With a market cap of $11.3 billion, Paramount Skydance Corporation(PSKY) is a leading global media and entertainment company formed through the merger of Paramount Global and Skydance Media. It produces and distributes film, television, sports, news, and streaming content through its brands, including Paramount Pictures, CBS, and Paramount+.

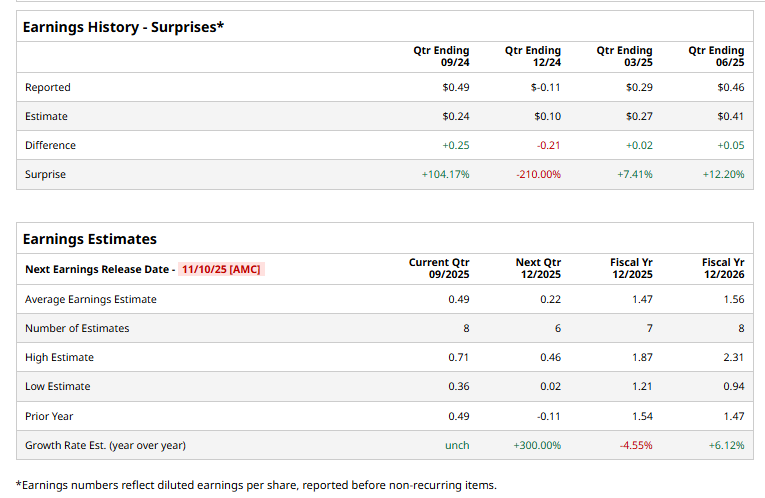

The company is expected to announce its third-quarter results after the markets close on Monday, Nov. 10. Ahead of the event, analysts expect PSKY to deliver a profit of $0.49 per share, flat from the same figure reported in the year-ago quarter. The company has surpassed the Street’s bottom-line expectations in three of the past four quarters, while missing on another occasion.

For the current year, analysts expect Paramount’s earnings to drop 4.6% from $1.54 per share reported in 2024 to $1.47 per share. However, in fiscal 2026, its earnings are expected to grow 6.1% year over year to $1.56 per share.

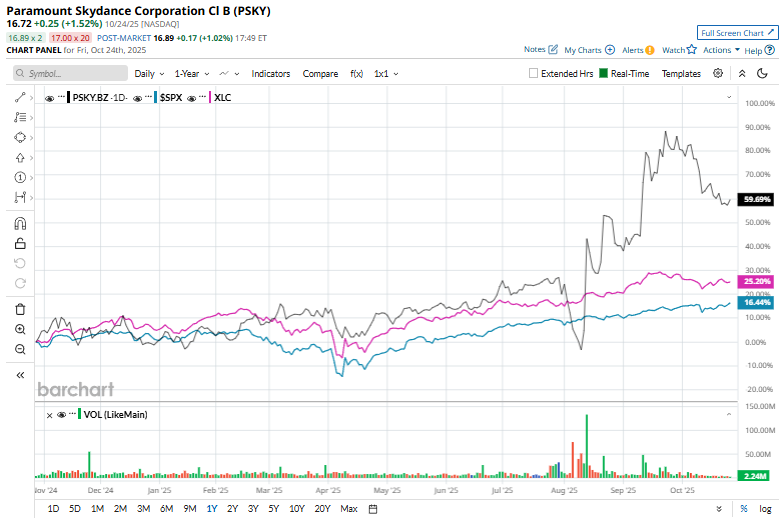

PSKY stock has climbed 62,3% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 16.9% gains and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 27.5% surge during the same time frame.

Despite robust price momentum over the past year, Paramount Skydance has been affected by heightened market volatility following President Trump’s critical remarks on China, which reignited trade tension fears. On Oct. 10, PSKY shares dipped 3.2% as concerns over worsening U.S.-China relations and potential tariffs dampened consumer sentiment and the outlook for discretionary spending.

The stock holds a consensus “Hold” rating overall. Of the 24 analysts covering the PSKY stock, opinions include one “Strong Buy,” 15 “Holds,” one “Moderate Sell,” and seven “Strong Sells.” While the stock currently trades above its mean price target of $13.44, the Street-high target of $20 implies a premium of 19.6% from the current market prices.