With a market cap of $191.6 billion, PepsiCo, Inc. (PEP) is a global leader in the manufacture, marketing, distribution, and sale of convenient foods and beverages. With iconic brands such as Lay’s, Doritos, Gatorade, Pepsi-Cola, Quaker, and Tropicana, the company operates across seven business segments and serves customers worldwide through diverse distribution channels.

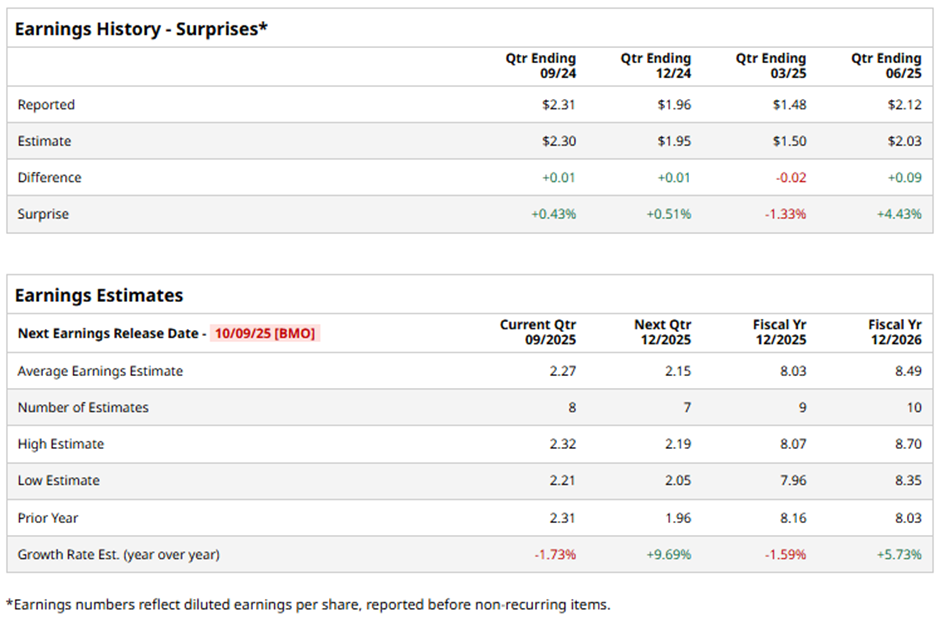

The Purchase, New York-based company is expected to announce its fiscal Q3 2025 results before the market opens on Thursday, Oct. 9. Ahead of this event, analysts expect PepsiCo to report an adjusted EPS of $2.27, down 1.7% from $2.31 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect PEP to report an adjusted EPS of $8.03, a decrease of 1.6% from $8.16 in fiscal 2024. However, adjusted EPS is projected to rebound, growing 5.7% year-over-year to $8.49 in fiscal 2026.

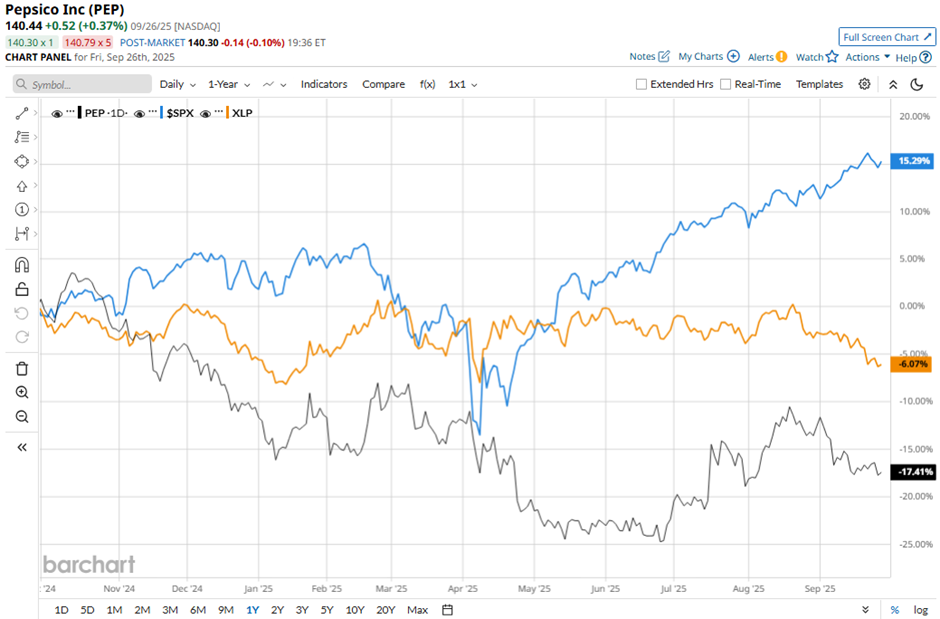

Shares of PepsiCo have dropped 17.2% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.6% increase and the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.9% decrease over the same period.

PepsiCo shares climbed 7.5% on Jul. 17 after the company reported Q2 2025 revenue of $22.7 billion and adjusted EPS of $2.12, above expectations. Investors were encouraged by management’s plans to boost lagging North American sales with new protein-enhanced snacks and beverages and the relaunch of core brands like Lay’s and Tostitos without artificial ingredients.

Analysts' consensus view on PEP stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 21 analysts covering the stock, six recommend "Strong Buy," 14 suggest "Hold," and one has "Strong Sell." The average analyst price target for PepsiCo is $153.05, indicating a potential upside of nearly 9% from the current levels.