/Medtronic%20Plc%20HQ-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $120.1 billion, Medtronic plc (MDT) is a global leader in healthcare technology, transforming lives through innovative solutions that alleviate pain, restore health, and extend life. With a commitment to advancing health equity and using data-driven insights, Medtronic connects people to personalized, life-changing care across more than 70 complex conditions.

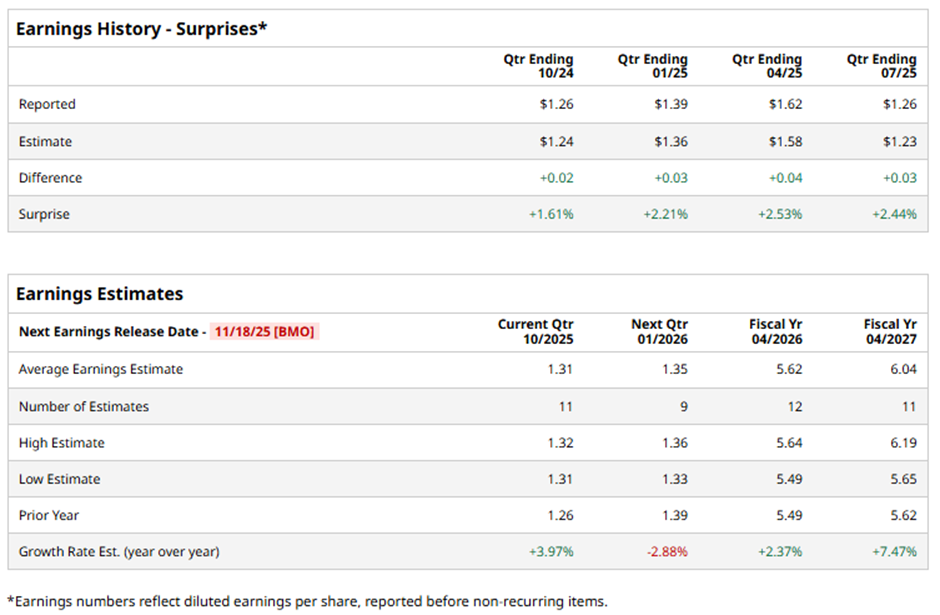

The Galway, Ireland-based company is slated to announce its fiscal Q2 2026 results before the market opens on Tuesday, Nov. 18. Ahead of the event, analysts expect Medtronic to report an adjusted EPS of $1.31, up nearly 4% from $1.26 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2026, analysts predict the medical device company to report adjusted EPS of $5.62, a 2.4% rise from $5.49 in fiscal 2025. In addition, adjusted EPS is anticipated to grow 7.5% year-over-year to $6.04 in fiscal 2027.

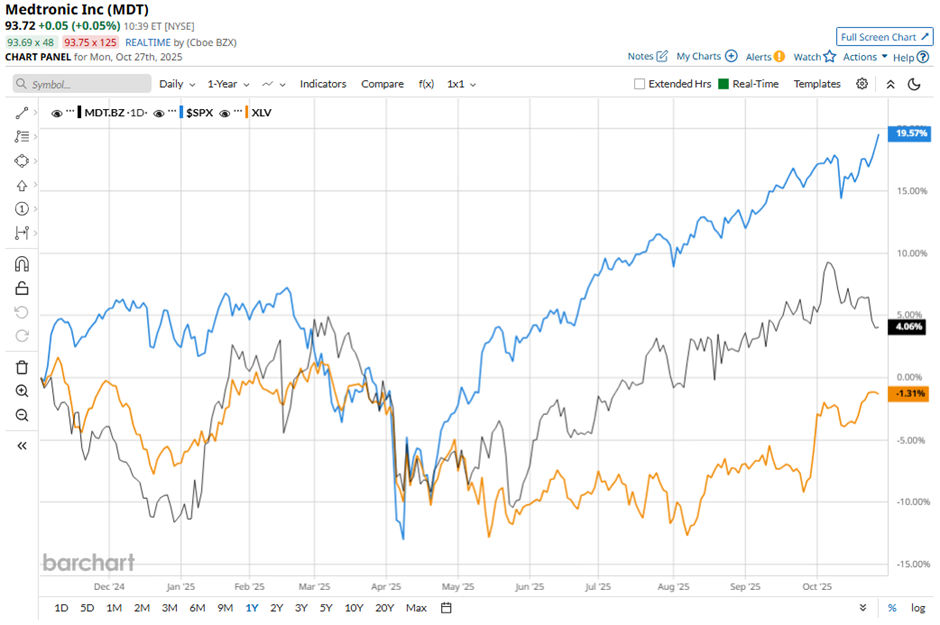

Shares of Medtronic have risen 3.1% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) nearly 18% increase. However, the stock has outpaced the Health Care Select Sector SPDR Fund's (XLV) 2.1% decline over the same period.

Medtronic reported Q1 2026 results on Aug. 19. The company posted adjusted EPS of $1.26, beating the consensus estimate and marking a 2.4% increase from the year-ago quarter. Revenue for the quarter reached $8.58 billion, surpassing forecasts and growing 8.3% year-over-year. Additionally, the company raised its full-year adjusted EPS guidance to $5.60 - $5.66 and projected organic revenue growth of 5%. Nevertheless, on that day, MDT shares dropped 3.1%.

Analysts' consensus rating on MDT stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 31 analysts covering the stock, 14 recommend a "Strong Buy,” one has a "Moderate Buy" rating, 15 give a "Hold" rating, and one has a "Strong Sell.” The average analyst price target for Medtronic is $101.54, indicating a potential upside of 8.3% from the current levels.