PPL Corporation (PPL), headquartered in Allentown, Pennsylvania, focuses on providing electricity and natural gas to approximately 3.6 million customers. Valued at $26.8 billion by market cap, the company generates electricity from power plants, as well as markets wholesale and retail energy and natural gas. It also delivers natural gas to customers in Kentucky and Rhode Island and generates electricity from power plants in Kentucky. The leading utility company is expected to announce its fiscal first-quarter earnings for 2025 before the market opens on Wednesday, Apr. 30.

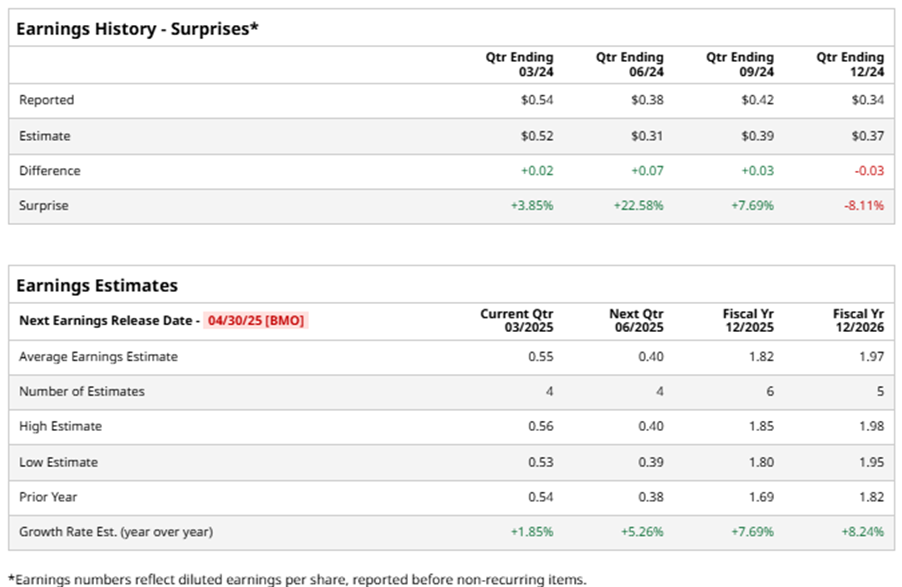

Ahead of the event, analysts expect PPL to report a profit of $0.55 per share on a diluted basis, up 1.9% from $0.54 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect PPL to report EPS of $1.82, up 7.7% from $1.69 in fiscal 2024. Its EPS is expected to rise 8.2% year over year to $1.97 in fiscal 2026.

PPL stock has outperformed the S&P 500’s ($SPX) 6% gains over the past 52 weeks, with shares up 33% during this period. Similarly, it outperformed the Utilities Select Sector SPDR Fund’s (XLU) 18.1% gains over the same time frame.

PPL has been outperforming by strategically investing $20 billion in infrastructure upgrades and emission reduction initiatives. The company is focusing on building a net-zero energy system and adding renewable sources to its generation portfolio. These efforts have resulted in fewer outages for customers and are expected to drive cost savings and increase margins. PPL's partnership with industry and academic partners aims to accelerate low-carbon energy technologies for a resilient grid. The company's strategic initiatives have fueled its growth, with rising demand and potential projects in the pipeline for continued success.

On Feb. 13, PPL shares closed down marginally after reporting its Q4 results. Its adjusted EPS of $0.34 missed Wall Street expectations of $0.37. The company’s revenue was $2.2 billion, topping Wall Street forecasts of $2.1 billion. PPL expects full-year EPS in the range of $1.75 to $1.87.

Analysts’ consensus opinion on PPL stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 15 analysts covering the stock, 10 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and four give a “Hold.” PPL’s average analyst price target is $37.33, indicating a potential upside of 3% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.