With a market cap of $11.2 billion, Pinnacle West Capital Corporation (PNW) provides retail and wholesale electric services primarily across the state. Through its subsidiary, it generates, transmits, and distributes electricity using a diverse mix of nuclear, gas, oil, coal, and solar resources.

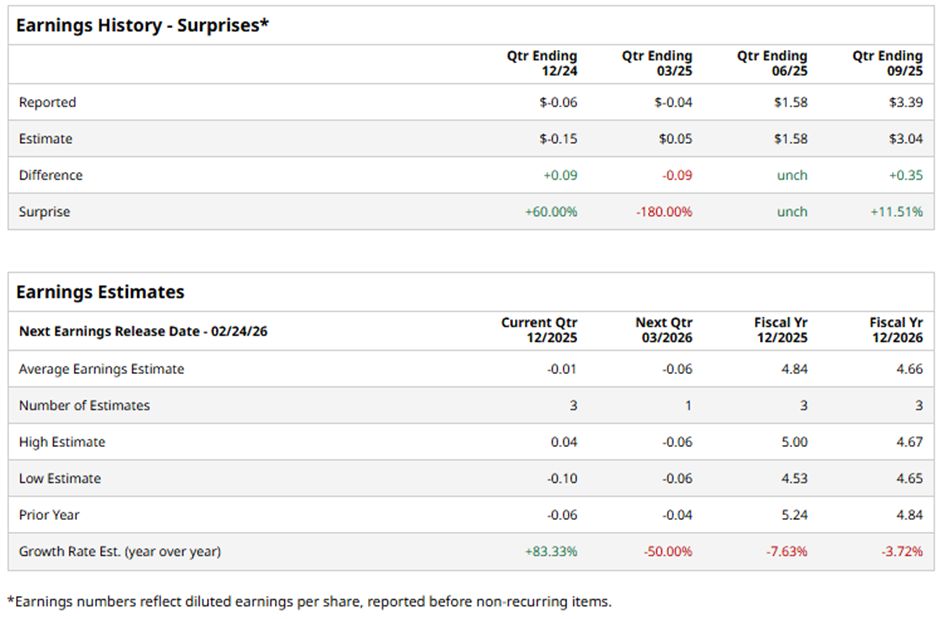

The Phoenix, Arizona-based company is expected to unveil its fiscal Q4 2025 results soon. Before the event, analysts anticipate PNW to report a loss of $0.01 per share, an 83.3% improvement from a loss of $0.06 per share in the year-ago quarter. It has exceeded or met Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts predict Pinnacle West Capital to report EPS of $4.84, a decline of 7.6% from $5.24 in fiscal 2024.

PNW stock has risen 8.2% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.9% gain and the State Street Utilities Select Sector SPDR ETF's (XLU) 9.4% return over the same period.

Shares of Pinnacle West recovered 1.1% on Nov. 3 after the company reported strong Q3 2025 results, posting consolidated net income of $413.2 million ($3.39 per share), up from $395.0 million ($3.37 per share) a year ago. Investor sentiment was further supported by 2.4% customer growth, 5.4% weather-normalized sales growth, and a record peak demand of 8,631 MW, driven by the third-hottest Arizona summer on record.

The company also raised its 2025 EPS guidance to $4.90 - $5.10 and announced plans to invest more than $2.5 billion annually through 2028 to support Arizona’s rapid growth.

Analysts' consensus rating on PNW stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 17 analysts covering the stock, opinions include four "Strong Buys" and 13 "Holds." The average analyst price target for Pinnacle West Capital is $95.78, indicating a potential upside of 2.2% from the current levels.