/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $255.6 billion, Salesforce, Inc. (CRM) is a global leader in customer relationship management (CRM) technology, offering cloud-based solutions that help businesses of all sizes connect with their customers across sales, service, marketing, commerce, and more. The company provides a robust platform powered by AI, data, and automation to drive customer success and digital transformation.

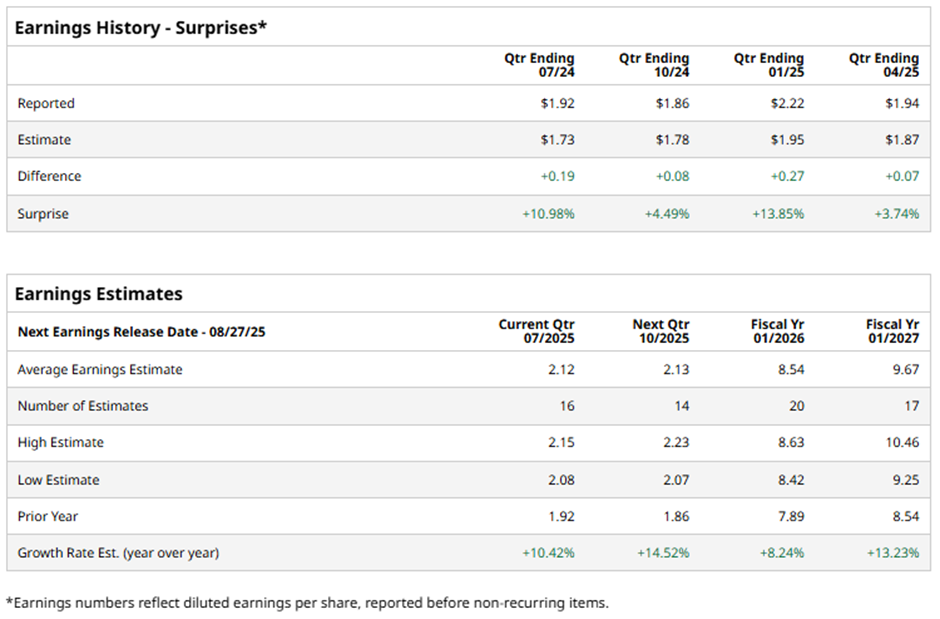

The San Francisco, California-based company is slated to announce its fiscal Q2 2026 earnings results on Wednesday, Aug. 27. Ahead of this event, analysts expect Salesforce to report an EPS of $2.12, a 10.4% growth from $1.92 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2026, analysts expect the customer-management software developer to report EPS of $8.54, marking an increase of 8.2% from $7.89 in fiscal 2025. Moreover, EPS is anticipated to grow 13.2% year-over-year to $9.67 in fiscal 2027.

Shares of Salesforce have risen 3.7% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 17.2% gain and the Technology Select Sector SPDR Fund's (XLK) nearly 26% return over the same period.

Despite beating Q1 2026 expectations with adjusted EPS of $2.58 and revenue of $9.8 billion on May 28, Salesforce shares fell 3.3% the next day due to concerns over slowing core cloud growth and a softer-than-expected Q2 CRPO outlook. While Q1 CRPO rose 12% to $29.6 billion, the Q2 guide implied single-digit constant currency CRPO growth. Additionally, the fiscal 2026 revenue guidance, although slightly raised to $41 billion - $41.3 billion, was driven in part by currency tailwinds, tempering enthusiasm about underlying growth momentum.

Analysts' consensus view on Salesforce stock remains bullish, with a "Strong Buy" rating overall. Out of 49 analysts covering the stock, 36 recommend a "Strong Buy," two "Moderate Buys," nine "Holds," and two "Strong Sells." As of writing, the stock is trading below the average analyst price target of $355.89.