/Textron%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shuuerstock.jpg)

Providence, Rhode Island-based Textron Inc. (TXT) is a global multi-industry company that manufactures aircraft, automotive engine components, and industrial tools. Valued at $15.5 billion by market cap, Textron operates through Textron Aviation, Bell, Textron Systems, Industrial, Textron Aviation, and Finance segments.

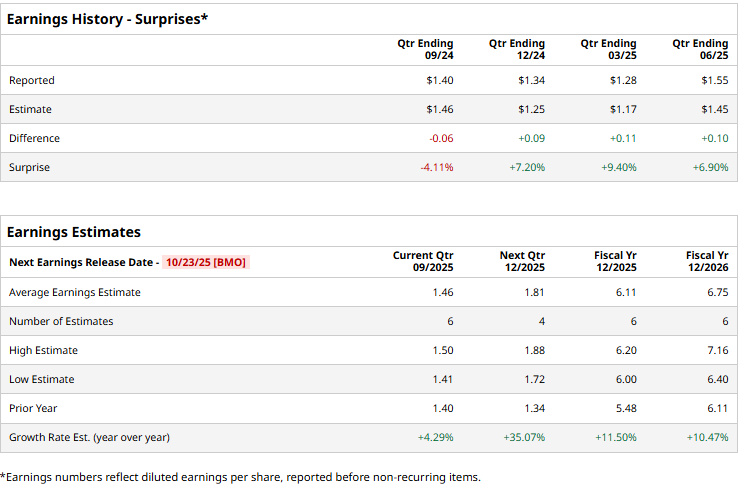

The industrial sector major is set to announce its third-quarter results before the market opens on Thursday, Oct. 23. Ahead of the event, analysts expect Textron to deliver an adjusted profit of $1.46 per share, up 4.3% from $1.40 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed projections on one other occasion.

For the full fiscal 2025, TXT is expected to deliver an adjusted EPS of $6.11, up 11.5% from $5.48 in 2024. In fiscal 2026, its earnings are expected to surge 10.5% year-over-year to $6.75 per share.

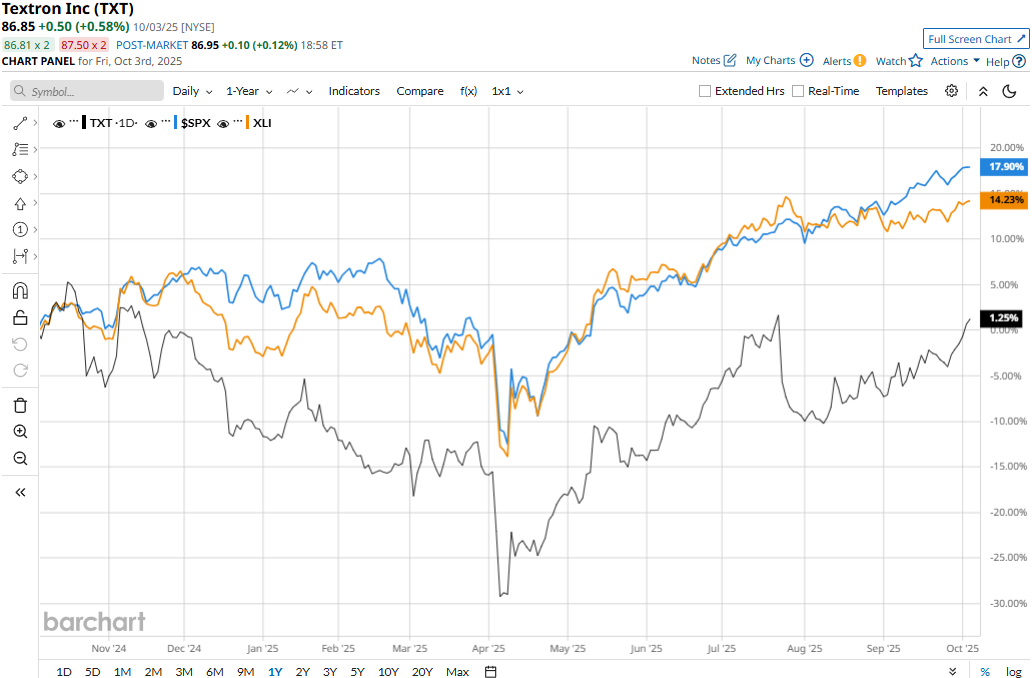

Textron’s stock prices have observed a marginal 86 bps uptick over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.8% surge and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% gains during the same time frame.

Despite reporting better-than-expected topline and earnings, Textron’s stock prices plunged 7.2% in the trading session following the release of its Q2 results on Jul. 24. Although the company’s industrial revenues observed a decline, driven by growth in commercial aircraft and helicopter businesses, the company’s overall revenues came in at $3.7 billion, up 5.4% year-over-year, 2.4% above the Street’s expectations. Meanwhile, TXT reported a modest 65 bps increase in adjusted EPS to $1.55, surpassing the consensus estimates by 6.9%.

However, the company reported notable quarter-on-quarter declines in Aviation, Bell, and Textron Systems’ backlogs, which unsettled investor confidence.

Nonetheless, analysts remain optimistic about the stock’s prospects. TXT maintains a consensus “Moderate Buy” rating overall. Of the 14 analysts covering the stock, opinions include five “Strong Buys” and nine “Holds.” Its mean price target of $92 suggests a 5.9% upside potential from current price levels.