Monster Beverage Corporation (MNST), headquartered in Corona, California, develops, markets, sells, and distributes energy drink beverages and concentrates. Valued at $67.3 billion by market cap, the company offers Monster Energy energy drinks, Monster Energy Ultra energy drinks, Java Monster non-carbonated coffee + energy drinks, and more. The beverage company is expected to announce its fiscal third-quarter earnings for 2025 in the near term.

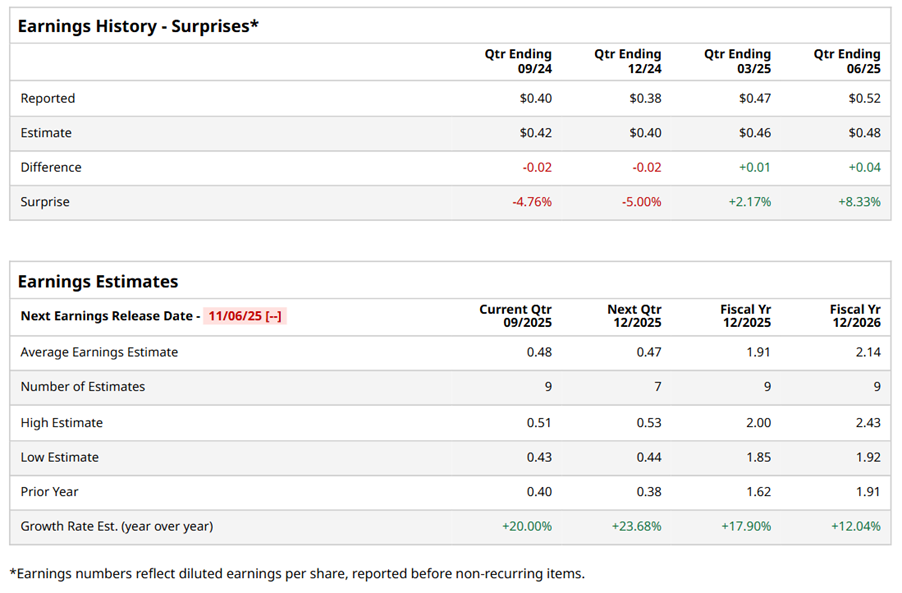

Ahead of the event, analysts expect MNST to report a profit of $0.48 per share on a diluted basis, up 20% from $0.40 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect MNST to report EPS of $1.91, up 17.9% from $1.62 in fiscal 2024. Its EPS is expected to rise 12% year over year to $2.14 in fiscal 2026.

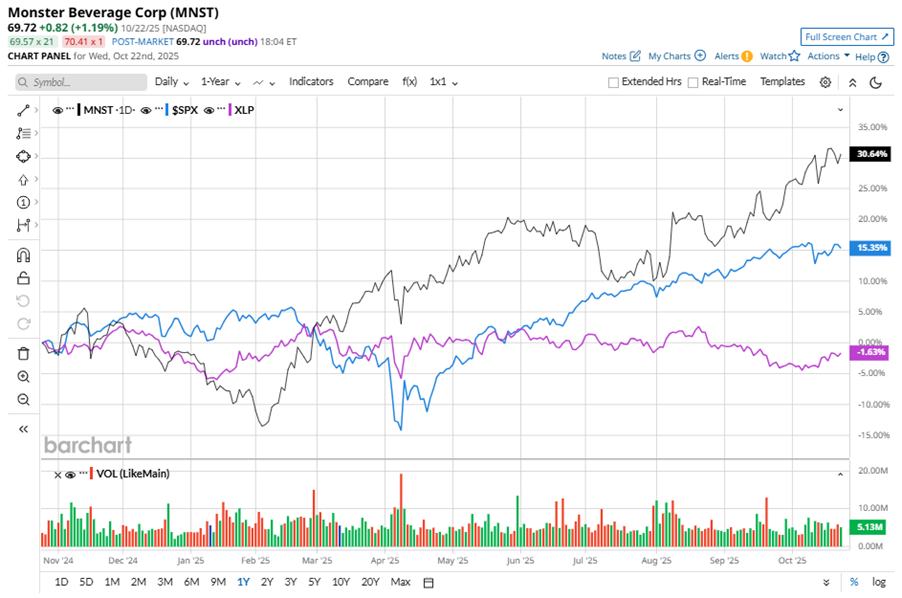

MNST stock has outperformed the S&P 500 Index’s ($SPX) 14.5% gains over the past 52 weeks, with shares up 30.1% during this period. Similarly, it notably outperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.8% dip over the same time frame.

On Aug. 7, MNST shares closed up by 2.2% after reporting its Q2 results. Its adjusted EPS of $0.52 beat Wall Street expectations of $0.48. The company’s revenue was $2.11 billion, exceeding Wall Street's $2.08 billion forecast.

Analysts’ consensus opinion on MNST stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 23 analysts covering the stock, 11 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” nine give a “Hold,” and two advocate a “Strong Sell.” While MNST currently trades above its mean price target of $68.36, the Street-high price target of $79 suggests an upside potential of 13.3%.