/W_R_%20Berkley%20Corp_%20phone%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

W. R. Berkley Corporation (WRB) is an insurance holding company headquartered in Greenwich, Connecticut and has a market capitalization of $28.8 billion. The firm operates primarily in the property-casualty insurance and reinsurance sectors, offering specialized commercial insurance products and reinsurance on both admitted and non-admitted bases across multiple geographies.

Its decentralized operational structure allows individual business units to respond quickly to local market conditions and encourages accountability among management. It is scheduled to announce its fiscal Q3 2025 earnings report after the market closes on Monday, Oct. 20.

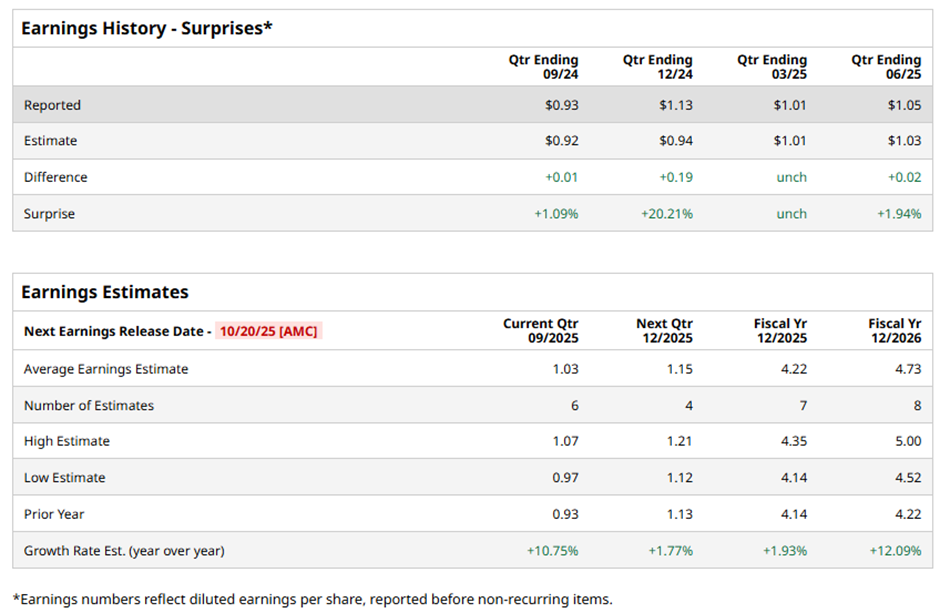

Ahead of this event, analysts expect this insurance company to report a profit of $1.03 per share, 10.8% higher than the prior-year quarter value of $0.93. The company has met or exceeded Wall Street’s earnings estimates in each of the last four quarters. In Q2, WRB’s EPS of $1.05 surpassed the forecasted figure by 1.9%.

For fiscal 2025, analysts expect W. R. Berkley to report a profit of $4.22 per share, up 1.9% from $4.14 per share in fiscal 2024. Its EPS is expected to further grow 12.1% year-over-year (YoY) to $4.73 in fiscal 2026.

WRB has gained 33.8% over the past 52 weeks, outpacing both the S&P 500 Index’s ($SPX) 15.6% rise and the Financial Select Sector SPDR Fund’s (XLF) 19.6% return over the same time frame.

Investors appear bullish on WRB stock due to stronger-than-expected underwriting performance, expanding net premiums, and improving investment income. In its last reported quarter, the company’s net premiums written for Q2 rose to a record $3.4 billion, which helped it beat estimates.

Wall Street analysts are moderately optimistic about WRB stock, with a “Moderate Buy” rating overall. Among 19 analysts covering the stock, six recommend a “Strong Buy,” 12 suggest a “Hold,” and one indicates a “Strong Sell” rating.

While the company is trading above its mean price target of $73.75, its Street-high price target of $86 suggests a 13.3% premium to its current price levels.