/Norwegian%20Cruise%20Line%20Holdings%20Ltd%20ship%20by-%20Tatiana%20Dyuvbanova%20via%20iStock.jpg)

Valued at $10.4 billion by market cap, Norwegian Cruise Line Holdings Ltd. (NCLH) is a leading global cruise company headquartered in Miami, Florida. As of 2024, it operates a combined fleet of 34 ships across three brands, Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises, offering itineraries to approximately 700 destinations worldwide.

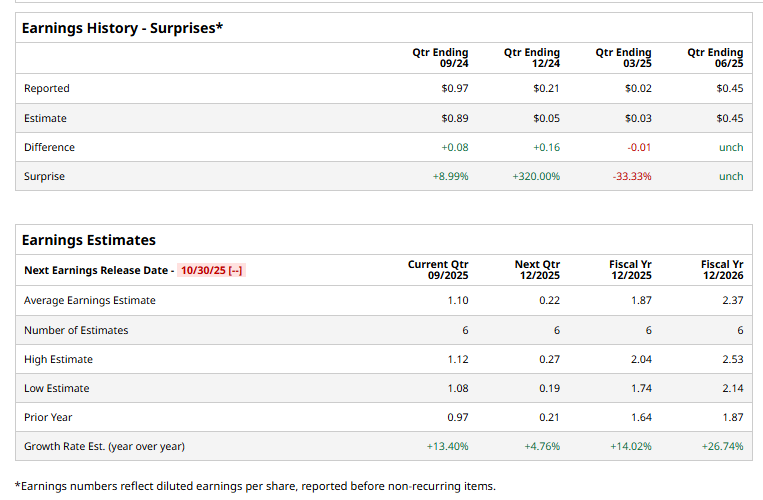

The leading cruise operator is expected to announce its fiscal third-quarter earnings shortly. Ahead of the event, analysts expect NCLH to report a profit of $1.10 per share on a diluted basis, up 13.4% from $0.97 per share in the year-ago quarter. The company has beaten or met the consensus estimates in three of the last four quarters, while missing on another occasion.

For the current year, analysts expect NCLH to report EPS of $1.87, up 14% from $1.64 in fiscal 2024. Its EPS is expected to rise 26.7% year over year to $2.37 in fiscal 2026.

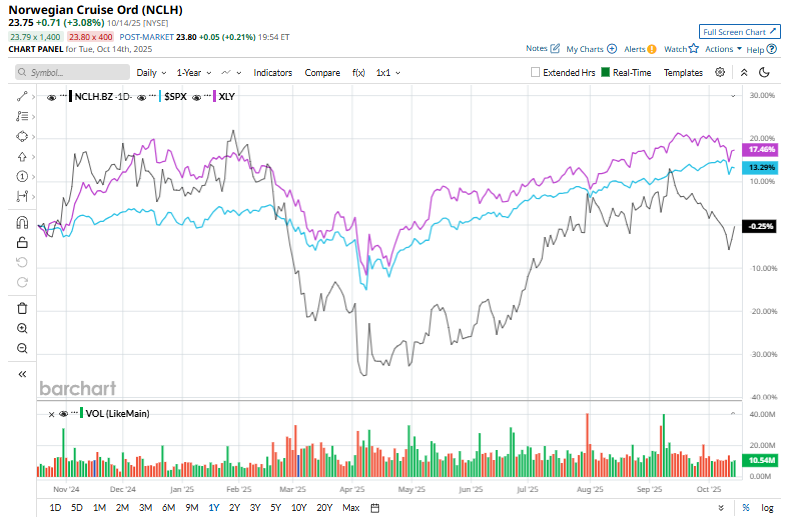

Norwegian Cruise shares have struggled over the past year, surging 1.7%, underperforming both the S&P 500’s ($SPX) 13.4% gains and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 18.7% gains over the same period.

On Oct. 9, NCLH shares dipped 1.7% after Morgan Stanley (MS) analyst Stephen Grambling reiterated a “Hold,” with a price target of $27.

Analysts’ consensus opinion on NCLH stock is fairly upbeat, with a “Moderate Buy” rating overall. Out of 22 analysts covering the stock, 15 advise a “Strong Buy” rating, and seven give a “Hold.” NCLH’s average analyst price target is $30.57, indicating an ambitious potential upside of 28.7% from the current levels.