/PNC%20Financial%20Services%20Group%20Inc%20bank%20sign-%20by%20Adam%20McCullough%20via%20Shutterstock.jpg)

The PNC Financial Services Group, Inc. (PNC) ranks among the largest U.S. financial institutions, offering retail and business banking, lending, corporate and government services, as well as wealth and asset management, with operations built around serving customers and communities. The company’s market capitalization is approximately $79.8 billion. The financial firm has scheduled the release of its fiscal 2025 third-quarter earnings report before the market opens on Wednesday, October 15.

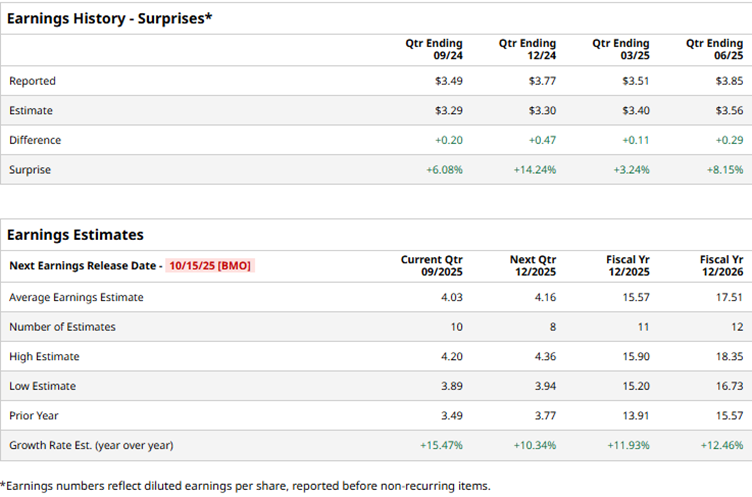

Ahead of this event, analysts project the bank to report a profit of $4.03 per share, reflecting a 15.5% jump from $3.49 per share registered in the year-ago quarter. Even more impressive is the company’s solid track record of consistently surpassing Wall Street's bottom-line estimates in the last four quarterly reports. In the most recent quarter, PNC posted an EPS of $3.85, surpassing the consensus estimate by a solid 8.2% margin.

Over the longer term, analysts expect PNC’s earnings to continue a steady climb. Profit is projected to rise 11.9% in fiscal 2025, reaching $15.57 per share compared with $13.91 in 2024. The momentum is expected to carry into fiscal 2026, with EPS forecast to jump another 12.5% year over year (YOY) to $17.51, underscoring confidence in the bank’s growth trajectory.

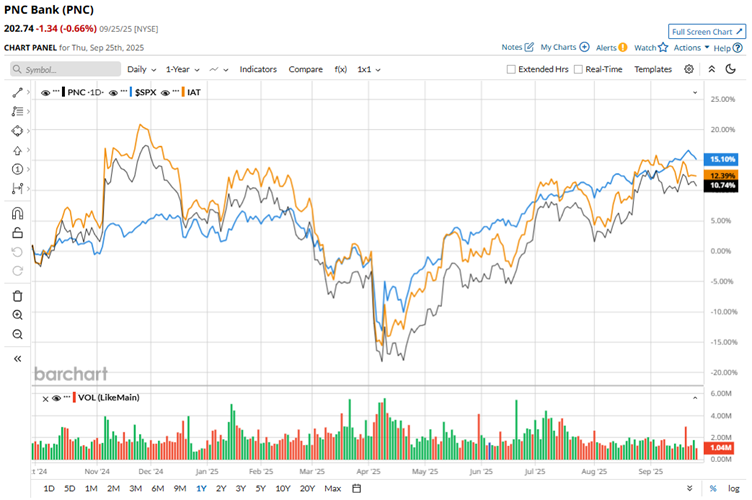

PNC shares have gained 11.5% over the past year, but the performance trails broader benchmarks. The S&P 500 Index ($SPX) delivered a stronger 15.4% return during the same period, while regional banking peers, tracked by the iShares U.S. Regional Banks ETF (IAT), climbed 13.9%, leaving PNC a step behind both the market and its industry rivals.

PNC Financials’ stock inched higher after the bank topped expectations with its second-quarter results on Jul. 16. The quarter showcased strong loan growth despite a choppy macro backdrop, fueled by faster customer acquisition and deeper relationships with existing clients. Revenue climbed 4.6% YOY to $5.7 billion, and topped Wall Street projections of $5.6 billion. Meanwhile, EPS jumped 13.6% to $3.85, beating Wall Street’s forecasted figure of $3.56.

Wall Street analysts are moderately optimistic about PNC stock, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 13 recommend a "Strong Buy," two indicate a "Moderate Buy," eight advise a “Hold,” and the remaining one has issued a “Strong Sell.”

The current configuration is slightly more bullish than two months ago, with 12 analysts suggesting a "Strong Buy." The mean price target for PNC is $217, indicating a 7% upside potential.