/Thermo%20Fisher%20Scientific%20Inc_%20logo%20on%20building-by%20JHVEPhoto%20via%20iStock.jpg)

Thermo Fisher Scientific Inc. (TMO) is a leading global company that supports science by providing tools, instruments, and services for laboratories and research centers. Headquartered in Waltham, Massachusetts, the company works in more than 60 countries.

It serves various healthcare sector industries, including pharmaceuticals and biotechnology, helping customers with research, diagnostics, and manufacturing. The company has a market capitalization of $202.47 billion.

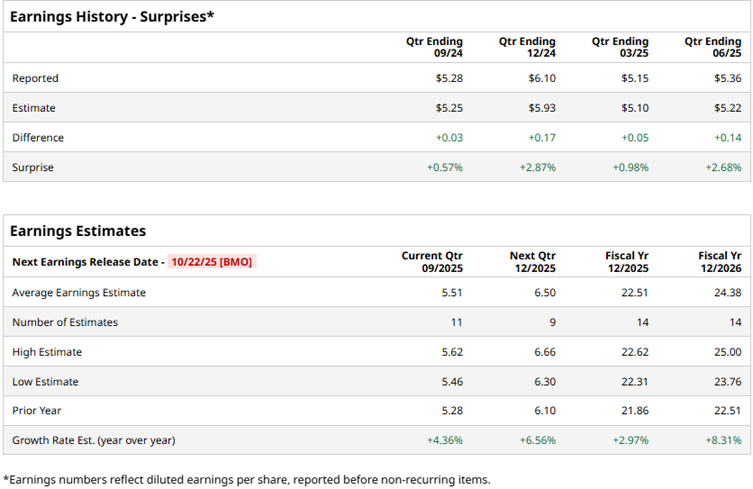

Thermo Fisher is set to report its third-quarter results for fiscal 2025 on Oct. 22, 2025, before the market opens. Ahead of the results, Wall Street analysts are expecting modest increases in its bottom line. For the third quarter, its profit is expected to be $5.51 per diluted share, up 4.4% year over year (YOY). The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

For the current fiscal year, its profit is expected to increase by 3% from the prior year to $22.51 per diluted share.

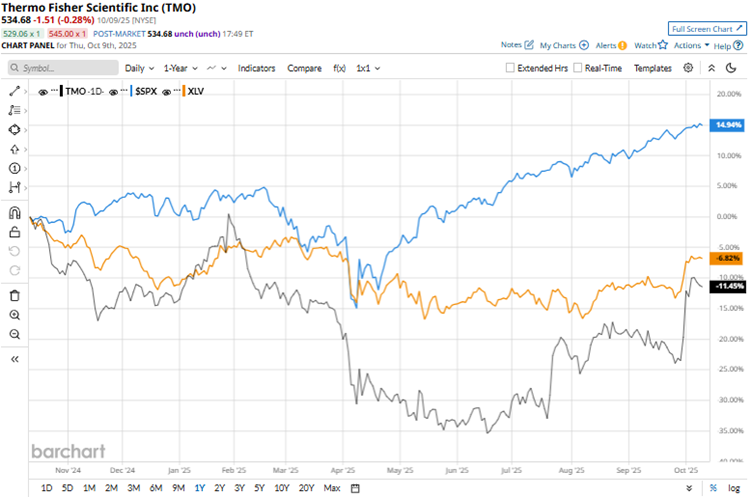

Thermo Fisher’s stock has been underperforming the broader market over the past year. Over the past 52 weeks, the stock has declined 10.8%, while it has gained 2.8% year-to-date (YTD). On the other hand, the broader S&P 500 Index ($SPX) has gained 16.3% and 14.5% over the same periods, respectively.

Next, we compare the stock with its own sector. The Health Care Select Sector SPDR Fund (XLV) has declined about 6% over the past 52 weeks, but rose 4.8% YTD. Therefore, Thermo Fisher’s stock has underperformed the healthcare sector.

In the second quarter, Thermo Fisher’s revenue increased by 3% YOY to $10.86 billion. On the other hand, its adjusted EPS dropped marginally from $5.37 in Q2 2024 to $5.36 in Q2 2025. However, both the top and bottom-line figures were better than what the Wall Street analysts were expecting. The stock climbed 9.1% intraday on July 23 due to this earnings beat.

Thermo Fisher has also carried out notable acquisitions this year. The company acquired the purification and filtration business from Solventum Corporation (SOLV) for about $4 billion. It also acquired Sanofi’s sterile fill-finish and packaging site in Ridgefield, New Jersey, which enables additional drug manufacturing in the U.S.

Wall Street analysts have been bullish about Thermo Fisher’s prospects. Among the 27 analysts covering the stock, it has a consensus rating of “Strong Buy” overall. The configuration of the ratings is more bullish than it was a month ago, with 19 “Strong Buy” ratings now, up from 18. The ratings are rounded up by three “Moderate Buy” ratings and five “Holds.”

The mean price target of $556.21 indicates a 4% upside from current levels, while the Street-high price target of $650 implies a 21.6% upside.