to its earlier plan to split into two entities, separating its entertainment and networks divisions. While WBD emphasized there’s no guarantee of a deal, the move signals an effort to unlock shareholder value amid ongoing industry challenges like debt, cord-cutting, and streaming competition.

Additionally, its shares rose 4.6% on Oct. 13 after the company reportedly rejected a $20-per-share takeover offer from Paramount Skydance, which it viewed as undervaluing the business. The move signaled management’s confidence in WBD’s higher intrinsic worth and fueled investor optimism. Adding momentum, Citigroup raised its price target to $25 from $14 while maintaining a ‘Buy’ rating, citing stronger fundamentals and improving profitability in the streaming segment.

The stock maintains a consensus “Moderate Buy” rating overall. Of the 26 analysts covering the WBD stock, opinions include nine “Strong Buys,” one “Moderate Buy,” and 16 “Holds.” As of writing, the stock is trading above its mean price target of $18.47.