/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

San Diego, California-based QUALCOMM Incorporated (QCOM) is a fabless semiconductor company. With a market cap of $180.2 billion, QUALCOMM operates through Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI) segments.

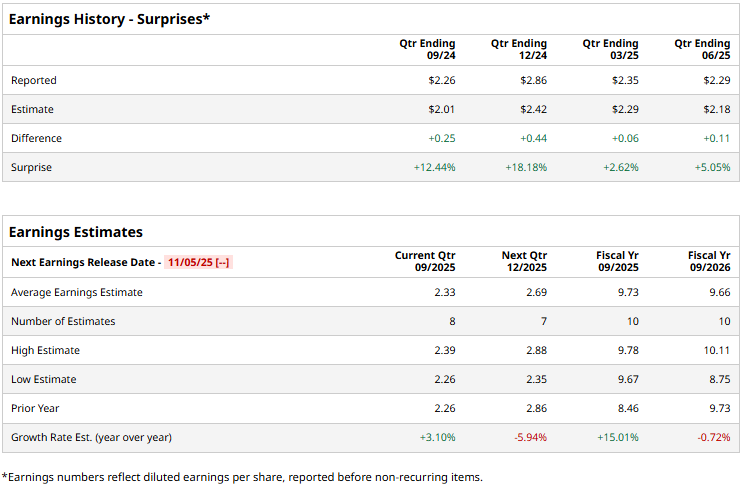

The semiconductor giant is gearing up to release its Q4 earnings after the market closes on Wednesday, Nov. 5. Ahead of the event, analysts expect QCOM to report an EPS of $2.33, up 3.1% from $2.26 reported in the year-ago quarter. Moreover, the company has surpassed the Street’s bottom-line expectations in each of the past four quarters by notable margins.

For the full fiscal 2025, QCOM is expected to deliver an EPS of $9.73, marking a 15% increase from $8.46 reported in fiscal 2024. While in fiscal 2026, its earnings are expected to observe a marginal dip to $9.66 per share.

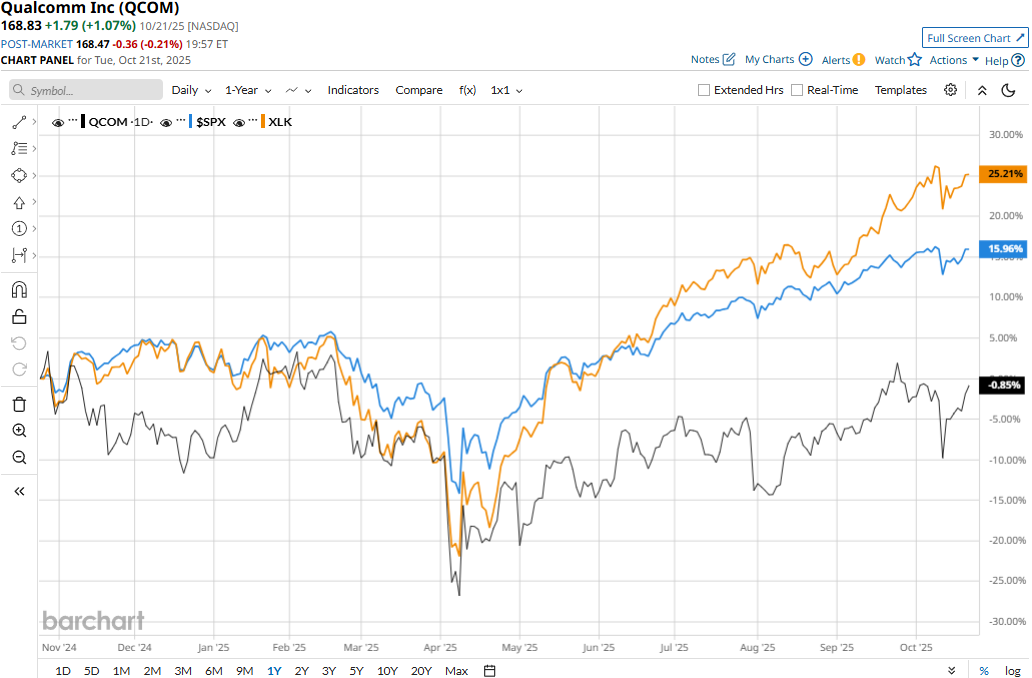

QCOM stock prices have observed a marginal 11 bps dip over the past 52 weeks, notably underperforming the Technology Select Sector SPDR Fund’s (XLK) 24.3% surge and the S&P 500 Index’s ($SPX) 15.1% returns during the same time frame.

QUALCOMM’s stock prices plunged 7.7% in the trading session after the release of its mixed Q3 results on Jul. 30. Supported by its diversification into different areas and growth in IoT revenues, the company’s total revenues for the quarter surged 10.3% year-over-year to $10.4 billion, surpassing the consensus estimates by 39 bps. However, the company’s handset revenues of $6.3 billion and automotive revenues of $984 million both fell short of Street expectations, which likely unsettled investor confidence.

On a more positive note, the company’s adjusted net income surged 14.8% year-over-year to $3 billion, beating the consensus estimates by a notable margin.

The consensus view on QCOM stock is cautiously optimistic, with a “Moderate Buy” rating overall. Of the 33 analysts covering the stock, opinions include 14 “Strong Buys,” one “Moderate Buy,” 17 “Holds,” and one “Strong Sell.” Its mean price target of $181.08 suggests a 7.3% upside potential from current price levels.