With a market cap of $64.8 billion, Vistra Corp. (VST) is the largest competitive power generator in the U.S., boasting a generation capacity of about 41,000 megawatts, sufficient to supply electricity to 20 million homes. With a diverse portfolio spanning natural gas, nuclear, coal, solar, and battery storage, Vistra is leading the nation’s transition toward a cleaner energy future, targeting a 60% emissions reduction by 2030 and net-zero carbon by 2050.

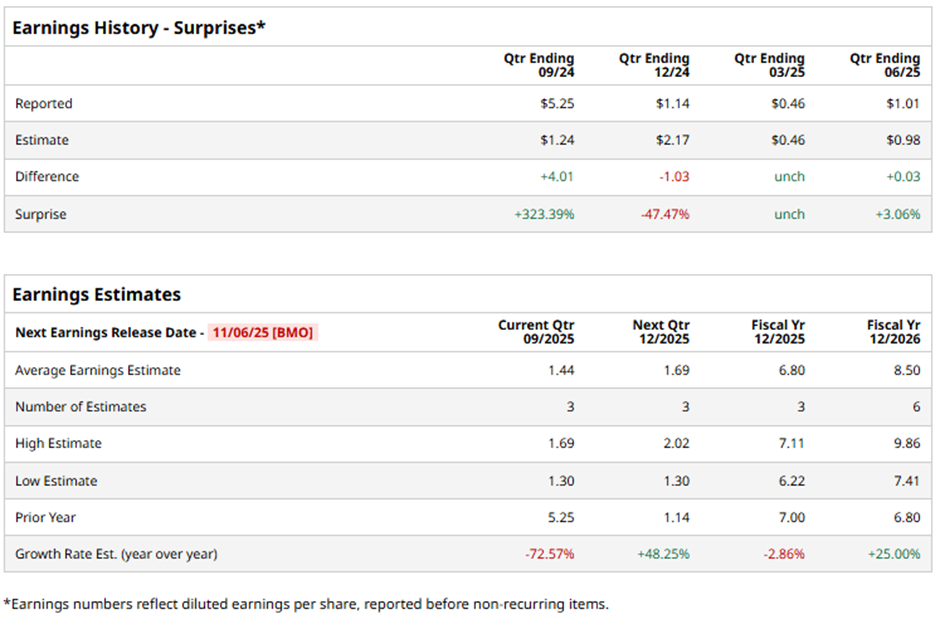

The Irving, Texas-based company is expected to unveil its fiscal Q3 2025 results before the market opens on Thursday, Nov. 6. Before the event, analysts anticipate Vistra to report an EPS of $1.44, down 72.6% from $5.25 in the year-ago quarter. It has surpassed or met Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the company to report EPS of $6.80, a 2.9% decline from $7 in fiscal 2024. However, EPS is anticipated to grow 25% year-over-year to $8.50 in fiscal 2026.

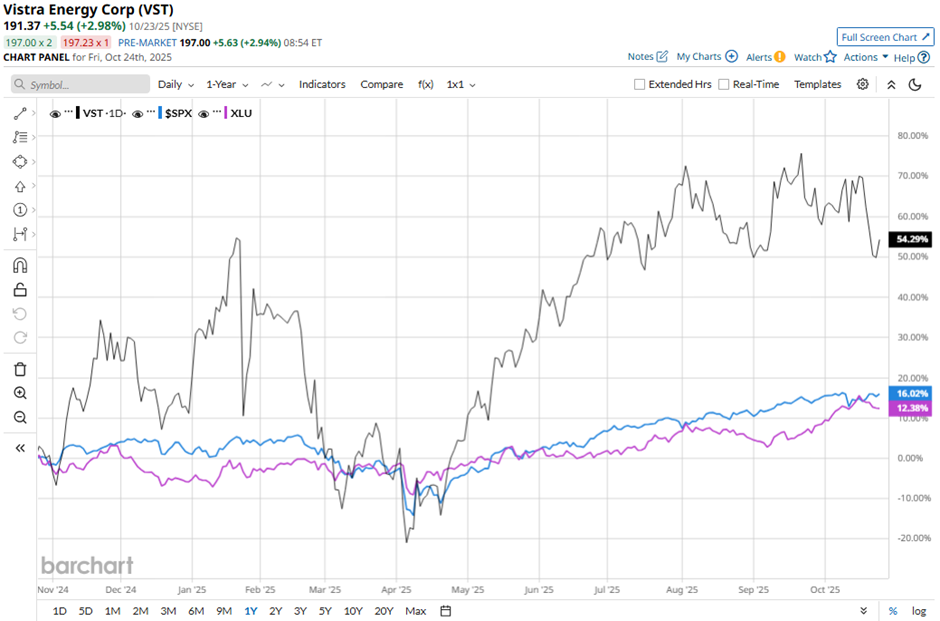

VST stock has jumped 57.7% over the past 52 weeks, outpacing the S&P 500 Index's ($SPX) 16.2% gain and the Utilities Select Sector SPDR Fund's (XLU) 11.4% increase over the same period.

Shares of Vistra rose 2.4% on Aug. 7 after it reported Q2 2025 results. The company lifted its 2026 adjusted EBITDA outlook to over $6.8 billion. Investors reacted positively to the company’s plans to expand nuclear capacity by over 600 megawatts by 2030 to meet growing electricity demand from data centers and AI-related industries. Additional support came from the 2,600-MW natural gas acquisition from Lotus Infrastructure Partners and the 20-year license extension for the Perry Nuclear Power Plant.

Analysts' consensus rating on VST stock is bullish, with an overall "Strong Buy" rating. Out of 17 analysts covering the stock, opinions include 14 "Strong Buys" and three "Holds." The average analyst price target for Vistra is $240.38, indicating a potential upside of 25.6% from the current levels.