/Northrop%20Grumman%20Corp_%20phone%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $86.6 billion, Northrop Grumman Corporation (NOC) is a leading global aerospace and defense technology company that delivers innovative solutions across air, land, sea, space, and cyberspace. It operates through four key segments: Aeronautics Systems; Defense Systems; Mission Systems; and Space Systems, offering advanced capabilities in autonomous systems, strike, C4ISR, cyber, and space technologies to customers worldwide.

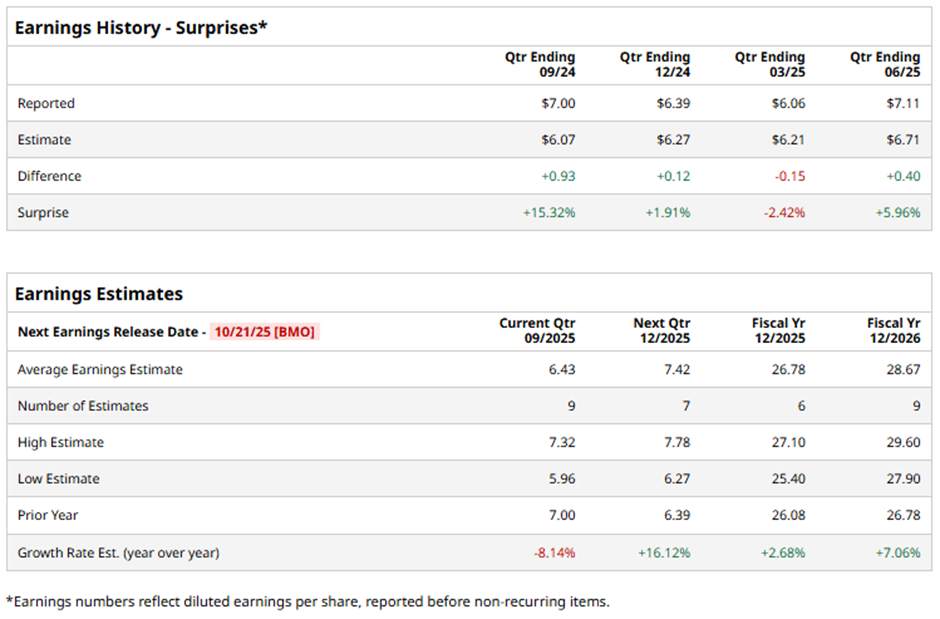

The Falls Church, Virginia-based company is expected to release its fiscal Q3 2025 results before the market opens on Tuesday, Oct. 21. Ahead of this event, analysts project NOC to report an adjusted EPS of $6.43, an 8.1% decline from $7 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the defense contractor to report adjusted EPS of $26.78, up 2.7% from $26.08 in fiscal 2024. Looking ahead, adjusted EPS is projected to grow 7.1% year-over-year to $28.67 in fiscal 2026.

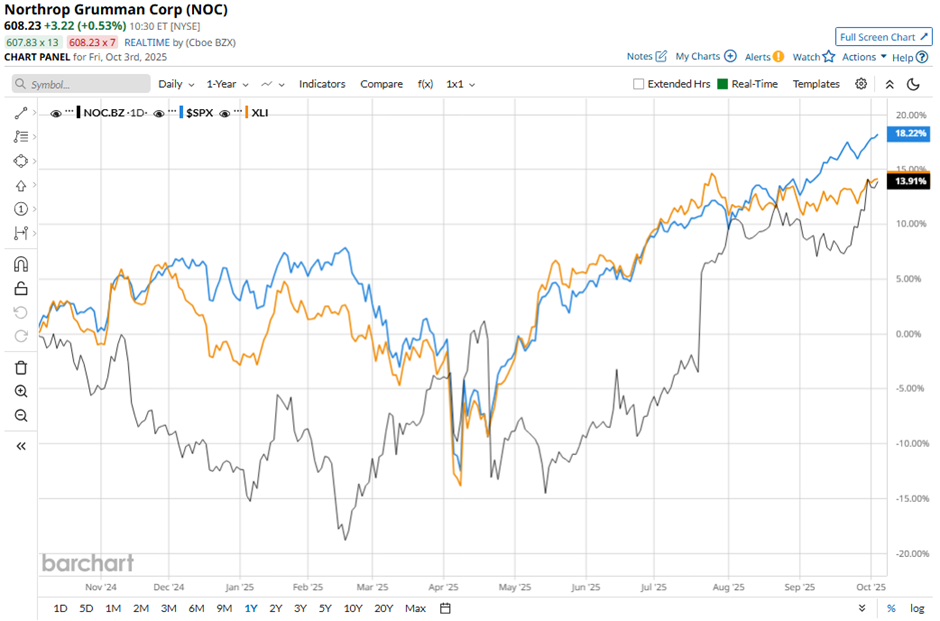

NOC stock has risen 13.2% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 18.2% return and the Industrial Select Sector SPDR Fund's (XLI) 14.7% gain over the same period.

Shares of Northrop Grumman climbed 9.4% on Jul. 22 after the company posted stronger-than-expected Q2 2025 adjusted EPS of $7.11 and revenue of $10.4 billion. Net income also surged to $1.17 billion, or $8.15 per share. Additionally, the company raised its 2025 annual profit forecast to $25 per share - $25.40 per share, signaling strong demand for its military aircraft and defense systems amid ongoing geopolitical tensions.

Analysts' consensus view on NOC stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, eight suggest a "Strong Buy," one gives a "Moderate Buy," and 11 provide a "Hold" rating. This configuration is less bullish than three months ago, with 11 analysts suggesting a "Strong Buy."

As of writing, it is trading above the average analyst price target of $603.75.