/ServiceNow%20Inc%20building%20in%20Silicon%20Valley-by%20Sundry%20Photography%20via%20iStock.jpg)

Valued at about $189.8 billion by market capitalization, California-based ServiceNow, Inc. (NOW) is harnessing artificial intelligence (AI) to empower people and organizations worldwide. Moving at the speed of innovation, the company helps businesses across industries transform with a trustworthy, human-centered approach to scaling technology. Its AI-driven platform connects people, processes, data, and devices, boosting productivity and unlocking stronger business outcomes.

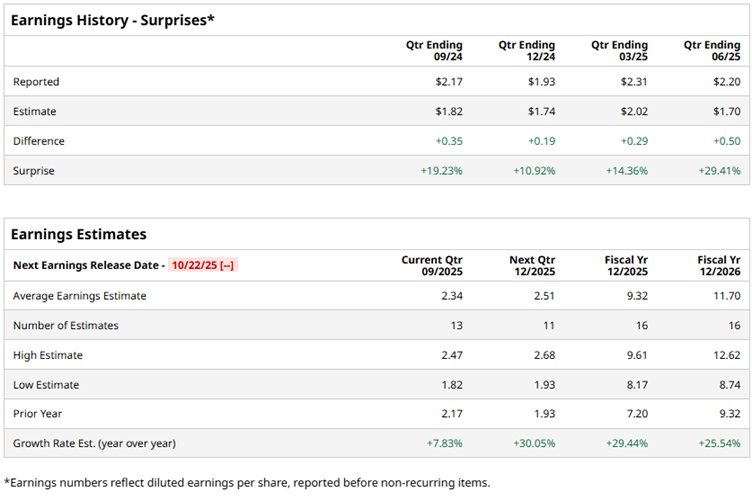

Having reported its fiscal 2025 second-quarter results in July, the company is now preparing to roll out its third-quarter earnings soon. And ahead of this event, analysts are looking for ServiceNow to post earnings of $2.34 per share in the upcoming report, a 7.8% increase from the $2.17 per share it earned in the same quarter last year.

The company has built a reputation for beating expectations, having outpaced Wall Street’s profit estimates in each of the past four quarters. Looking ahead, bottom-line growth is expected to remain steady. For fiscal 2025, earnings are projected to rise 29.4% to $9.32 per share, up from $7.20 reported in fiscal 2024, followed by another 25.5% gain in fiscal 2026, lifting EPS to $11.70.

ServiceNow shares have inched up about 2.4% over the past year, trailing the broader market and its tech peers. By comparison, the broader S&P 500 Index ($SPX) has climbed roughly 17.8% over the same period, while the Technology Select Sector SPDR Fund (XLK) surged an impressive 27.8%. The muted stock performance highlights how ServiceNow has lagged behind the broader tech rally, even as investors poured into growth and AI-driven names.

On Jul. 23, ServiceNow reported its second quarter earnings report which not only blew past Wall Street’s top and bottom-line forecasts but also showed strong growth across the board, triggering a 4.2% surge in shares on Jul. 24. The company credited its AI-powered platform as a major growth driver, while strategic partnerships and acquisitions further strengthened its competitive edge.

Notably, the company’s current remaining performance obligations (cRPO) rose 24.5% year-over-year (YOY) to $10.92 billion by the end of Q2, signaling a substantial pipeline of revenue yet to be recognized and a solid outlook for the near term.

Even with ServiceNow showing lackluster price performance over the past year, Wall Street remains bullish on the stock, with an overall “Strong Buy” rating. Among 42 analysts covering the stock, 34 recommend a "Strong Buy," three indicate a "Moderate Buy," four advise a “Hold,” and the remaining one has issued a “Strong Sell.”

In fact, the sentiment has shifted slightly more bullish over the past month, with “Strong Buy” recommendations rising from 33 to 34. Plus, analysts have set a mean price target of $1,153.89, implying roughly 26.5% upside potential from the current market price.