San Diego, California-based Realty Income Corporation (O) acquires and manages freestanding commercial properties that reap rental revenue under long-term net lease agreements. With a market cap of $53.8 billion, Realty Income’s portfolio consists of thousands of commercial properties leased to numerous clients across 90+ industries.

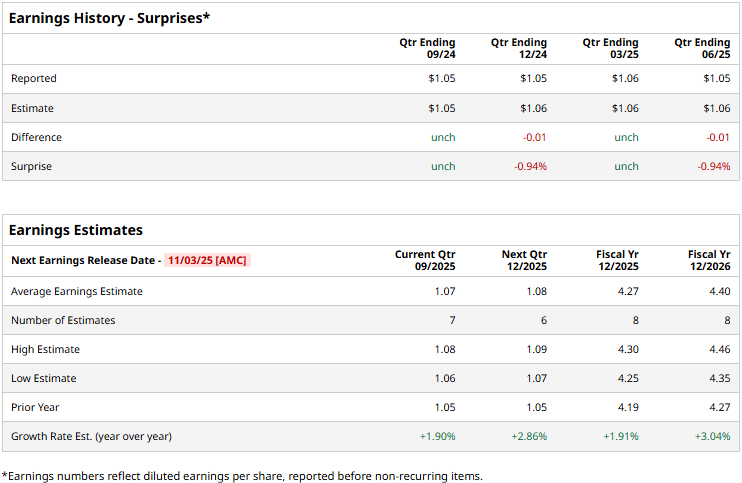

The real estate giant is set to unveil its third-quarter results after the market closes on Monday, Nov. 3. Ahead of the event, analysts expect Realty Income to deliver an adjusted funds from operations (AFFO) of $1.07 per share, up 1.9% from $1.05 per share reported in the year-ago quarter. While the company has missed the Street’s AFFO estimates twice over the past four quarters, it met the projections on two other occasions.

For the full fiscal 2025, the company is expected to deliver an AFFO of $4.27 per share, up 1.9% from $4.19 per share in 2024. While in fiscal 2026, its AFFO is expected to grow 3% year-over-year to $4.40 per share.

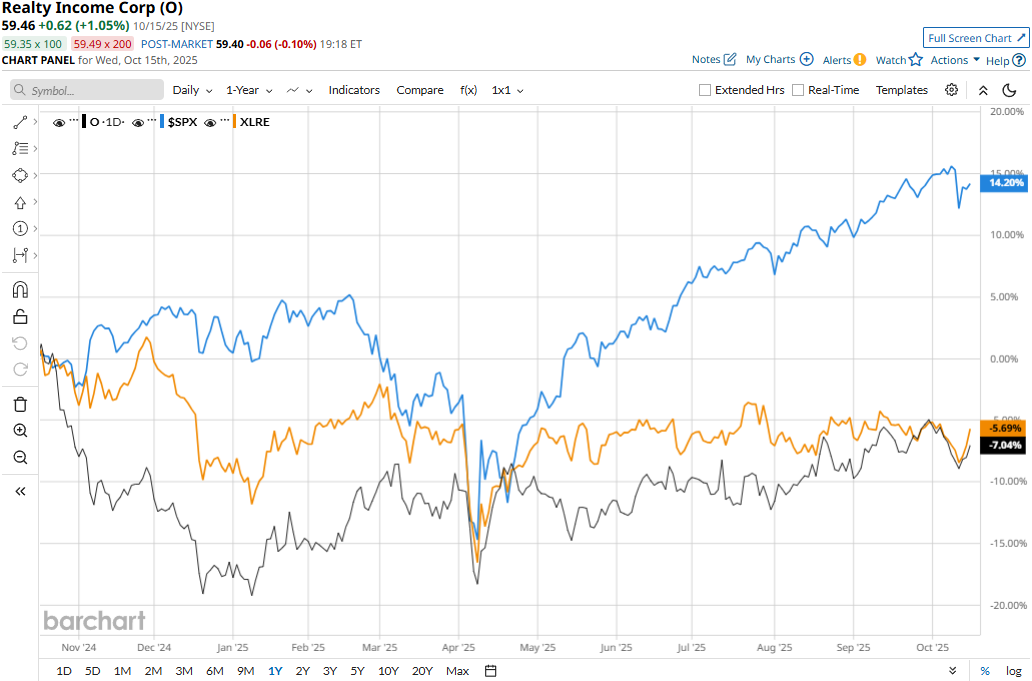

Realty Income’s stock prices have dropped 6.2% over the past 52 weeks, lagging behind the Real Estate Select Sector SPDR Fund’s (XLRE) 5.4% decline and the S&P 500 Index’s ($SPX) 14.7% gains during the same time frame.

Realty Income’s stock prices observed a marginal uptick in the trading session following the release of its mixed Q2 results on Aug. 6. Despite the growing macro uncertainty and downturn in the real estate sector in recent quarters, the company maintained strong fundamentals. Its topline for the quarter surged by an impressive 5.3% year-over-year to $1.4 billion, exceeding the Street’s expectations by more than 1%. However, due to an increase in the number of outstanding shares, Realty Income’s AFFO per share decreased 94 bps year-over-year to $1.05, missing the consensus estimates by a small margin.

Analysts remain cautious about Realty’s prospects. The stock maintains a consensus “Hold” rating overall. Of the 25 analysts covering the stock, opinions include four “Strong Buys,” one “Moderate Buy,” and 20 “Holds.” Its mean price target of $61.97 suggests a modest 4.2% upside potential from current price levels.