/Southwest%20Airlines%20Co%20plane-by%20Eliyahu%20Parypa%20via%20iStock.jpg)

Dallas, Texas-based Southwest Airlines Co. (LUV) is a passenger airline company, providing scheduled air transportation services in the U.S. and near-international markets. With a market cap of $17.1 billion, Southwest employs over 70,000 people and its operations span various U.S. states and 10 other nations.

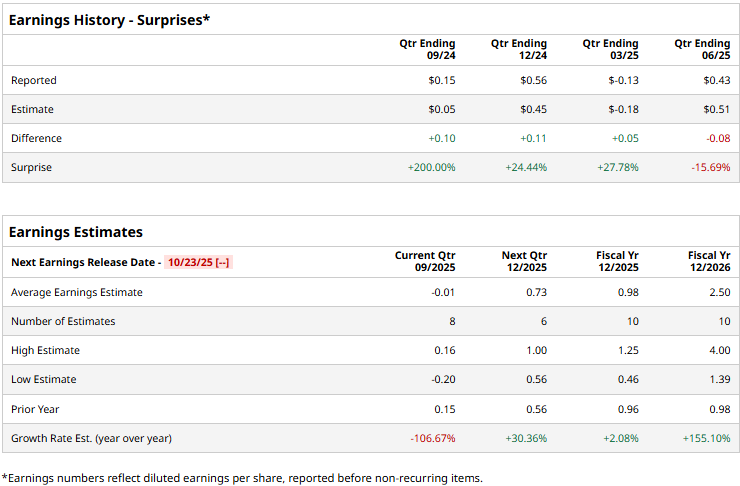

The airline giant is set to release its third-quarter results before the market opens on Thursday, Oct. 23. Ahead of the event, analysts expect Southwest to report a non-GAAP loss of $0.01 per share, down 106.7% from a profit of $0.15 per share reported in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates thrice over the past four quarters, while missing the projections on one other occasion.

For the full fiscal 2025, Southwest is expected to deliver an adjusted EPS of $0.98, up 2.1% from $0.96 in 2024. In fiscal 2026, its earnings are expected to surge 155.1% year-over-year to $2.50 per share.

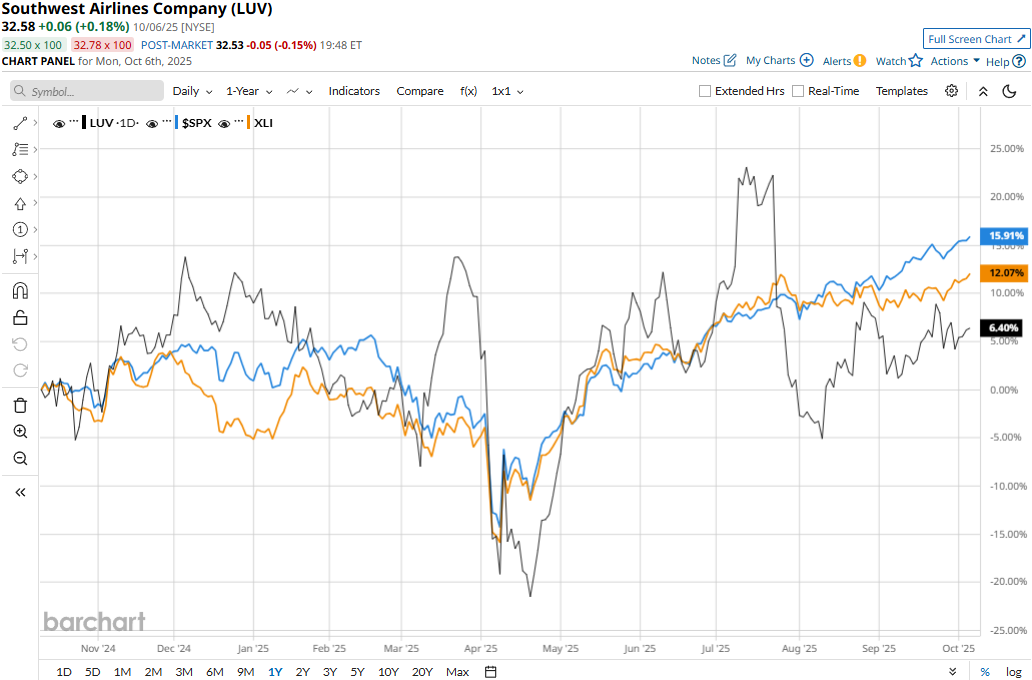

LUV stock prices have gained 4.3% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.2% surge and the Industrial Select Sector SPDR Fund’s (XLI) 14.5% returns during the same time frame.

Southwest Airlines’ stock prices plummeted 11.2% in a single trading session following the release of its disappointing Q2 results on Jul. 23 and maintained a downward trajectory for the next four trading sessions. The company’s passenger revenues dropped 1.3% year-over-year to $6.6 billion, along with notable declines in freight and other revenues. Overall, the airlines reported a topline of $7.2 billion, down 1.5% year-over-year, falling 70 bps below the Street expectations. Moreover, Southwest’s adjusted EPS tanked by 25.9% year-over-year to $0.43, missing the consensus estimates by 15.7%.

Analysts remain cautious about the stock’s prospects. Southwest maintains a consensus “Hold” rating overall. Of the 21 analysts covering the stock, opinions include four “Strong Buys,” one “Moderate Buy,” 11 “Holds,” one “Moderate Sell,” and four “Strong Sells.” As of writing, LUV is trading slightly above its mean price target of $32.12.