/Nike%2C%20Inc_%20logo%20by-%20Poetra_RH%20via%20Shutterstock.jpg)

Beaverton, Oregon-based NIKE, Inc. (NKE) designs, produces, markets, and sells athletic footwear, apparel, equipment, accessories, and services. Valued at $105.2 billion by market cap, the company offers products under the trademarks NIKE, Jumpman, Converse, All Star, Star Chevron, and Jack Purcell, along with operating digital platforms with fitness apps, wellness content, and retail services. The sportswear giant is expected to announce its fiscal first-quarter earnings for 2026 after the market closes on Tuesday, Sep. 30.

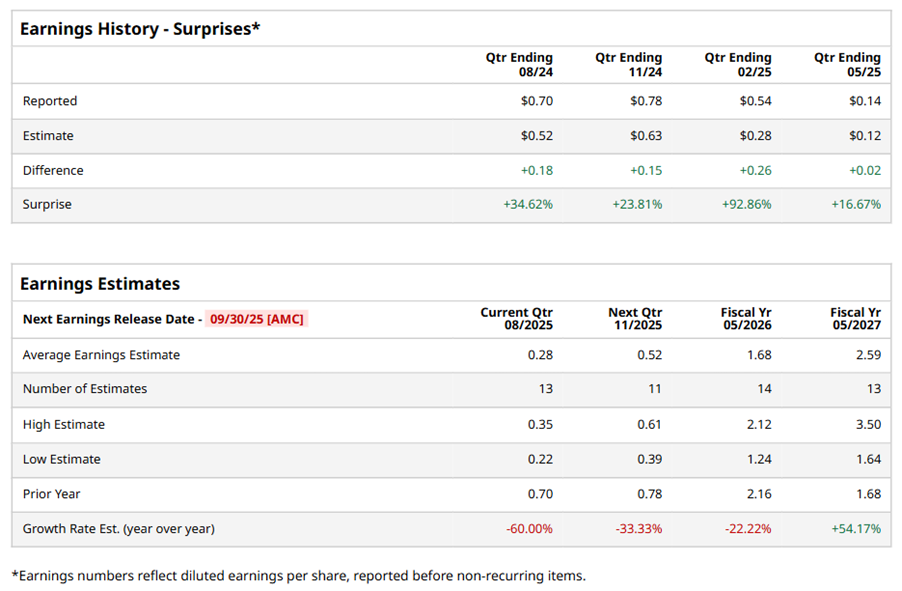

Ahead of the event, analysts expect NKE to report a profit of $0.28 per share on a diluted basis, down 60% from $0.70 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect NKE to report EPS of $1.68, down 22.2% from $2.16 in fiscal 2025. However, its EPS is expected to rise 54.2% year over year to $2.59 in fiscal 2027.

NKE stock has significantly underperformed the S&P 500 Index’s ($SPX) 15.4% gains over the past 52 weeks, with shares down 21.3% during this period. Similarly, it notably underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 18.3% gains over the same time frame.

NKE's struggles stem from several factors, including a lack of innovation, reduced reliance on third-party sellers, and intense competition in Greater China. Domestic brands like Anta and Li-Ning are gaining ground, while U.S. tariffs further complicate sourcing from China and other hubs, such as Vietnam.

On Jun. 26, NKE reported its Q4 results, and its shares closed up more than 15% in the following trading session. Its revenue stood at $11.1 billion, down 12% year-over-year. The company’s adjusted EPS declined 85.9% from the year-ago quarter to $0.14.

Analysts’ consensus opinion on NKE stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 36 analysts covering the stock, 15 advise a “Strong Buy,” four suggest a “Moderate Buy,” 15 give a “Hold,” and two recommend a “Strong Sell.” NKE’s average analyst price target is $80.56, indicating a potential upside of 16.3% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.