/Nordson%20Corp_%20facility-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $10.7 billion, Nordson Corporation (NDSN) is a global precision technology leader that engineers systems to dispense, apply, and control adhesives, coatings, sealants, biomaterials, and other fluids. Operating across Industrial Precision Solutions; Medical and Fluid Solutions; and Advanced Technology Solutions segments, it serves a wide array of industrial, consumer, and medical markets with both manual and automated systems.

The Westlake, Ohio-based company is expected to release its fiscal Q2 2025 earnings results on Monday, May 19. Ahead of this event, analysts project NDSN to report an adjusted EPS of $2.36, a marginal growth from $2.34 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the adhesives and industrial coatings maker to report an adjusted EPS of $9.91, up 1.9% from $9.73 in fiscal 2024. Moreover, adjusted EPS is expected to grow nearly 8% year-over-year to $10.70 in fiscal 2026.

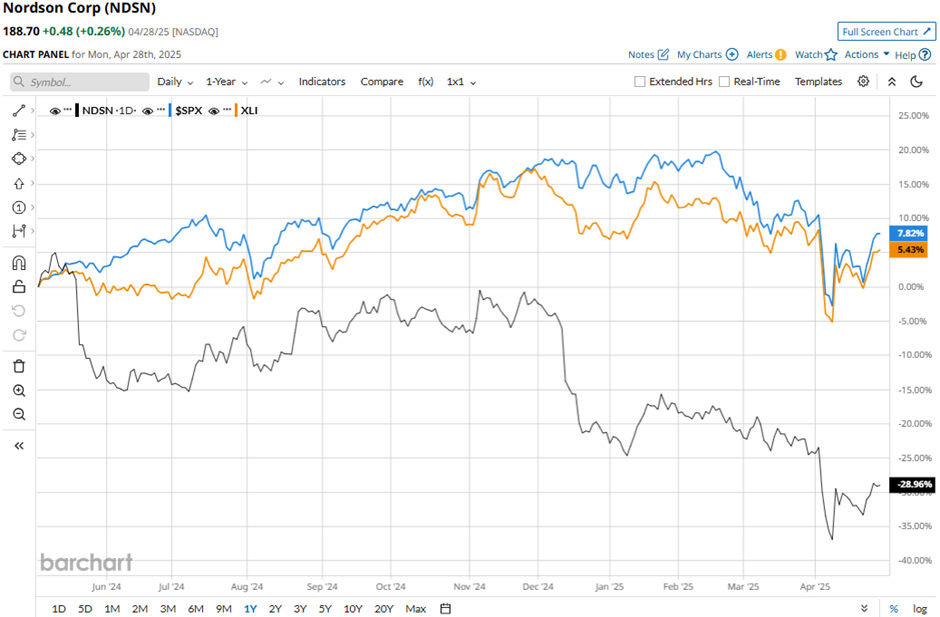

Over the past 52 weeks, Nordson has decreased 27.5%, lagging behind the broader S&P 500 Index's ($SPX) 8.4% gain and the Industrial Select Sector SPDR Fund's (XLI) 5.5% rise over the same period.

Despite reporting weaker-than-expected Q1 2025 adjusted EPS of $2.06 and revenue of $615.4 million on Feb. 19, NDSN shares recovered marginally the next day. The company reported a 15% increase in backlog, signaling strengthening demand across its end markets. The management emphasized broad-based order entry acceleration and operational discipline that delivered earnings in line with guidance mid-point despite volume headwinds.

Moreover, the company issued an upbeat Q2 2025 outlook with expected sales of $650 million - $690 million and adjusted EPS of $2.30 - $2.50.

Analysts' consensus view on Nordson stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among eight analysts covering the stock, four suggest a "Strong Buy" and four recommend a "Hold." As of writing, NDSN is trading below the average analyst price target of $249.28.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.