/Hartford%20Financial%20Services%20Group%20Inc_%20logo%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $37.3 billion, The Hartford Insurance Group, Inc. (HIG) provides a wide range of insurance and financial services to individuals and businesses across the United States and internationally. Its operations include property and casualty insurance, employee benefits, and investment management solutions offered through multiple specialized segments.

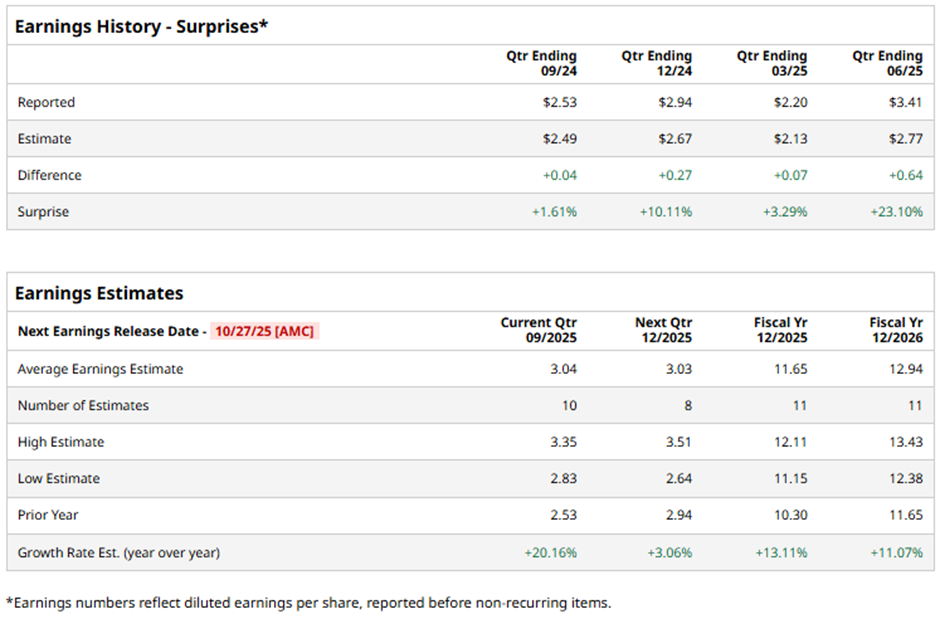

The Hartford, Connecticut-based company is expected to release its fiscal Q3 2025 results after the market closes on Monday, Oct. 27. Ahead of this event, analysts expect HIG to report an adjusted EPS of $3.04, up 20.2% from $2.53 in the prior year's quarter. It has exceeded Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts forecast Hartford Insurance to post an adjusted EPS of $11.65, reflecting a 13.1% rise from $10.30 in fiscal 2024.

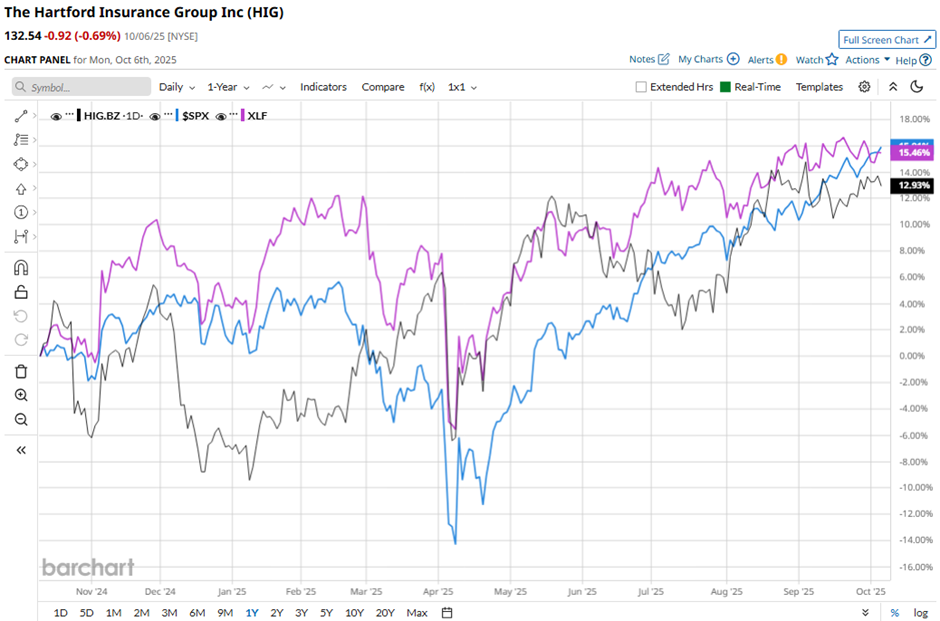

Shares of Hartford Insurance have increased 12.2% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 17.2% gain and the Financial Select Sector SPDR Fund's (XLF) 17.6% return over the period.

Shares of Hartford Insurance rose 2.8% following its Q2 2025 results on Jul. 28 due to a strong 35% jump in quarterly profit, driven by higher insurance spending and robust investment income. Net income available to common stockholders climbed to $990 million or $3.44 per share, up from $733 million or $2.44 per share a year earlier, while property and casualty written premiums grew 8% in the quarter. Additionally, net investment income rose to $664 million, an increase of $62 million, reflecting effective reinvestment at higher interest rates.

Analysts' consensus view on HIG stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 10 recommend "Strong Buy," two suggest "Moderate Buy," and 12 indicate “Hold.” The average analyst price target for Hartford Insurance is $139.70, indicating a potential upside of 5.4% from the current levels.