With a market cap of $48.3 billion, Sempra (SRE) is an energy infrastructure company with operations across the United States, Mexico, and international markets. It operates through three main segments: Sempra California; Sempra Texas Utilities; and Sempra Infrastructure, providing natural gas and electric services while developing and operating energy infrastructure for cleaner energy access.

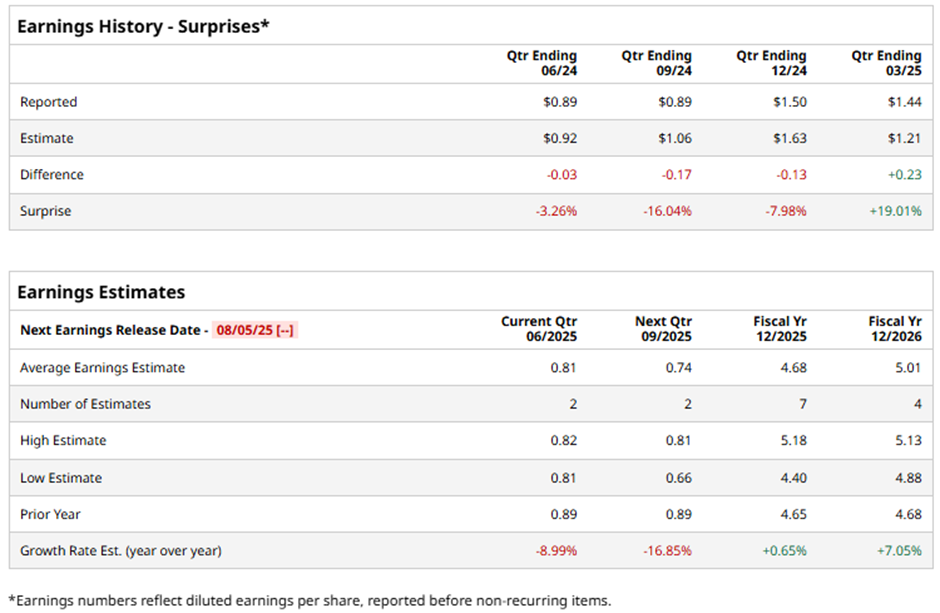

The San Diego, California-based company is slated to announce its fiscal Q2 2025 earnings results on Tuesday, Aug. 5. Ahead of this event, analysts expect Sempra to report an adjusted EPS of $0.81, a decline of nearly 9% from $0.89 in the year‑ago quarter. It has exceeded Wall Street's earnings expectations in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts expect the natural gas and electricity provider to report adjusted EPS of $4.68, a marginal rise from $4.65 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 7.1% year-over-year to $5.01 in fiscal 2026.

Shares of Sempra have decreased 2.4% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 10.2% return and the Utilities Select Sector SPDR Fund's (XLU) 17.5% gain over the same period.

Despite Sempra reporting better-than-expected Q1 2025 adjusted EPS of $1.44, its shares fell marginally on May 8. Total revenue came in at $3.8 billion, missing the consensus estimate. Additionally, earnings in the Sempra Texas Utility segment declined to $146 million from $183 million year-over-year, and the "Parent and Other" segment posted a wider loss of $110 million.

Analysts' consensus view on Sempra stock remains cautiously optimistic, with an overall "Moderate Buy" rating. Out of 18 analysts covering the stock, eight recommend a "Strong Buy," one "Moderate Buy," and nine "Holds." As of writing, the stock is trading below the average analyst price target of $81.53.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.