/Mckesson%20Corporation%20logo%20on%20building-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $97.9 billion, McKesson Corporation (MCK) is a global leader in healthcare services and information technology. The company operates through four segments: U.S. Pharmaceutical; Prescription Technology Solutions (RxTS); Medical-Surgical Solutions; and International, providing pharmaceutical distribution, medical-surgical supplies, and technology-driven healthcare solutions worldwide.

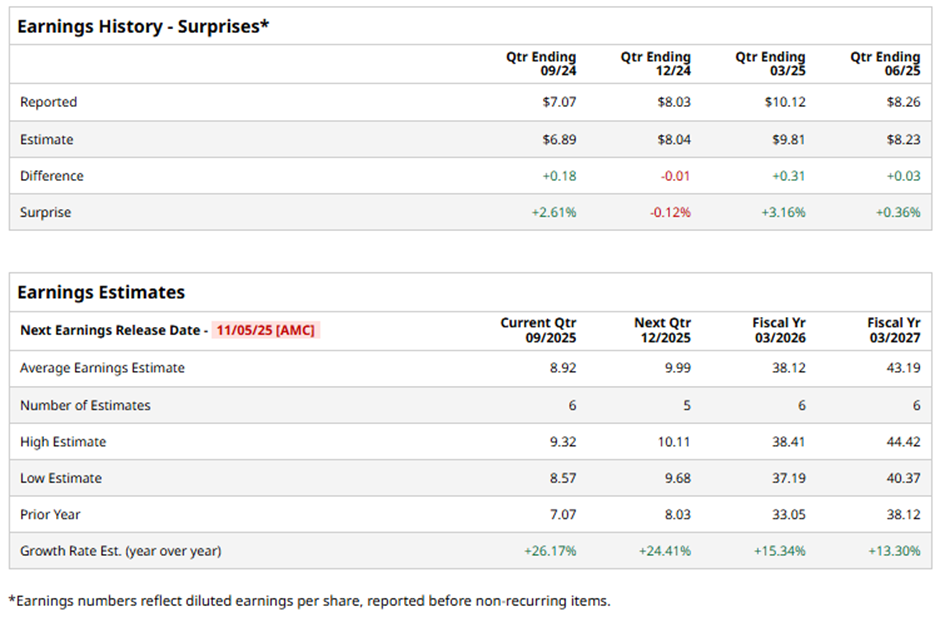

The Irving, Texas-based company is set to announce its fiscal Q2 2026 results after the market closes on Wednesday, Nov. 5. Ahead of the event, analysts forecast McKesson to post an adjusted EPS of $8.92, a 26.2% growth from $7.07 in the same quarter last year. The company has surpassed Wall Street's bottom-line projections in three of the past four quarters while missing on another occasion.

For fiscal 2026, analysts expect the U.S. drug distributor to report adjusted EPS of $38.12, a 15.3% increase from $33.05 in fiscal 2025.

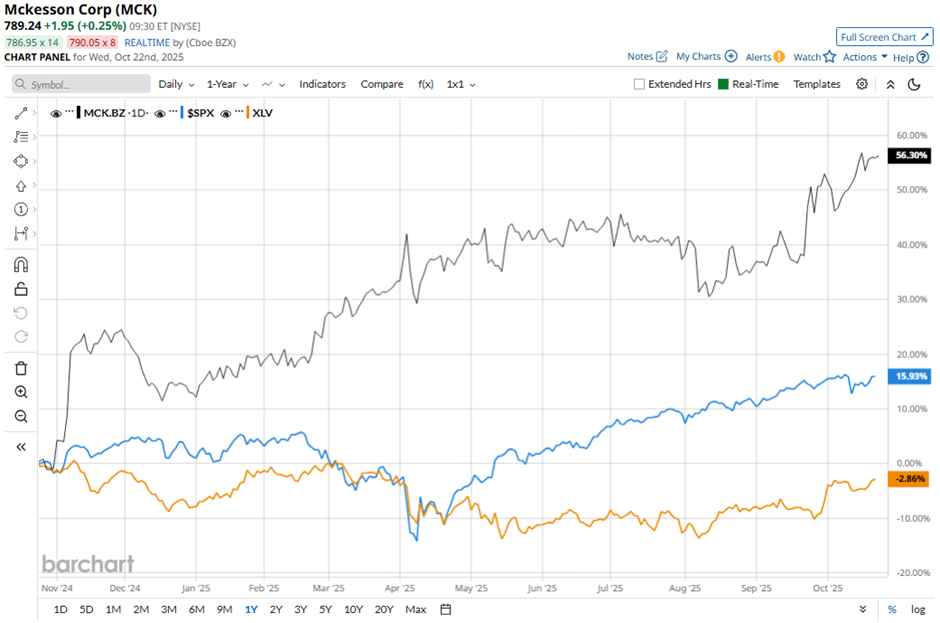

MCK stock has climbed 54.9% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 15.1% rise and the Health Care Select Sector SPDR Fund's (XLV) 3.1% decrease over the same period.

Despite McKesson’s better-than-expected Q1 2026 adjusted EPS of $8.26 and revenue of $97.83 billion on Aug. 6, shares tumbled 5.8% the next day. The company’s GAAP EPS dropped 10.7% to $6.25 because of a $189 million bad debt provision linked to the Rite Aid bankruptcy, raising worries about credit risk and earnings quality.

Analysts' consensus rating on MCK stock is bullish, with an overall "Strong Buy" rating. Out of 17 analysts covering the stock, opinions include 12 "Strong Buys" and five "Holds." The average analyst price target for McKesson is $839.27, indicating a potential upside of 6.3% from the current levels.