/Monolithic%20Power%20System%20Inc%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

The Kirkland, Washington-based Monolithic Power Systems, Inc. (MPWR) is a leading American semiconductor company specializing in high-performance, energy-efficient power solutions. Founded in 1997 by CEO Michael Hsing, the company is currently valued at a market cap of $25.7 billion and operates globally with a presence in over 15 countries.

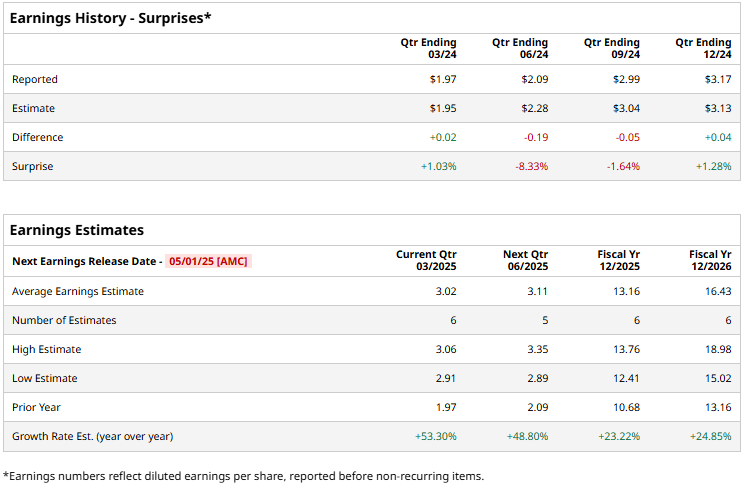

It is expected to release its fiscal Q1 earnings results on Thursday, May 1. Ahead of this event, analysts expect the semiconductor company to report a profit of $3.02 per share, up 53.3% from $1.97 per share in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts expect MPWR to report an EPS of $13.16, up 23.2% from $10.68 in fiscal 2024.

Shares of MPWR have dropped 12.2% over the past 52 weeks, trailing both the S&P 500 Index's ($SPX) 6% rise and the Technology Select Sector SPDR Fund’s (XLK) marginal return over the same time frame.

On Apr. 4, Monolithic Power shares dropped 8.6% in pre-market trading after China announced a 34% tariff on all U.S. imports, intensifying trade tensions. The move hit U.S. chipmakers particularly hard due to their heavy reliance on Chinese demand.

Nevertheless, Wall Street analysts are highly optimistic about Monolithic stock, with a "Strong Buy" rating overall. Among the 14 analysts covering the stock, nine recommend "Strong Buy," two suggest “Moderate Buy,” and three indicate “Hold.”

The average price target for MPWR is $767.25, which indicates a 42.9% potential upside from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.