/Resmed%20Inc_%20logo%20and%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

San Diego, California-based ResMed Inc. (RMD) develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders. Valued at a market cap of $41.1 billion, the company is scheduled to announce its fiscal Q1 earnings for 2026 in the near future.

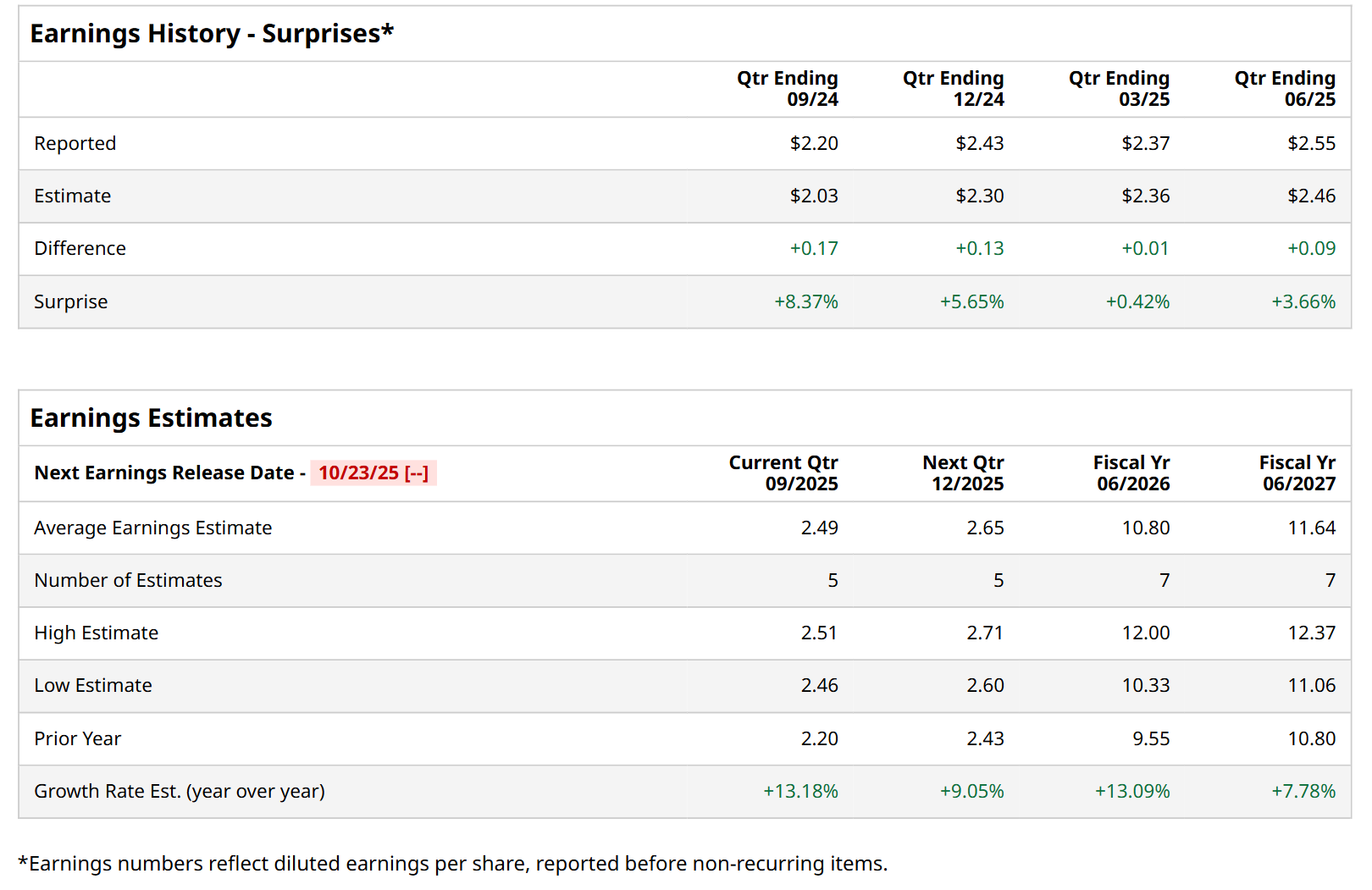

Before this event, analysts expect this healthcare company to report a profit of $2.49 per share, up 13.2% from $2.20 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.55 per share in the previous quarter topped the consensus estimates by 3.7%.

For fiscal 2026, analysts expect RMD to report a profit of $10.80 per share, representing a 13.1% increase from $9.55 per share in fiscal 2025. Furthermore, its EPS is expected to grow 7.8% year-over-year to $11.64 in fiscal 2027.

Shares of RMD have rallied 20.3% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 17.2% uptick and the Health Care Select Sector SPDR Fund’s (XLV) 5% drop over the same time frame.

ResMed released better-than-expected Q4 results on Jul. 31, prompting its shares to surge 2.7% in the following trading session. The company’s revenue grew 10.2% year-over-year to $1.3 billion, surpassing consensus expectations by 2.3%. Moreover, its adjusted EPS soared 22.6% from the year-ago quarter to $2.55, and came in 3.7% ahead of analyst estimates.

Wall Street analysts are moderately optimistic about RMD’s stock, with a "Moderate Buy" rating overall. Among 17 analysts covering the stock, eight recommend "Strong Buy," two indicate "Moderate Buy," six suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for RMD is $290.92, implying a 3.4% potential upside from the current levels.