/Roper%20Technologies%20Inc%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Sarasota, Florida-based Roper Technologies, Inc. (ROP) operates market-leading businesses that design and develop vertical software and technology-enabled products for a variety of defensible niche markets. Valued at $53.6 billion by market cap, Roper operates through Application Software, Network Software, and Technology Enabled Products segments.

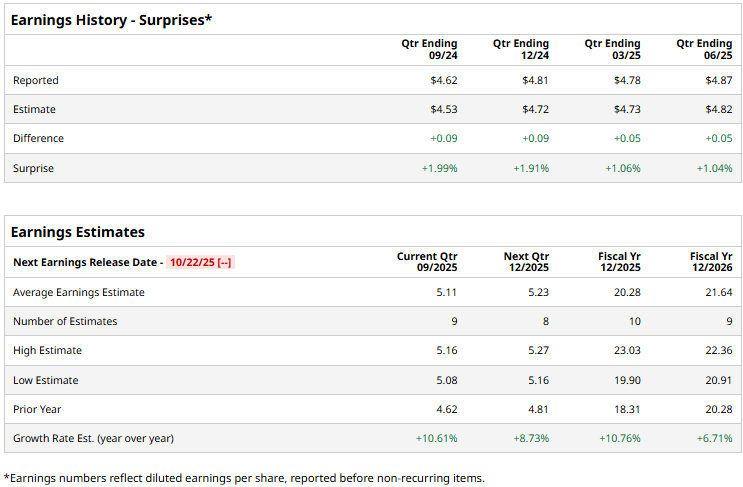

The software major is expected to announce its third-quarter results on Wednesday, Oct. 22. Ahead of the event, analysts expect Roper to deliver a non-GAAP profit of $5.11 per share, up 10.6% from $4.62 per share reported in the year-ago quarter. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect ROP to report an adjusted EPS of $20.28, up 10.8% from $18.31 in 2024. While in fiscal 2026, its earnings are expected to grow 6.7% year-over-year to $21.64 per share.

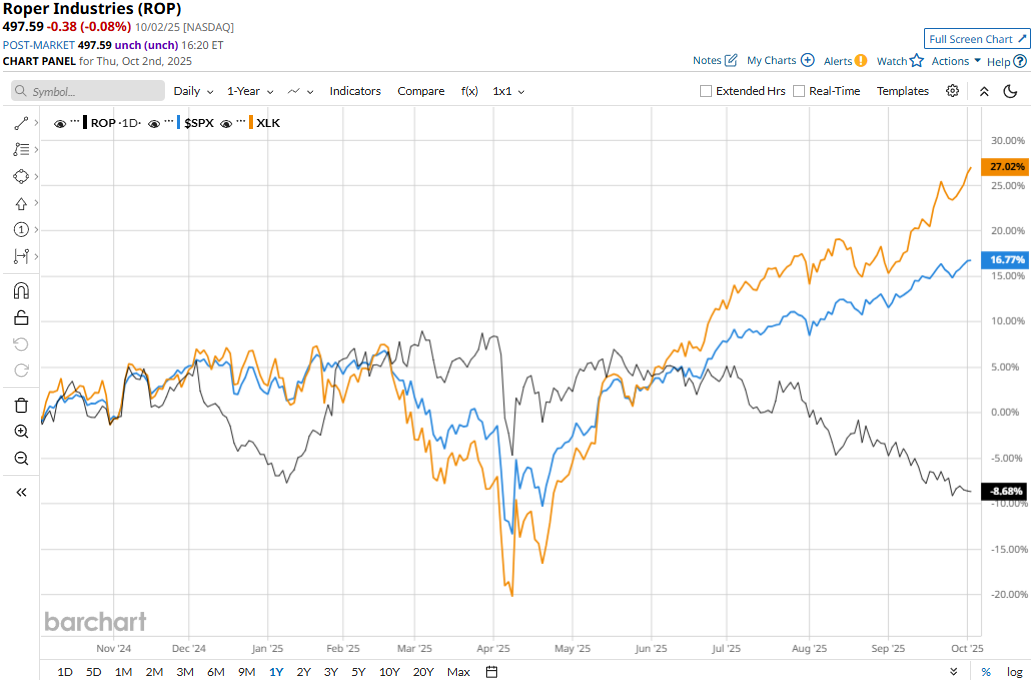

ROP stock prices have declined 9.8% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.6% gains and the Technology Select Sector SPDR Fund’s (XLK) 29% surge during the same time frame.

Roper Technologies’ stock prices gained 1.3% in the trading session following the release of its impressive Q2 results on Jul. 21. Driven by a solid 7% growth in organic revenues and 6% increase in contribution from acquisitions, the company’s overall net revenues for the quarter surged 13.2% year-over-year to $1.9 billion, surpassing the Street’s expectations. Meanwhile, its adjusted EPS for the quarter grew by a solid 8.7% year-over-year to $4.87, beating the consensus estimates by 1%.

The consensus opinion on ROP stock is moderately bullish, with an overall “Moderate Buy” rating. Out of the 18 analysts covering the stock, 10 recommend “Strong Buy,” one advises “Moderate Buy,” six suggest “Hold,” and one advocates a “Strong Sell” rating. Its mean price target of $640.14 indicates a 28.6% upside potential from current price levels.