Valued at a market cap of $201.6 billion, The Walt Disney Company (DIS) is a leading entertainment conglomerate with a diversified portfolio spanning media networks, film and television studios, theme parks and resorts, consumer products, and direct-to-consumer streaming platforms. Founded in 1923 and headquartered in Burbank, California, Disney is one of the world’s most influential content and intellectual property owners, with iconic franchises including Disney, Pixar, Marvel, Star Wars, and National Geographic.

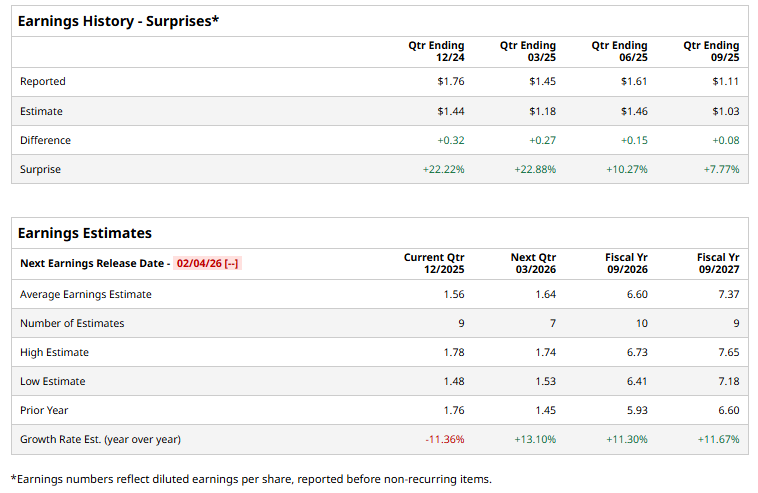

The entertainment giant is expected to announce its fiscal first-quarter earnings for 2026 soon. Ahead of the event, analysts expect DIS to report a profit of $1.56 per share on a diluted basis, down 11.4% from $1.76 per share in the year-ago quarter. On a positive note, the company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect DIS to report EPS of $6.60, up 11.3% from $5.93 in fiscal 2025.

DIS shares have surged 4% over the past year, trailing the S&P 500’s ($SPX) 17% gains and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 20.8% gains over the same time frame.

On Dec. 11, Disney shares gained 2.4% after the company announced a landmark three-year licensing and investment agreement with OpenAI, making Disney the first major content partner for Sora, OpenAI’s generative AI video platform. Beginning in early 2026, Sora and ChatGPT Images will enable fans to create short, shareable videos and images using more than 200 licensed characters, environments, and assets from Disney, Pixar, Marvel, and Star Wars, excluding talent likenesses and voices.

Alongside the licensing deal, Disney will become a major OpenAI customer, deploying ChatGPT internally and integrating OpenAI’s technology into Disney+ to power new subscriber experiences, including curated Sora-generated content. Disney will also make a $1 billion equity investment in OpenAI and receive warrants for additional equity.

Analysts’ consensus opinion on DIS stock is highly bullish, with a “Strong Buy” rating overall. Out of 29 analysts covering the stock, 20 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” five give a “Hold,” and a “Strong Sell.” DIS’ average analyst price target is $135.28, indicating a potential upside of 18.5% from the current levels.