/Quanta%20Services%2C%20Inc_%20logo%20and%20stock%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $59.8 billion, Quanta Services, Inc. (PWR) is a leading specialty contractor focused on designing, building, maintaining, and repairing infrastructure networks across North America. Headquartered in Houston, Texas, it benefits from rising demand for grid modernization, clean energy, and data center infrastructure, specially with AI-driven power needs.

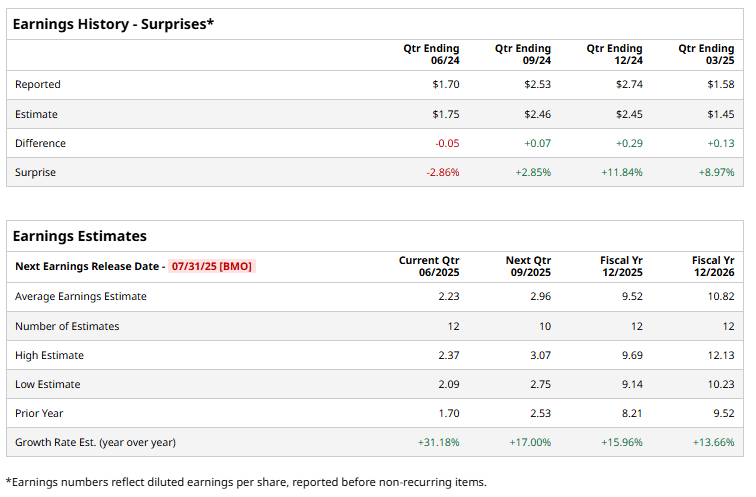

The industrial giant is expected to report its Q2 earnings on Thursday, July 31, before the market opens. Ahead of the event, analysts expect PWR to report a profit of $2.23 per share, up 31.2% from a profit of $1.70 per share reported in the year-ago quarter. It has exceeded analysts' earnings estimates in three of the past four quarters, while only missing on one occasion.

For the current year, analysts expect PWR to report EPS of $9.52, up 16% from $8.21 in fiscal 2024. Looking ahead, analysts expect its earnings to surge 13.7% year-over-year to $10.82 per share in fiscal 2026.

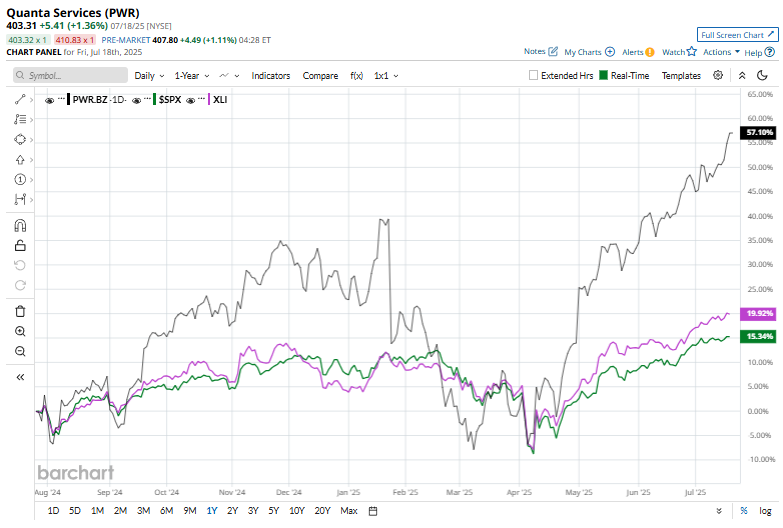

Over the past year, PWR shares have surged 52.4%, outperforming the S&P 500 Index’s ($SPX) 13.6% gains and the Industrial Select Sector SPDR Fund’s (XLI) 20.6% uptick over the same time frame.

On May 1, Quanta Services shares surged nearly 10% following the release of its Q1 2025 results, thanks to robust demand tied to U.S. power grid upgrades, a surge in AI-driven data center construction, and the ongoing reshoring of manufacturing amid global supply chain realignments. It posted an adjusted EPS of $1.78 and revenue of $6.2 billion, both exceeding analyst expectations. The company also lifted its full-year profit guidance to a range of $10.05 to $10.65 per share, above consensus estimates.

Moreover, analysts remain fairly bullish about PWR stock’s prospects, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 16 recommend a “Strong Buy” and nine suggest a “Hold.” PWR currently trades above its mean price of $370.77, and its Street-high target of $440 implies a premium of 9.1% from its prevailing