/PTC%20Inc%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Boston, Massachusetts-based PTC Inc. (PTC) provides software solutions and services globally that aid manufacturing companies in designing, operating, and managing products. With a market cap of $24.3 billion, PTC’s operations span the Americas, Europe, and the Indo-Pacific.

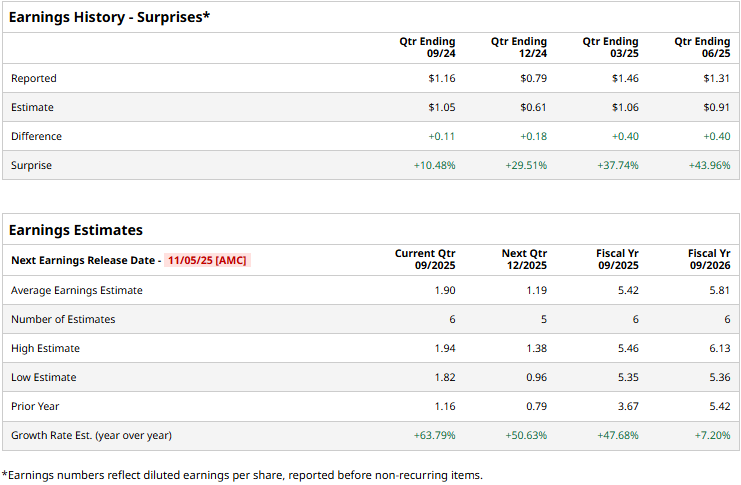

The tech major is expected to release its fourth-quarter results after the markets close on Wednesday, Nov. 5. Ahead of the event, analysts expect PTC to deliver an EPS of $1.90, up a massive 63.8% from $1.16 reported in the year-ago quarter. Moreover, the company has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect PTC to deliver an EPS of $5.42, up 47.7% from $3.67 reported in fiscal 2024. While in fiscal 2026, its earnings are expected to further grow 7.2% year-over-year to $5.81 per share.

PTC stock prices have gained 11.6% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 14.8% gains and the Technology Select Sector SPDR Fund’s (XLK) 24.8% surge during the same time frame.

PTC’s stock prices gained 6.1% in the trading session following the release of its impressive Q3 results on Jul. 30. The company’s strategy of enabling product data foundations and extending the value of that data across the enterprise has resonated well with customers across its various verticals and geographies, enabling solid growth. PTC’s total revenues for the quarter soared 24.2% year-over-year to $643.9 million, beating the Street’s expectations by 10.6%. Further, its non-GAAP net income skyrocketed 67.3% year-over-year to $197.4 million, surpassing the consensus estimates by a large margin.

Analysts remain bullish on the stock’s prospects. PTC has a consensus “Moderate Buy” rating overall. Of the 19 analysts covering the stock, opinions include 12 “Strong Buys,” one “Moderate Buy,” and six “Holds.” Its mean price target of $227.17 suggests a 10.3% upside potential from current price levels.