/State%20Street%20Corp_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Boston, Massachusetts-based State Street Corporation (STT) provides a range of financial products and services to various types of investors worldwide. With a market cap of $32.8 billion, State Street serves asset managers, retirement plan providers, insurance companies, foundations, and more.

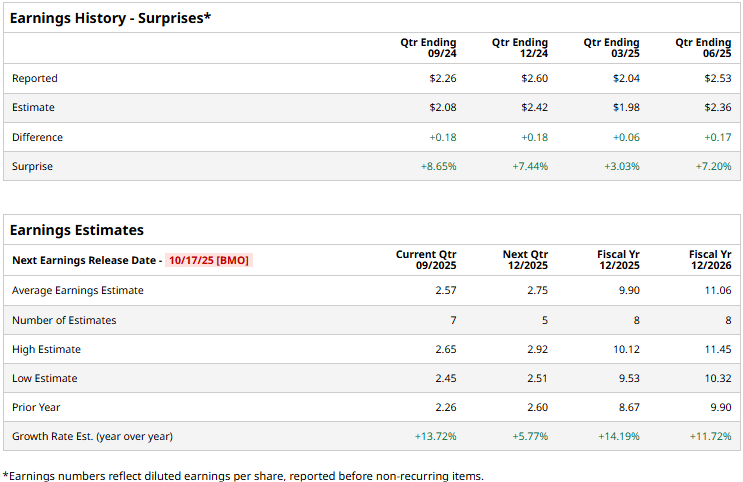

The financial sector major is expected to unveil its third-quarter results before the market opens on Friday, Oct. 17. Ahead of the event, analysts expect STT to deliver a profit of $2.57 per share, up 13.7% from $2.26 per share reported in the year-ago quarter. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect STT to deliver an EPS of $9.90, up 14.2% from $8.67 reported in 2024. In fiscal 2026, its bottom line is expected to grow by 11.7% year-over-year to $11.06 per share.

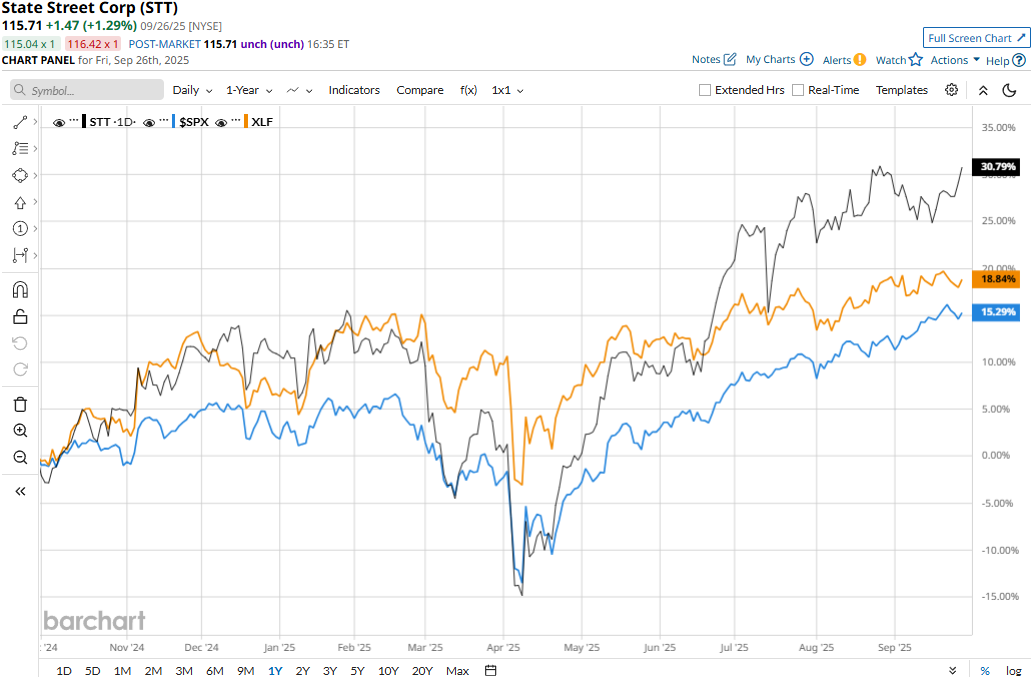

STT stock prices have soared 31.4% over the past 52 weeks, notably outperforming the Financial Select Sector SPDR Fund’s (XLF) 19.6% surge and the S&P 500 Index’s ($SPX) 15.6% gains during the same time frame.

Despite delivering better-than-expected results, State Street’s stock prices dropped 7.3% in the trading session following the release of its Q2 results on Jul. 15. Driven by continued business momentum, STT’s assets under custody reached a record $49 trillion, and AUM touched $5 trillion. Meanwhile, driven by growth in fee-based revenues, its overall topline for the quarter surged 8.1% year-over-year to $3.5 billion, beating the Street’s expectations by 2.1%. However, the company observed an 82 bps decline in net interest income to $729 million, which likely didn’t impress investors.

Nonetheless, STT’s EPS of $2.53 surpassed the consensus estimates by 7.2%. Following the initial dip, State Street’s stock prices gained 6.4% in the three subsequent trading sessions.

Analysts remain optimistic about the stock’s prospects. STT maintains a consensus “Moderate Buy” rating overall. Of the 19 analysts covering the stock, opinions include 10 “Strong Buys,” three “Moderate Buys,” five “Holds,” and one “Moderate Sell.” As of writing, STT is trading slightly below its mean price target of $118.66.