Chicago, Illinois-based Mondelez International, Inc. (MDLZ) manufactures, markets, and sells a wide range of snacks and beverages, including cookies, crackers, salted snacks, cakes, chocolates, and more. With a market cap of $79.8 billion, Mondelez’s operations span various countries in the Americas, Indo-Pacific, the Middle East, Africa, and Europe.

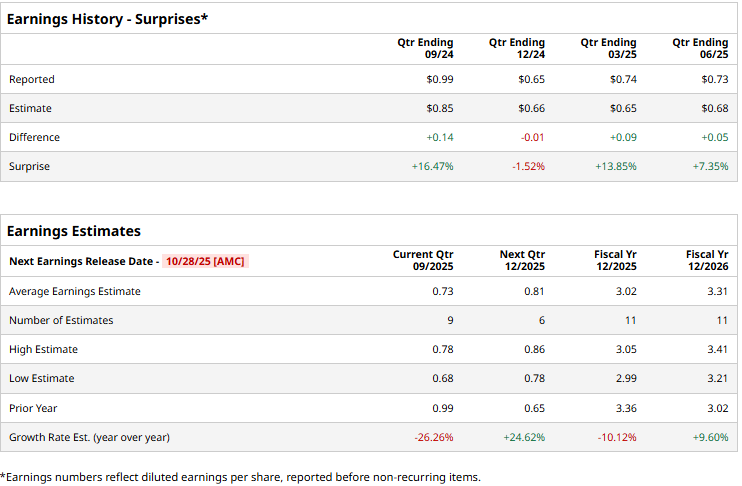

The company is set to announce its third-quarter results after the market closes on Tuesday, Oct. 28. Ahead of the event, analysts expect Mondelez to deliver an adjusted profit of $0.73 per share, down a staggering 26.3% year-over-year from $0.99 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2025, the company is expected to deliver an adjusted EPS of $3.02, down 10.1% from $3.36 reported in 2024. While in fiscal 2026, its earnings are expected to rebound 9.6% year-over-year to $3.31 per share.

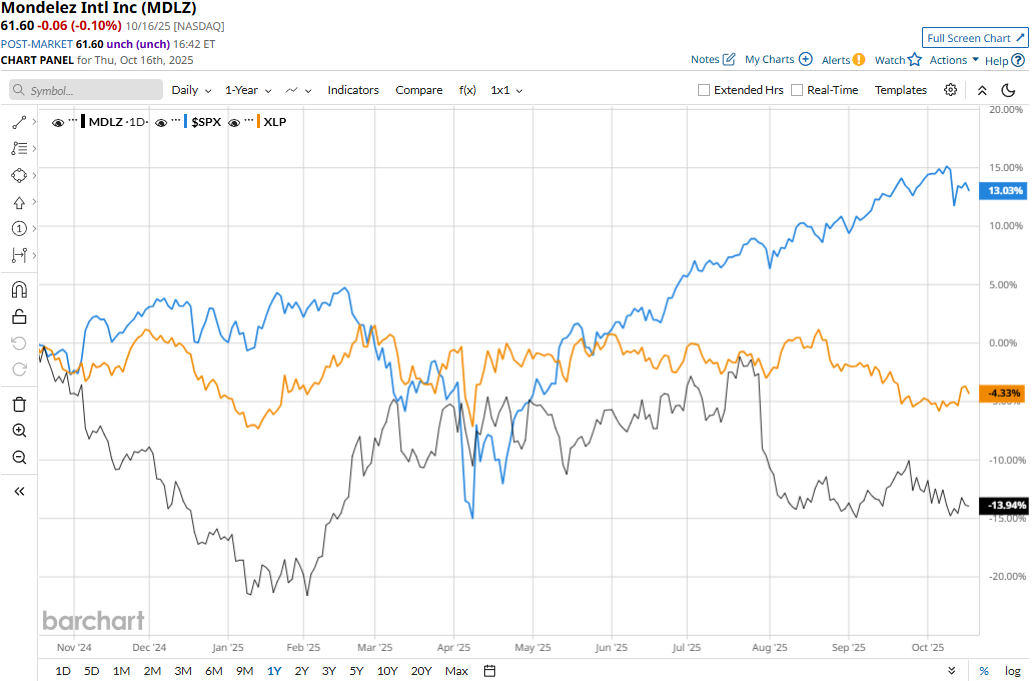

MDLZ stock prices have plunged 14.3% over the past 52 weeks, notably lagging behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.6% decline and the S&P 500 Index’s ($SPX) 13.5% gains during the same time frame.

Despite reporting better-than-expected results, Mondelez’s stock prices dropped 6.6% in the trading session following the release of its Q2 results on Jul. 29 and maintained a negative momentum for five subsequent trading sessions. The company observed notable double-digit revenue growth in Europe, Asia, the Middle East, and Africa. However, its sales in North American and Latin American markets have remained on a downward trajectory. Nevertheless, its overall topline grew by a notable 7.7% year-over-year to almost $9 billion, 1.2% ahead of the Street’s expectations.

Meanwhile, due to rising raw material costs, its adjusted EPS dropped 12% year-over-year to $0.73, but surpassed the consensus estimates by 7.4%. Investors’ sentiments were primarily impacted by Mondelez’s dim outlook. Despite solid performance in Q2, the company expects its full-year earnings to remain under pressure due to rising cocoa prices.

Analysts maintain a cautiously optimistic outlook on Mondelez. The stock holds a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, opinions include 14 “Strong Buys,” three “Moderate Buys,” seven “Holds,” and one “Strong Sell.” Its mean price target of $72.65 suggests a 17.9% upside potential from current price levels.