/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $145.2 billion, Palo Alto Networks, Inc. (PANW) is the global cybersecurity leader, delivering AI-powered solutions that protect networks, clouds, and operations with precision and speed. Through its unified platform and Zero Trust approach, the company empowers organizations to embrace digital transformation in an ever-evolving threat landscape securely.

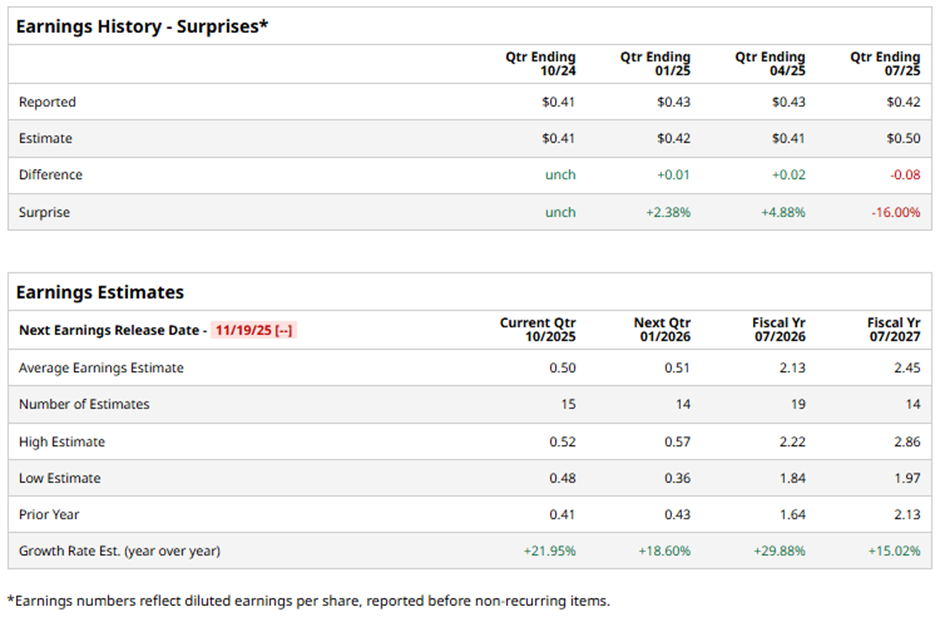

The Santa Clara, California-based company is slated to announce its fiscal Q1 2026 results soon. Ahead of this event, analysts expect Palo Alto Networks to report an EPS of $0.50, a 22% increase from $0.41 in the year-ago quarter. It has exceeded or met Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2026, analysts expect the security software maker to report EPS of $2.13, a 29.9% growth from $1.64 in fiscal 2024.

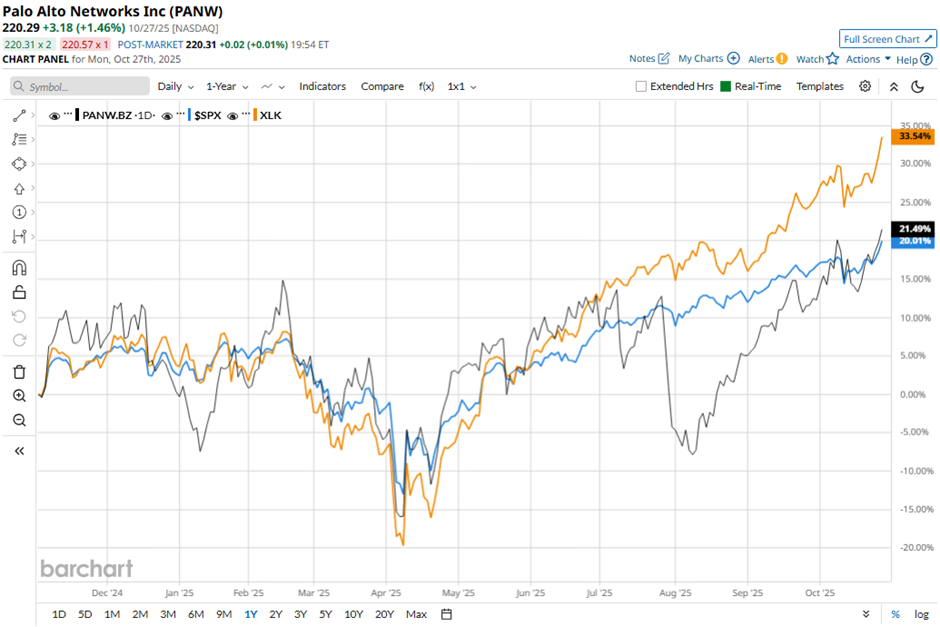

Shares of Palo Alto Networks have soared 20.2% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 18.4% return. However, the stock has lagged behind the Technology Select Sector SPDR Fund's (XLK) 29.8% surge over the same period.

Shares of Palo Alto Networks rose 3.1% following its Q4 2025 results on Aug. 18. The company reported better-than-expected adjusted EPS of $0.95 and revenue of $2.54 billion. Investors were further encouraged by the company’s fiscal 2026 revenue forecast of $10.48 billion - $10.53 billion and adjusted EPS outlook of $3.75 - $3.85, both above analysts’ estimates. Optimism also stemmed from strong demand for its AI-powered cybersecurity solutions and product expansion through launches like Cortex Cloud and Prisma AIRS, along with its planned $25 billion CyberArk acquisition.

Analysts' consensus view on PANW stock remains cautiously optimistic, with an overall "Moderate Buy" rating. Out of 48 analysts covering the stock, 33 recommend a "Strong Buy," three "Moderate Buys," 11 "Holds," and one "Strong Sell." As of writing, the stock is trading above the average analyst price target of $218.26.